This equals the highest level of confidence recorded in the eight years the survey has been running.

“2006 saw a big improvement in sentiment amongst investors,” ASB Head of Investment Services Jonathan Beale says. “At the start of the year we were at a historically low level of confidence, around 9%. Through each quarter of the year there was a steady increase, mainly as investors’ belief that their returns would either stay the same or increase improved."

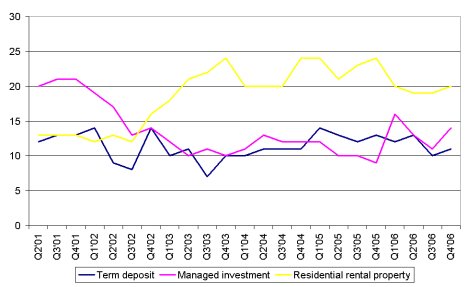

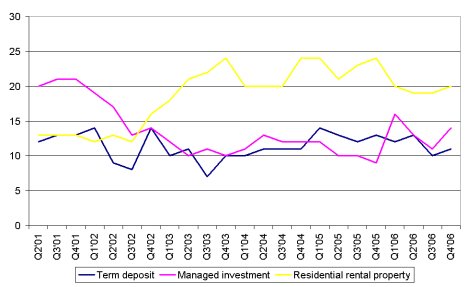

Residential rental property remains the highest ranked asset class, despite continued debate about the direction of the housing market and a large number of mortgages requiring to be re-fixed in the final quarter of 2006 – up slightly to a net 20%.

After two quarters of falling confidence, managed funds rose again to become the second most popular type of investment, up three points to 14%.

As illustrated in the graph below managed funds have been out of favour since around 2001, however the trend over the past four quarters is positive for this sector.

What is interesting though is that investors are favouring more conservative funds.

Beale notes that along with increased confidence in funds there has been “good flows into funds in the fourth quarter" into the bank's products.

“The noticeable trend amongst these investors has been a preference for funds with a more conservative approach.”

Another question added into the survey gives a worrying picture of what people consider as their investments.

The bank asked: Do you consider your residential home as being part of your investment portfolio?

It says that 75% of those who own a home answered yes to this question.

“While the fact three quarters of people consider their home is part of their investment portfolio is not unexpected, it is still a matter of concern,” Beale says. “Despite increasing affordability issues, home ownership rates are still high in New Zealand, while investment in other asset classes is relatively modest.”

| « UK listed trusts have good year | Sovereign takes regulation bull by the horns » |

Special Offers

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved