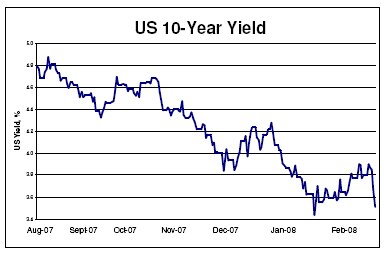

Global bond markets continued their downward trend. The chart below shows the steady fall in the US 10-year yield over the last seven months, including the amount of volatility over the last three months. It has certainly been a large fall.

After a weak first half of the month, the US market turned around and bounced back strongly, with other bourses following suit. The latter part of the month tended to be a general decline, although somewhat limited in relation to what has been the trend over the past 15 weeks. Of note is the strong rebound in the oil price at the end of the month, going over the psychological USD100 a barrel mark.

The NZX followed this trend, although its lows were not as low (and the bouncebacks were nowhere as strong). For example, one particularly bad day on global markets was February 5. If NZ had not been on holiday the next day, we would have probably had a similar large fall to that experienced by Australia and other markets in its wake. Fortunately, the next day saw a recovery and, while we didn't feature in the strong up market, we missed the volatility that resulted on other world markets from that activity.

It does seem like this increased volatility is going to be around for some time. The credit crisis still has no light at the end of its uncertainty tunnel and markets do not like unease. As a result, company result periods are especially nervous times.

We saw an example of this in New Zealand with Fletcher Building. Their result was not overly disappointing, but it was not overly encouraging, either. The problem for the company (and its shareholders) was that its result was released on a bad day for global sharemarkets and, because it did not surprise on the upside, it got punished.

Is this rational? Not really, but such events happen in times of significant volatility. So, are bargains then created through this irrationality? Undoubtedly and if you happen to glance back at market history in a couple of years' time, you may well be shaking your head and saying why did I not purchase XYZ, Inc. at that time.

It is not that straight forward, however. Some purchases made now may take a very long time to realise their value, while others may well fall even further and be much cheaper next week.

This is the time when active managers really earn their stripes. Good fundamental research will find those companies that provide the strongest value over the long term. During the years 2003-2006 (inclusive), the very strong markets were driven by a lot of corporate activity. In many cases, low quality companies were being acquired because their managements had not been efficient and their share prices had not risen as expected (and they were thus "cheap"). The hint of a takeover saw these share prices then rise very strongly. As a result, lower quality companies performed better than higher quality companies. However, a down market will tend to show the opposite effect, with strong companies significantly outperforming the weaker companies.

So, with two months of incredible headwinds already suffered on world markets, what are expectations for returns over the whole 2008 year? If only we knew, but we will take the liberty of making some predictions. We will start with the easiest sector to make some type of estimate. We do not believe that the RBNZ will raise interest rates further in 2008, given the weakening domestic economy and the significant slowdown we are witnessing in the housing market. However, it is not likely to lower rates, either, this year, as inflation concerns are still amplified. Hence, cash should be one of the strongest performers in 2008, with such a high Official Cash Rate available at no risk. Hence returns are likely to be around the 8.25%- 8.5% level for an investment in 90-day bank bills.

The bond markets may well be a mixture of government bonds offering a haven (and hence a relatively strong performance) and corporate credit spreads remaining stubbornly wide (although with a large amount of volatility). The latter reflects the continued uncertainty in credit markets and the strong feeling that there is still some more pain to come. Domestically, we are still seeing finance companies struggling, with MFS Boston the latest to fall over. All up, there seems little prospect anything too much higher than low single digit returns from a portfolio of predominantly corporate credits in 2008.

A global bond portfolio may perform somewhat better if hedged into NZD, as the still weakening US dollar and the low likelihood of RBNZ rate cuts means that the NZD is expected to remain high throughout the year. Currently, this premium is delivering over 5% p.a. as a risk-free benefit to a global bond portfolio over a corresponding domestic portfolio. While global corporate credits are possibly going to continue to struggle against the uncertainty, global sovereigns, led by the US Fed, are expected to continue on an easing bias to add stimulus to weakening economies. (The RBA may be a near term exception to this trend.)

