by Andrea Malcolm

When Auckland financial advice firm National Capital canvassed New Zealanders on whether they felt KiwiSaver contributions should be compulsory, nearly two thirds, 62%, of the 672 respondents said, yes.

Those closer to retirement age were the most likely to answer yes, with 79% aged 65 and over and 71% aged 60-64 in agreement. At the other end of the demographic scale, 68% of Gen Z aged 18 to 27, also agreed.

Millennials or 28-43 year olds were the exception, with only 48% supporting compulsory contributions. Reasons given were maintaining personal choice and autonomy, and affordability/cost of living pressures, and opposing mandatory participation in the scheme.

The survey also found most respondents (74%) plan to use their KiwiSaver for either living expenses in retirement or paying off their mortgage.

National Capital founder and co-director Clive Fernandes said while the younger generation has been educated more about the importance of finance and savings, and older generations are close to retirement, Millennials have the most expenses and still see retirement as being a long way off.

Cost of non-contribution

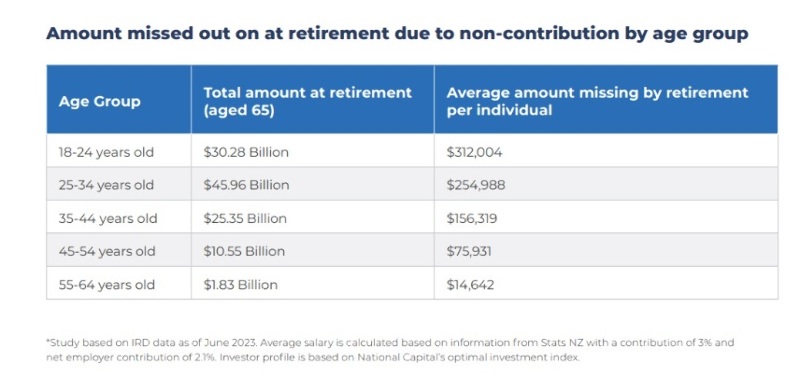

Using data from IRD, MBIE and Stats NZ, National Capital says if the 703,325 non-contributing KiwiSaver members contributed the 3% minimum, the collective amount they could get at retirement was approximately $113 billion. The demographic most at risk of significant losses was those aged 18-24, each potentially missing out on an average of more than $300,000.

The findings were part of National Capital’s fourth KiwiSaver Value for Money Report which rates diversified KiwiSaver funds against six pillars; performance after fees, assessment of the value provided for fees, fund management capability, provider stability, portfolio composition and processes, and ethical investing.

The report found the amount of wages Kiwis contributed to their KiwiSaver in the last quarter of 2023 fell 0.03% on Q3 giving an overall contribution of 4.27%, well below National Capital’s recommended optimum of 6.3%.

Fernandes says the cost of living may be having an impact and it doesn’t bode well for Kiwi’s retirement prospects.

The report also looked at how KiwiSaver members are invested with an asset allocation index in which higher the index, the higher growth allocation.

After edging up three points in the March quarter to 59, the allocation index remained consistent in the last two quarters with a negligible increase to 59.6. However this too falls short of the optimal of 68.8%.

For the last quarter this was 56 compared to an optimal rating of 68.8. The gap represents a potential $48 billion in lost earnings and Kiwis are not investing their money in the best way for their life stage.

Ratings

For high growth funds, Booster Socially Responsible High Growth followed by FANZ Lifestages High Growth, Booster High Growth, Generate Focused Growth and Milford Aggressive were all rated A across the pillars.

All A-rated high growth funds were New Zealand owned. Booster’s Socially Responsible High Growth Fund maintained its leading rating from the last quarter with an improved 5 year annualised return of 11% per annum over the previous five years.

Last year FANZ Lifestages KS HG had the highest return of 19.7%. The average one year return as of December 2023 for all high growth funds was 15. 19%. The gap between the worst and best performing funds, based on five year performance, grew to 4.66% as of the quarter.

A-rated growth funds were Simplicity Growth, Fisher Two Growth, Milford Active Growth, Pie Growth and Booster Growth. Simplicity remains the only passive manager to rank among the A-rated growth funds. Pie’s growth fund debuted onto the A list, while Generate and Fisher Funds fell off. Milford Active remained the top performing fund for the past five years, with an annualised return of 10.55% per annum.

Across all categories, the performance gap between worst and best performing over a five year period, rose to 5.83% in Q4, from 5.28% for Q3 last year.

Average fees varied greatly across the different categories. High growth had the highest average fees of 1.12%, while conservative had the lowest at 0.61%. The Milford Cash Fund had fees of 0.20%, making it the lowest fee KiwiSaver fund.

While a growing number of providers have been phasing out fixed monthly membership fees, 12 of the 24 KiwiSaver providers researched still mentioned charging membership fees in their product disclosure statements.

| « KiwiSaver portability settings blocking investors from private asset benefits | Simplicity takes stake in tax tech company » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

The problem with this question is that it ignores the alternative. Compulsory KiwiSaver contributions means more money will go into KiwiSaver. That money has to come from somewhere. So, in voting for compulsory KiwiSaver, you are voting for less of something else. It is also worse than that, as you are not voting about what you do with your money but what others have to do with their money.

You can therefore allocate people to one of 4 groups:

Those that were saving and so are unaffected, ie do not need to save more. In some cases, this will be redirecting savings from elsewhere. Surely it is better to let the savings go where the individual believes they are best to go and not to KiwiSaver to make the providers wealthier! Having individuals invest directly or in non-KiwiSaver schemes, or build a business, may be better for the individual and the country.

Those that break the law and choose not to save. I am not sure that making criminals out of otherwise law-abiding people is sensible or good public policy.

Those that borrow to invest. Most will fall into this category as the alternative would have been to use the compulsory contributions to pay down debt, mortgage, credit card etc. The Australian experience also suggests that as the balances rise, the level of personal debt rises.

Those that genuinely save more. This is likely to be a small group and so the law to make contributions compulsory is a law for a relatively small group.

The one thing that is certain is that compulsory KiwiSaver will make the providers better off. What is good for the industry is not necessarily good for the individual.

The more important question is “are New Zealanders saving sufficient for their retirement?” The industry claims no, but we do not know. The best evidence that we have, is that most were saving sufficient for their retirement taking into account the policy settings around NZ Super. Therefore, making people save more than is sufficient, does not seem like good public policy.

Also important, is the question, “is the country getting value for money out of the $1 billion taxpayers spend each year at present on KiwiSaver subsidies?” Understanding this before we tinker with KiwiSaver might be beneficial.

Perhaps the National Capital survey might have been best to look at the value for money and adequacy of savings, and not free beer!