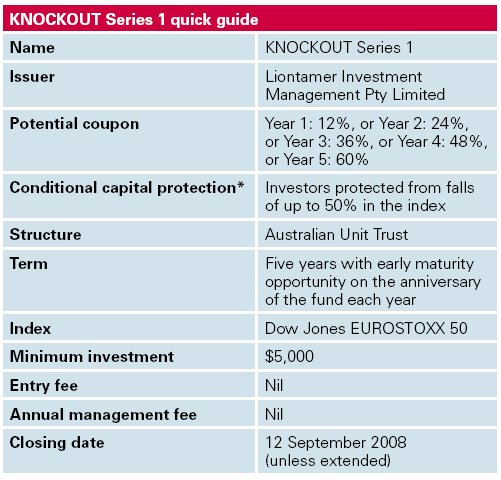

How does it work?

Investors have the potential to earn a 12% coupon rate per

annum which builds up over the five year term of the investment

(not compounded). Payment of the coupon is dependent on

the performance of a basket of Europe's 50 leading blue chip

companies, as measured by the Dow Jones EURO STOXX 50

Index. If the level of the index is the same or higher than its

starting level in a year's time, investors will earn the 12% coupon.

Even better, the fund will close early (that's the 'knockout') with

a full return of capital.

If the index doesn't maintain its value, investors simply stay invested for another year and the same test applies. Each year Liontamer compares the index to its starting level on the anniversary of the fund. Investors get five opportunities (one each year) to earn the high coupon and achieve a knockout (maturity of the fund). If this happens at the end of Year 2 the coupon jumps to 24%, if it happens at the end of Year 3, it's a 36% coupon, Year 4 is 48% and Year 5 is 60%. For each year they stay invested, the coupon jumps up in value to compensate for the longer term.

Jumper units

KNOCKOUT Series 1 has a great new feature called 'jumper

units'. As described above, if the fund doesn't close early, investors

simply stay in for another year. The coupon investors could earn

at the end of each year jumps up in value by 12%, reaching the

maximum of 60% in Year 5.

Investors need to be prepared to

stay invested for the full five years; however, the fund will actually

mature as soon as they are eligible for a coupon payment.

Jumper example

For simplicity, let's say the sharemarket index starts at a level

of 100 when the fund starts:

In this example, the index is below its starting level at the end

of Years 1 and 2, so there is no early maturity or coupon paid. In

Year 3 it rises to a higher level triggering a coupon payment of

36% and a full return of capital to investors.

What level of capital protection is there?

As an example, if the index continuously falls

in value, to a low point of –40% at the end of Year 5, investors

still receive a full return of capital (but no coupon payment). If

the index breaks the 50% safety-net during the term, the return

of capital tracks the performance of the index, just like any

ordinary sharemarket tracker fund. Any loss mirrors the loss in

the index.

Who provides the capital protection?

With any form of capital protection, the financial strength of

the bank providing it is important. This is because the bank is

legally liable to repay the investment amount to the fund if the

conditions of the protection are met. It is very important for

investors to ensure the bank has a strong credit rating. In this

case, KBC Bank has an AA- credit rating from Standard &

Poor's (similar to most well-known NZ banks).

How will the fund be taxed?

Those

who qualify as de minimis investors (i.e. have $50,000 or less

invested in overseas shares) may derive a tax-free capital gain on

the sale of their units to Liontamer on the maturity (including

early maturity) of the fund, depending on their individual

circumstances.

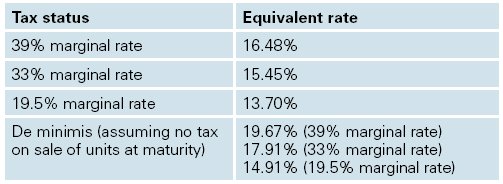

As an example, if the 12% coupon is paid at the end of the first

year, we have calculated the gross return required on a one year

deposit (on an investment which is not equity-linked) to match this

coupon (assuming the FDR method is applied by non-de minimis

investors in the year the coupon is paid):

Important note: For taxation advice relevant to your personal

circumstances, we strongly recommend that you talk to a tax adviser.

About the sharemarket index

Full details are contained in the Investment Statement and registered Prospectus,

provided by Liontamer Investment Management Pty Ltd (ABN 23 104 174 325).

Copies can be obtained from Liontamer Adviser Relations on 0800 210 450.

*100% capital protected where an Early Maturity Event occurs, and at final

maturity unless the Final Index Level is less than the Starting Index Level and the

Index Level has fallen below the Capital Protection Threshold (50% of the Starting

Index Level) on any Observation Date. There is a more detailed description of

the conditional capital protection in the Investment Statement (including an

explanation of the terms used above) and the limited circumstances when capital

protection may not be available.

# None of KBC Bank NV, KBC Asset Management NV or KBC Group NV

guarantees repayment of the investment amount or any returns on the investment

nor do any of them accept any liability to investors. However, as the Fund Asset

Provider, KBC Bank NV is legally liable to pay to Liontamer as trustee of the fund

certain amounts. Neither KBC Group NV nor any other member of the KBC Group

guarantees the obligations of KBC Bank NV.

Order Investment Statements and fact sheets on

0800 210 450

or email adviser_relations@liontamer.com Special Offers © Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

The jumper units also have an excellent level of capital

protection in place*. Investors stay fully protected, so long as the

sharemarket index remains at, or above, half of its initial starting

level (measured at monthly observation points). This provides

substantial protection from falls of up to 50% in the index from

the starting level.

This fund will own investments that are capital protected by

KBC Bank, who is the 'Fund Asset Provider'. Capital protection

is conditional on the index remaining at, or above, half its initial

starting level at each monthly observation point during the term.

As at 31 March 2008

Liontamer believes that the determination which it has obtained

from the IRD allows investors in its trusts (which meet certain

criteria) to apply the Fair Dividend Rate (FDR) method to

calculate their taxable income from their investment. Generally,

the FDR method applies to investors with more than $50,000

invested in offshore equity investments. If you choose to use this

method, tax is payable each year on a maximum amount of 5%

of the total market value of your offshore share portfolio.

The coupon return is linked to a European sharemarket index;

the Dow Jones EURO STOXX 50 Index. This is the leading blue

chip index for Western Europe, and provides a good representation

of the leading companies in that area. The index covers 50 stocks

from 12 European countries: Austria, Belgium, Finland, France,

Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands,

Portugal and Spain. It currently includes such well-known giants as

Nokia, AXA, L'Oreal, Suez, Total, and Unilever.

Liontamer's parent company KBC Asset Management

(KBCAM)# has a lot of experience in European markets and

the company's main offices are based in Belgium, in the heart of

Europe. Based on KBC's experience in Europe and extensive

regional research, we believe that the medium-term outlook of the

European sharemarkets is positive.

« Responsible investing gains new momentum Tower: Beating back the bear » Commenting is closed

www.GoodReturns.co.nz