However, it is the equity markets that will likely exhibit the most interest. Both domestic and global markets have fallen so far this year that we give them very little chance of recovering those losses completely over the final eight months of 2008. There is also likely to be the large amount of continued volatility exhibited for probably the next six months, where markets can go up or down by 1% or more on any day.

We do believe that the market low experienced in mid-January will serve as the low for the year. Note, though, that this low could be tested several times over remaining months of 2008.

However, there could well be a temporary positive spell for the US sharemarkets (and hence the world's markets) after Easter. If the Fed lowers rates further (and there is a very strong chance they will), then this could provide a temporary stimulus that could well see the markets have a relatively strong few months on the back of this.

The fundamental expectation, though, is that economies are weak (or in recession) and with the US housing market continuing to sell off, resulting in severely weakening consumer confidence, corporate profits are likely to be well lower than the levels they have been at over the past few years.

We may have to wait until early 2009 before the

general uncertainty subsides and we can look

forward to stronger valuations, higher share prices

and a resumption of merger and acquisition activity.

With a strong level of confidence, we predict that

markets this time next year will be at higher levels

than they are at the end of February 2008.

Peter Lynn, Head of Strategy

Neither households nor businesses like the concept of higher interest rates but we suspect that many homeowners, companies and even banks in Spain now wish that the European central bank had operated a higher interest rate regime over the last 10 years. When Spain signed up for the Euro Project in the mid 1990s, many in the country (and particularly in the stock market) welcomed the implied promise of lower short term interest rates and borrowing costs that country's membership of the EMU promised. In fact, the combination of lower 'German' levels of interest rates and an initially competitive exchange rate within the fixed exchange rate regime that the Euro effectively adopted from 1996 onward provided a huge stimulus to the economy which even the global Y2K bust did little to dilute. Indeed, Spain's economic boom arguably accelerated further during the 2000s.

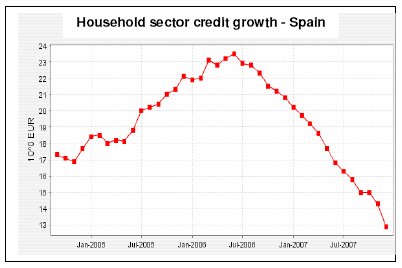

At the centre of Spain's rapid economic growth between 2001 and 2007 was a massive credit boom that saw the country's private sector increase its outstanding level of borrowing by over a trillion Euros (an amount roughly equivalent to the economy's total GDP). In particular, both households and companies borrowed aggressively in order to speculate in the local property market and, with some help from substantial inflows from both British and German investors, the result was an obvious and fierce property boom. However, as house prices increased, the cost of living and working in Spain increased sharply, with the result that there was an understandable increase in wage inflation in the economy as people sought 'compensation' for their higher living costs. At the same time, so much effort was being expended by companies and others on speculative activities that domestic productivity growth and perhaps even R&D suffered, with the result that the country's initially competitive position within the Euro System was eroded. Credit booms, while exciting in the short term, tend to damage competitiveness and introduce distortions into the economies that they infect.

Indeed, as Spain entered 2007, it did so with relatively high labour costs in comparison to local productivity levels and a heavily indebted private sector that had become accustomed to spending around 110% of every Euro that it earned. Clearly, the situation had become unsustainable and, as a consequence, we were not surprised to find Spain's economy beginning to lose momentum as 2007 progressed and the shortcomings of the boom were revealed.

At first, this slowdown proved relatively gentle, not least of all because companies could continue to access credit relatively cheaply, even if this borrowing activity had become a necessity rather than a luxury, as developers found themselves needing to fund rising inventories of unsold properties. Spain's predicament worsened significantly following the onset of the global credit market debacle in late August. Spain's banks, like many others, found it more difficult to raise the funding that they needed, a situation that implied that they were forced to become less accommodative to their own clients.

