Typical capital protection structures provide 100% protection of the initial capital invested. This should serve two purposes:

Although related, these are not the same. The first is psychological, and the second fundamental.

The psychological value cannot be understated. New Zealand investors’ reaction to the year 2000 market downturn was unfortunate, to say the least. After waiting until 1999 before most of us purchased international managed funds, we waited until the bottom of the market, around 2002/03, before selling.

By providing investors with confidence that they won’t lose any of their original capital, capital protection plays a valuable role because it prevents such emotionally-driven timing decisions.

Rising capital protection – fundamentally changes the risks of investing

Risk should not just be measured as “volatility” or “the risk of losing capital”. For most investors, the “risk of not achieving required returns to fund their lifestyle” is actually the most relevant measure.

Macquarie has researched the various capital protected structures available via institutional trading desks worldwide. We found what we believe to be the most appropriate protection structure for retail investors investing in international equities – rising capital protection.

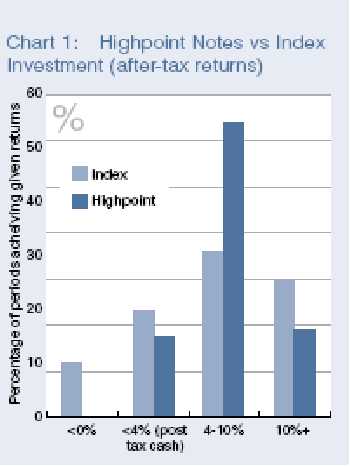

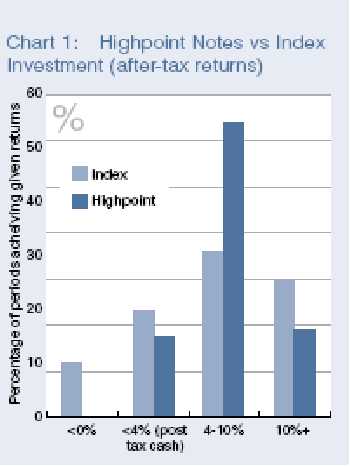

Macquarie Highpoint Notes* offer a new approach to international equities investment by applying rising capital protection** to reduce the volatility of investing in international equities by around 30-40%. More relevantly, it increases the probability of achieving target returns between the cash rate and 10% p.a. after tax.

Analysis of the risk and returns of Highpoint Notes

This analysis is available from Macquarie upon request, but to provide an example of what drives these results, consider this:

To achieve 4% p.a. on an after-tax basis (6% pre-tax, being an above average cash rate for retail investors, and using 33% tax rate), for example, the Index needs to close on any given day over the next 8.5yrs, a level 40% higher than its current level.

Using historical data, the probability of the Index reaching 40% above its starting point on at least one day during an 8.5yr period is 88%.

The output of this analysis is shown in Chart 1.

Chart 1: Highpoint Notes vs Index Investment (after-tax returns)

Cost of rising capital protection structure

The cost of Highpoint Note’s structure is that investors cannot earn profits of more than 100% of their initial investment. In Chart 1 above, this is reflected in the lower probability of 10%+ p.a. returns (Highpoint Notes investors can still achieve 10%+ if the index rises to its 100% peak within 5yrs).

Therefore, for investors anticipating double digit returns from international equities markets over the coming decade, the cost of this protection structure needs to be considered in the context of the reduction of risks outlined above.

For investors anticipating less than 10% p.a. returns, as per the expectations of most market commentators, Highpoint Note’s rising capital protection structure represents a more appropriate alignment of expectations and product structure than a traditional long-only investment.

Summary

Highpoint Notes are not a typical capital protected investment. They materially alter the risk/return parameters of an international equities investment.

Note that in addition to the return/risk assumptions above, this analysis assumes that:

History does not support either of these assumptions and relaxing them would further increase the benefits of Highpoint Note’s rising capital protection structure. By removing the timing decision, Highpoint Notes offer further psychological and fundamental benefits.

Similar studies by UBS Warburg and Harvard have found that protected equities investments have outperformed on a risk-adjusted basis. UBS’s study found that protected strategies returned around 20bp less, but with around 64% less risk (using annual volatility as a risk measure).

For investors targeting returns equivalent to 8- 12% pre-tax (after-tax return of 5-9% p.a.) with very high capital stability, Highpoint Notes provide greater certainty of meeting target returns than many alternatives in the New Zealand market.

Highpoint Notes will be offered by Initial Public Offering, closing on March 23, 2005, and the minimum investment amount is $5,000. For further information call Macquarie on 0800 481 111.

* Macquarie Highpoint Notes are debt securities for the purposes of the Securities Act 1978 and are offered by Macquarie Investment Services Limited ABN 73 071 745 401 ("MISL") in its capacity as trustee of the Macquarie Highpoint Notes Trust and are ranking secured obligations of MISL, in its capacity as trustee of that trust. MISL is not an authorised deposit-taking institution for the purposes of the Banking Act (Cth) 1959 and MISL’s obligations do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542. Macquarie Bank Limited does not guarantee or otherwise provide assurance in respect of the obligations of MISL. Macquarie Bank is a company incorporated in Australia and authorised under the Banking Act 1959 (Australia) to conduct banking business in Australia. Neither Macquarie Bank Limited or any of its worldwide related bodies corporate (including Macquarie Investment Management Limited) are registered as a bank in New Zealand by the Reserve Bank of New Zealand under the Reserve Bank of New Zealand Act 1989. The combined Prospectus and Investment statement ("the Offer Document") has been registered with the New Zealand Companies Office. Applications to invest in Macquarie Highpoint Notes can only be made on the application form attached to the Offer Document. You should always consult with your investment or other financial adviser to determine whether investment in Macquarie Highpoint Notes is suitable for your particular financial needs, circumstances and or objectives.

** There is a cap on gains of 100% and protection only applies if held to maturity.

*** Historic evidence does not support this assumption (less than 5% of New Zealand managed funds FUM exited international equities positions within 6 months of the 1999-2000 peaks).

Special Offers © Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

« Macquarie hooks into Global Titans for notes Adding zing to fixed interest » Commenting is closed

www.GoodReturns.co.nz