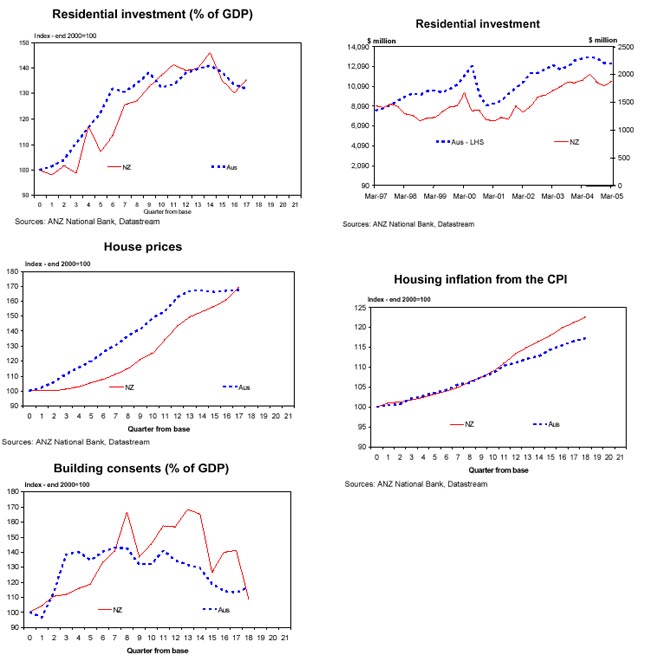

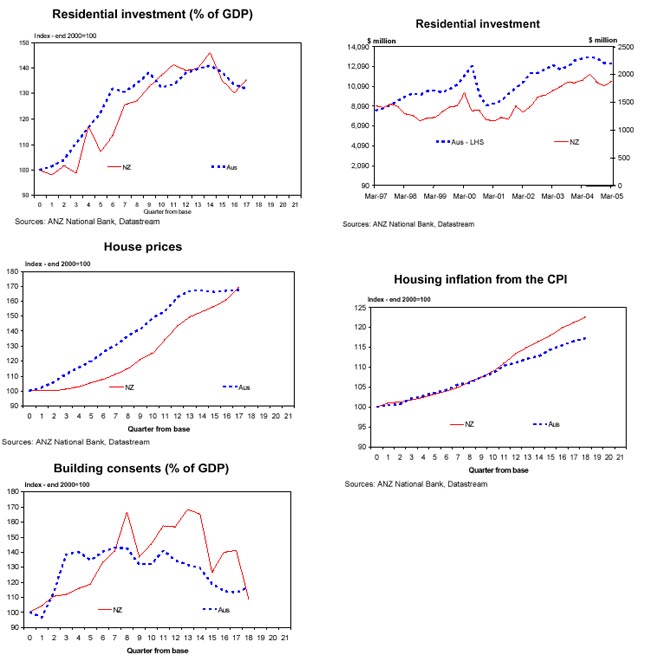

The housing cycles have, in fact, been synchronised since 1998. Both housing markets displayed a similar trough in late 2000 when we date the cycle. Since late 2000, whilst each nation has displayed alternate paths and degree of strength in house prices, housings component to the CPI, building consents, and residential investment, the end point (i.e now) is basically the same.

Given the relative positions of the housing markets during the cycle, is NZ being unduly penalised with higher interest rates relative to Australia?

Certainly there is a case but ANZ think housing is not completely to blame.

• NZ is getting greater CPI inflation pressure from housing. Rates, real estate agents fees and construction costs are all giving NZ housing related inflation a stronger upwards impulse.

• A key differentiating factor between Australia and NZ at present is non-housing consumer spending. Retail spending and credit growth in NZ is exceeding Australia and such a spending surfeit is coming when income growth is lower in New Zealand. The implication is that Australia has entered a balance sheet consolidation stage. This is easing excess demand pressures in the Australian economy. New Zealand is yet to start such a consolidation, and until NZ arrests its Freddy Mercury “I want it all and I want it now” binge behaviour, higher interest rates will be here for some time. Balance sheet consolidation in New Zealand will be either voluntarily or central bank (interest rate) induced.

| « NZPIF Conference 2005 | ‘Too soon to tell effect of migration drop’ » |

Special Offers

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved