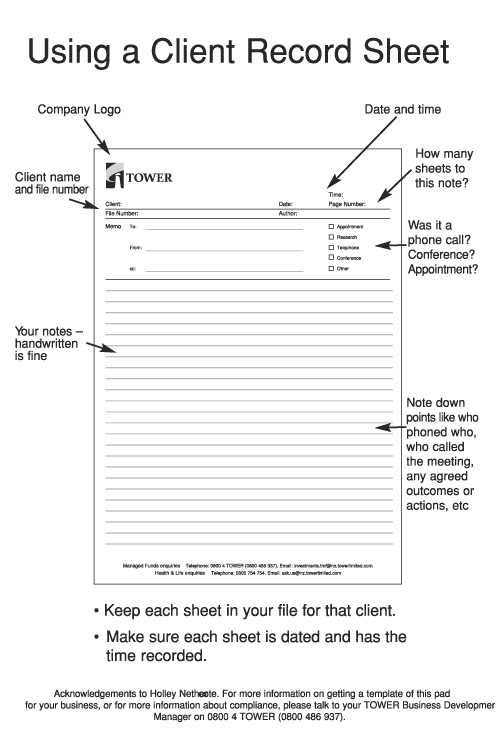

A good place to start is with a client record sheet, a useful tool that was introduced at the roadshow. The idea is for an adviser to use the client record sheet to jot down notes from meetings, appointments or phone conversations with a client.

The notes don’t have to be elaborate or detailed, nor do they need to be typed up afterwards. But by taking simple measures such as dating the sheet, noting the time of the transaction, the type of transaction that took place and any objectives or actions agreed upon can give advisers a meaningful and helpful record that can easily be referred to at a later date.

Getting into the habit of recording all transactions with clients is useful on many levels – but it’s particularly effective for providing a reference tool for both the adviser and the client. It’s a practice that almost sounds too simple to be of any real use, yet attendees at the roadshow will have heard some real life examples of just how useful a dated client record sheet can turn out to be – especially when it comes down to a case of just who said what and when.

TOWER has created notepads of client record sheets, which are available for advisers to use, and also offers a template sheet for advisers to copy and add their own company logo. Call your TOWER Business Development Manager on 0800 4 TOWER (0800 486 937) for more information.

Special Offers © Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

« Avoiding litigation The business of Numeria Finance » Commenting is closed

www.GoodReturns.co.nz