Consequently, the supply of credit to the already troubled property market began to dry up, with the result that forced sellers became apparent in the property markets and prices began to tumble. Although we have no reliable indicators of average house prices in the economy, the fact that new property starts are back to their 1992 levels speaks volumes about the decline in the housing market. Naturally, this weakness in the property market began to affect both consumer sentiment and solvency, with the result that retail sales growth has now all but evaporated within the economy.

To make matters worse, as global growth has slowed, Spain's already uncompetitive companies also began to struggle to export and to compete with imports, particularly as the Euro appreciated. Thus, as 2007 drew to a close, Spanish growth had begun to slow sharply and many of those who had borrowed aggressively during the boom were facing very pressing cash flow problems. Unsurprisingly, the banks began to find that many of the loans that they had made during the boom were turning 'bad' as the borrowers fell in difficulties and thus the economy's problems became the banks' problems as well.

In fact, as we entered 2008, it became apparent that Spain's banks were close to a crisis situation; had the European Central Bank not been prepared to lend them tens of billions of Euro's, then bank failures would have been very likely. However, there are now rumours that the global credit rating agencies are considering a (belated) downgrading of the Spanish banks, with the result that not only will the banks' financial positions become even more precarious at a fundamental level, it may also become difficult for the ECB to lend more money to these 'less than investment grade' institutions. 2008 therefore promises to be a very difficult year for Spain.

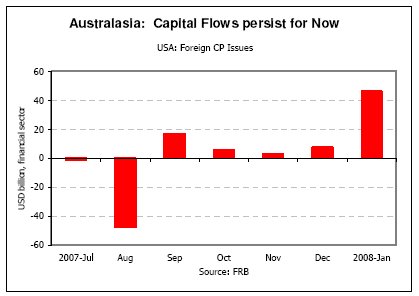

We related this story not simply for its own sake but also because it is the stuff of nightmares for the Reserve Banks of both Australia and New Zealand. Almost uniquely, the Antipodean financial institutions have been left relatively unscathed by the global credit crisis. Although their funding conditions have deteriorated at the margin, these institutions are continuing to access 'cheap' funding not just from Japan but even from the USA. Consequently, and in direct contrast to the situation. In Spain, the supply of credit in these countries remains surprisingly plentiful. But, Messers Bollard and Stevens are clearly concerned that, if they do not prevent people from over-borrowing, and the property markets from becoming even more overheated, then Australasia could move further down the road already travelled by Spain. Indeed, with savings rates at record lows, current account deficits high and property prices still high relative to wages, there is a concern that the Southern Hemisphere economies have already moved too far down this particular road.

In fact, Spain's predicament may one day threaten its continued membership of the Euro with presumably disastrous consequences for the economy and its creditors. Clearly, this is not a problem that neither Australia nor New Zealand face but, were the booms to become even more extended, then we suspect the subsequent slump could also result in weaker currencies, with a consequent jump in import costs and therefore higher prices in the shops, something that the central banks are mandated to prevent.

Given these fears, we would expect Australia's central bank to raise interest rates again and the RBNZ to hold its already high rate regime steady for the next few quarters as these institutions seek to prevent the local credit booms leading the economies to the uncomfortable place in which Spain now finds itself. Will the bankers be successful? To some extent, the credit booms have already become a little too advanced for our liking but we suspect that the central banks will be able to rein them back by the end of the year and although, this action will lead to substantially slower growth into 2009, this should allow the central banks to begin reducing interest rates in 2009 and to allow the local currencies to fall back to more comfortable levels (although the latter could still exert an unwelcome impact on the headline inflation rates).

Australasia may so far have escaped the worst

effects of the global credit crisis but its central

bankers' understandable desire to prevent further

excesses emerging in their economies seem

determined to end the party so that 2009's hangover,

though significant, is less extreme than that likely to

be faced by Spain and those other economies that

were allowed to stay at the 2000s' credit party too

long.

Andrew Hunt, Andrew Hunt Economics

| « ASSET - Thoughts for the day | Market Review: April 2008 commentary » |

Special Offers

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved