Residential property is making a comeback in terms of investor preference although housing prices have showed little price appreciation in recent years.

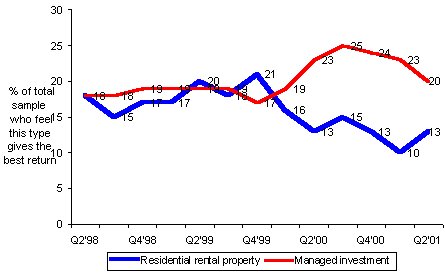

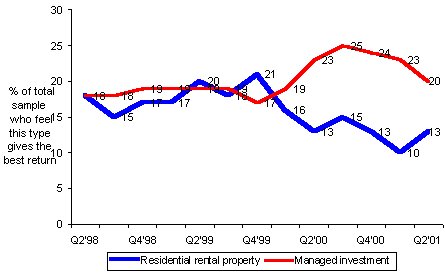

ASB Bank's latest Investor Confidence Survey says that investors perceive residential property as the second best option in terms of best returns. Its popularity has lifted 4% to 13%.

The change in perception is significant as residential property had been in decline for the past 18 months, ASB Bank Investments chief manager Roger Perry says.

He cautions investors about this shift: "New Zealand population growth remains low, constrained by migration over the past two years, and interest rates are forecast to rise early next year. Furthermore, the returns that an investor in rental property can achieve at the cheaper end of the market have been dampened by the recent reduction in state housing rents."

Perry says managed funds remain the type of investments which investors believe will yield the best return, but this belief has declined for the third consecutive quarter and is now at 20% of respondents. This is a fall of 5% in 9 months.

Perry says a large part of this is due to the fact that world sharemarkets have dropped almost 20% over the past 12 months.

"World shares are a large part of balanced funds, which is probably why we've seen a decline in investor's perceptions that managed investments will give the best returns."

In the latest quarterly survey the bank asked if investors planned changes to their portfolios as a result of the fall in markets.

Perry says two thirds of respondents said no. This shows a continued mature approach to investing. The third who did plan changes were mainly doing it because of lifestyle reasons.

To see what's happening in the housing market read: Housing figures a mixed bag. Special Offers

« Planning industry needs lowlifes Sovereign takes regulation bull by the horns »

Commenting is closed

www.GoodReturns.co.nz

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved