Credit markets crunched

The credit crunch that set in from mid 2007 owes its origin to sub-prime mortgages offered to US borrowers who failed to meet standard bank lending criteria.

Soaring default rates on these non-prime mortgages have fed through into so-called 'structured products' that were mass manufactured to securitize those mortgages: collateralized debt obligations (CDOs), collateralized loan obligations (CLOs), bank 'conduits' and special investment vehicles (SIVs).

Structured products were sold worldwide, exporting US sub-prime mortgage default risk to foreign investors. The sub-prime debacle has since imposed severe and continuing devaluation strains on these exotic, illiquid kinds of fixed interest securities.

Knock-on effects have forced banks to raise loan interest rates and tighten lending criteria, triggering a credit crunch that is expected to persist for an extended period. One result has been an additional increase to already high residential mortgage interest rates in New Zealand. However, not all is doom and gloom for fixed interest investments.

The TOWER Extended Markets Fund – Asset allocation: fixed interest

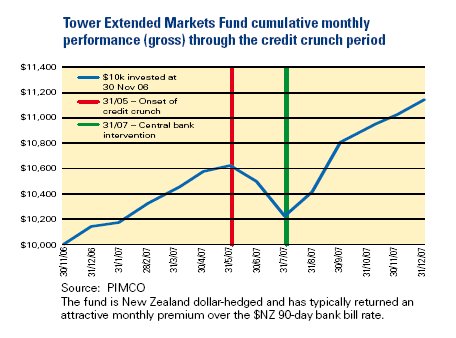

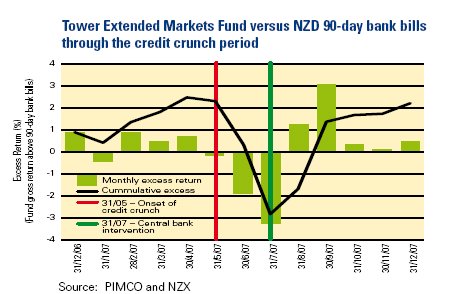

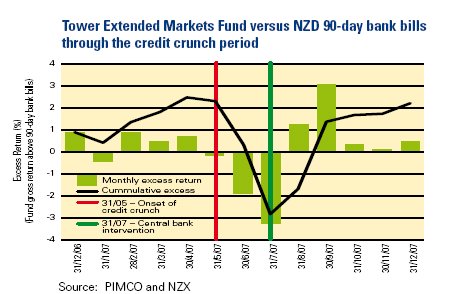

This fund offers an opportunity to benefit from higher bond yield spreads caused by the credit crunch. It invests in emerging market sovereign debt and US high-yield corporate bonds (but not in structured products). After dipping briefly during the initial shock , fund performance has since weathered the onset of the crunch well.

The fund is actively managed by PIMCO, one of the world's largest bond managers, whose expertise in fixed interest analysis enables it to pick-and-choose skillfully from the current buyers' market for good quality higher-yielding bonds. Its assets are traded on open, liquid exchanges and marked to market (valued off actual daily trading prices). TOWER Extended Markets Fund cumulative monthly performance (gross) through the credit crunch period.

Commodities a-booming

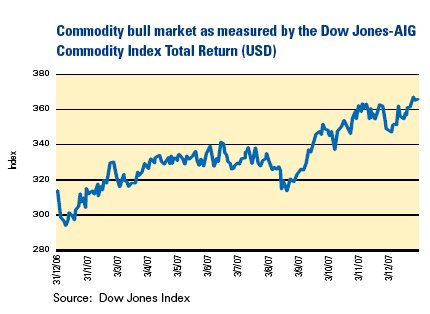

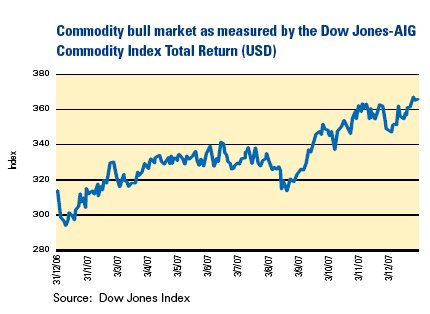

News media are filled with stories about the global commodity

bull market. Getting most attention at present are oil, petrol,

gold, and agricultural commodities. A weak US dollar is boosting

prices on top of relentless increase in world demand for energy,

metals, and agricultural commodities.

The agricultural commodity boom is underpinned by rising

demand from China, India and other emerging markets for

imported food, the negative effects of climate change on growing

conditions, and conversion of grains and sugar into biofuels to

help curb greenhouse gas emissions.

Commodities are receiving standard inclusion as an asset

class in their own right within prudently diversified investment

portfolios. For example, the New Zealand Superannuation

Fund recently confirmed a 5% strategic asset allocation to

commodities.

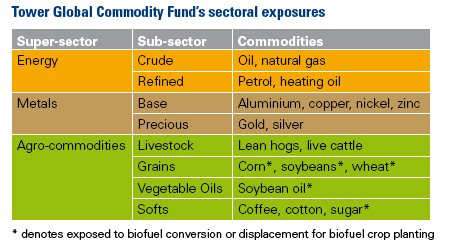

The Tower Global Commodity Fund – Asset allocation:

alternative investments

This fund represents a straightforward way for New Zealand

investors to diversify their portfolios into the commodity asset

class. It includes the 19 most important commodities (based

on world production value (US dollars) and future market

liquidity).

The table below shows these commodities classified by

sectors.

The Tower Extended Markets Fund and the Tower Global Commodity Fund are portfolio investment entities designed for pooling individuals' investments on wrap platforms and custodial services. Both funds are accessible through New Zealand's two largest wrap providers. For further information on these funds or to obtain an investment statement contact Michael Coote at (09) 302 1068 or michael.coote@tower.co.nz, or visit www.tower.co.nz

| « Absolute return funds expand with Kauri Notes Series II | The Best of Both Worlds » |

Special Offers

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved