Despite the fact that official interest rates have dropped to levels lower than were seen during the “tech wreck” period of 2000 to 2002, financial institutions – especially banks – are scrambling to rebuild their depleted capital bases and not keen to expand credit the way central banks have been urging them to do. Because the private sector is not leading the charge to reverse contraction in credit availability, the public sector has had to step into the breach.

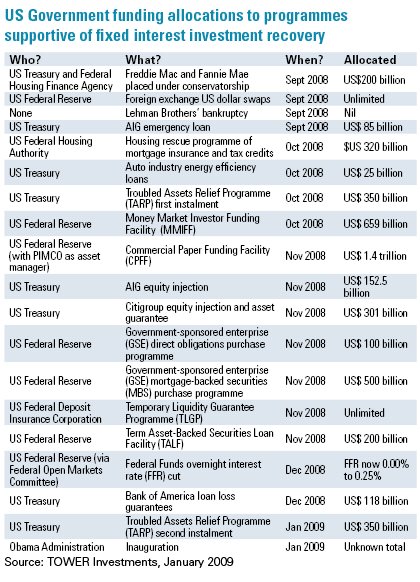

This takeover of the private sector’s role by government has been very pronounced in the United States, where central government agencies like the US Treasury, the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Federal Housing Finance Agency (FHFA) have intervened aggressively, particularly in trying to rehabilitate debt markets that have become dysfunctional due to lack of liquidity, collapse in prices, and loss of investor confidence.

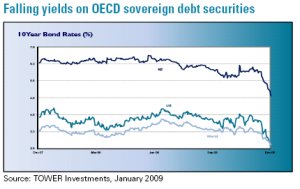

The global credit crisis has created a distinctively two-tiered fixed interest market, as is exemplified in the United States. Flight to safety fears – particularly pronounced since September 2008 when Wall Street investment bank Lehman Brothers entered Chapter 11 bankruptcy and the US federal government had to bail out giant insurer AIG - have caused bills and bonds issued by the US Treasury and other OECD sovereign debt issuers to jump in value due to buying pressure. Yields on these sovereign securities have fallen sharply as a result.

Conversely, other types of fixed interest securities – corporate bonds, asset-backed securities (ABS), mortgage-backed securities (MBS), bank-issued debt and loans, agency debt, municipal bonds, and emerging market sovereign debt – have nosedived as they were dumped and shunned by panicked investors.

US bond manager Pacific Investment Company (PIMCO) argues that, while the likes of US Treasury bonds are looking too expensive thanks to defensive buying pressure, there is recovery in prospect this year for higher quality non-government varieties of international fixed interest.

Key to its argument is that the US federal government, acting through agencies such as the Federal Reserve and Treasury, is investing huge quantities of public money to rehabilitate many types of non-government fixed interest securities. In effect these agencies have become the market makers for such securities, providing both market liquidity and price support.

Two core strategies applied by US authorities to fixing the debt markets involve using public funds to buy debt securities and also to purchase preference shares in financial institutions. The table summarises various such US government programmes underway since Freddie Mac and Fannie Mae were effectively nationalised.

PIMCO’s strategy is to be heavily invested in types of fixed interest securities likely to benefit most from massive US government intervention in order to be well-positioned for theirexpected recovery. As PIMCO’s chief executive officer Mohamed El-Erian puts it, “Investors should position their portfolios predominantly under the umbrella of government support rather than outside it; they should follow government actions rather than pre-empt them; and they should focus primarily on the senior parts of the capital structure.”(1)

PIMCO’s managing director Bill Gross has amplified upon the same theme:

“PIMCO’s view is simple: shake hands with the government; make them your partner by acknowledging that their checkbook represents the largest and most potent source of buying power in 2009 and beyond.”

“Anticipate, then buy what they buy, only do it first: agencybacked mortgages, bank preferred stocks, and senior bank debt; Aaa asset-backed securities such as credit card, student loan, and

auto receivables.”

“These have been well-advertised PIMCO strategies over the past 6 months but there are others in clear sight.”

“An Obama administration will quickly be confronted by the need to provide those hundreds of billions of dollars to states and large municipalities.”

“Their requests total nearly a trillion dollars and to think California or NYC would be allowed to fail is, well – unthinkable. “

“Municipal bonds then, selling at historically high ratios relative to US Treasuries, offer attractive price appreciation potential, or at the very least a defensiveness with high carry that a 2½% 10-year Treasury cannot.”

“As an additional strategy, global bond investors should recognize the value in high-quality investment-grade corporate bonds in many markets.”

“Yields of 6%+ for intermediate maturities are still common and readily available.”(2)

Additional features of BondPlus are:

• Portfolio Investment Entity (PIE)

• Income from international investments subject to Fair Dividend Rate (FDR) rules

• Returns 100% neutrally hedged to the New Zealand dollar

• Annual management fee now reduced to 1.05% plus GST

To obtain a copy of the Investment Statement for BondPlus or more information, contact Michael Coote at (09) 984 8210, email Michael.coote@tower.co.nz, or visit the Savings and

Investment section of the www.tower.co.nz website.

| « Tower: Beating back the bear | Infrastructure - Having you cake and eating it too » |

Special Offers

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved