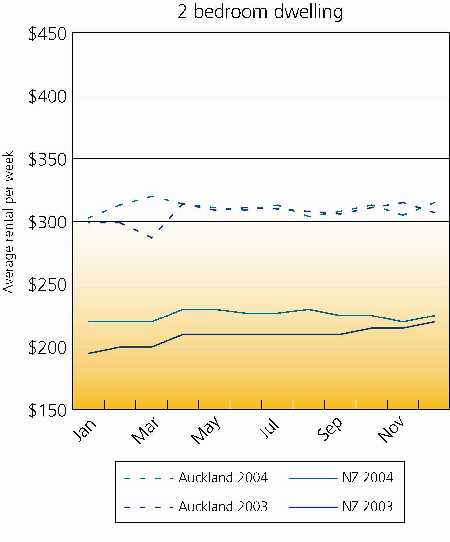

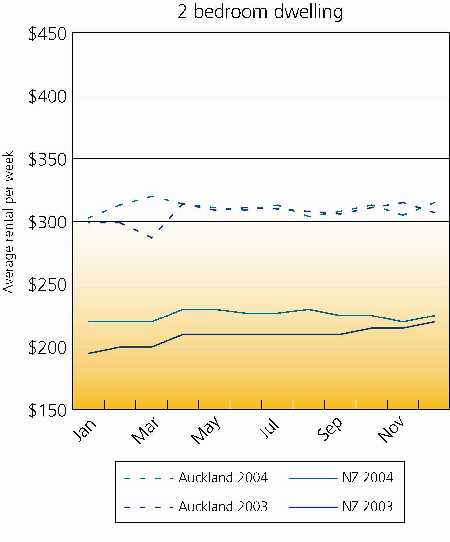

Crockers Property Group research shows that there was very little movement in Auckland rental prices in 2004, although nationally a small increase was recorded.

This has meant the gap between Auckland and the rest of the country is narrowing.

While Auckland rents remained substantially higher than elsewhere in New Zealand, the gap between the two narrowed considerably, director of Crockers Property Group, Rob Macdonald, said. “As Auckland becomes more expensive to live in and the population increases, more high density living becomes the norm. Rents are merely responding to the relative levels of supply and demand for the different types of accommodation available in the market today”.

However Macdonald said investors were continuing to purchase investment properties in Auckland “in the solid belief that property will always deliver the booty over time”.

Rental variations year-on-year ranged from high 13% gains for the New Zealand average between January and February 2003 to January and February 2004, down to small declines in the Auckland rental market between May and November 2004 compared with 2003.

In January 2003, an average 2 bedroom dwelling in Auckland was achieving 53% higher rental returns than that of the nationwide average. However, this margin fell to 38% in January 2004, and in the latest figures now stands at 32% for January 2005.

Similarly, an average 3 bedroom dwelling in Auckland which was achieving a 59% premium on average nationwide rentals in January 2003 dropped slightly to a 56% premium in January 2004.

This figure fell further to just 45% in January 2005. While rentals in Auckland are flat, the rest of the country is closing the gap (albeit still a significant gap).

| « NZPIF Conference 2005 | Auckland market recovering: agent » |

Special Offers

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved