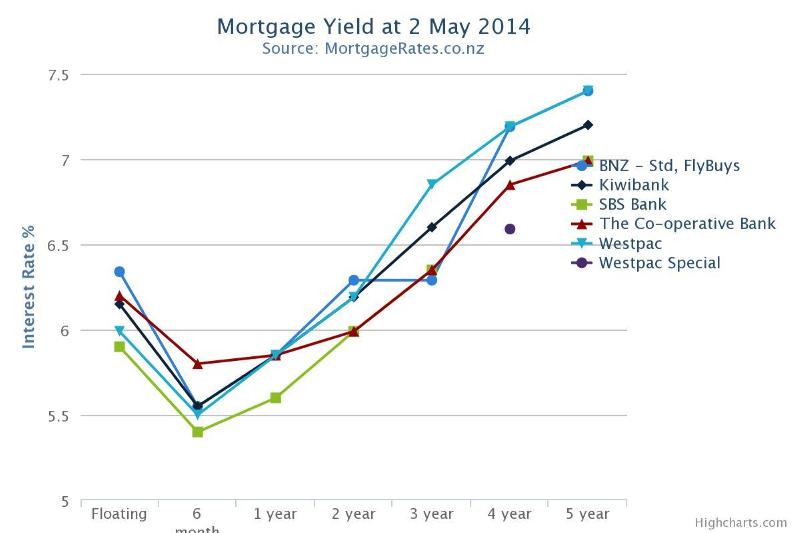

Floating rates have continued to rise this week, following the Reserve Bank's decision to hike the COR 25 points to 3%. However the increases haven't been uniform. The banks who have not passed on the increase include SBS and its fully-owned subsidiary HBS and HSBC. Where things varied from the expected plan is that BNZ increased Total Money the full 25 points, but only put its other floating rates up 15 points each.

SInce it only passed on part of the increase, it should follow that they would be the most competitive. However, that is not the case when you look at the rates table here where we have sorted it lowest to highest on floating rates.

While on floating rates it is worth noting that the three banks that offer an offset product (Kiwibank, Westpac and BNZ) have all increased their rates. Up until recently they all had identical pricing. Now Kiwibank leads at 5.95%, followed by Westpac on 5.99% and BNZ on 6.24%.

The other recent trend is that Westpac is taking a different approach to pricing its floating and revolving credit product. Previously it tended to have sharper pricing on its revolving credit faciltiy and often it looked uncompetitive on a floating rate comparison - now that situation has been reversed.

Generally fixed rates have remained static over the week; with a couple of exceptions.

The Co-operative Bank cut its five-year fixed rate to 6.99% (the only green arrow in the table!) Though it did increase its six-month and one-year rates.

A lender going the opposite way was AMP which hiked its five year rates.

TSB was the other lender of interest here during the week increasing all its fixed rates, except 18-months and two-years.

Lastly, Westpac changed its point of attact in the market launching a a four-year "special" of 6.59% which is 60 points less than its standard rate for this term. Of course there are all the usual conditions attached to the rate. Perhaps the most interesting thing is that four-year terms are not particularly popular with borrowers, so it will be interesting to assess this offer's attractiveness (or otherwise).

Westpac also removed its two year special this week.

| « Bank distribution drives ANZ's mortgage growth | ASB makes 3-year hero rate and offers more cash » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved