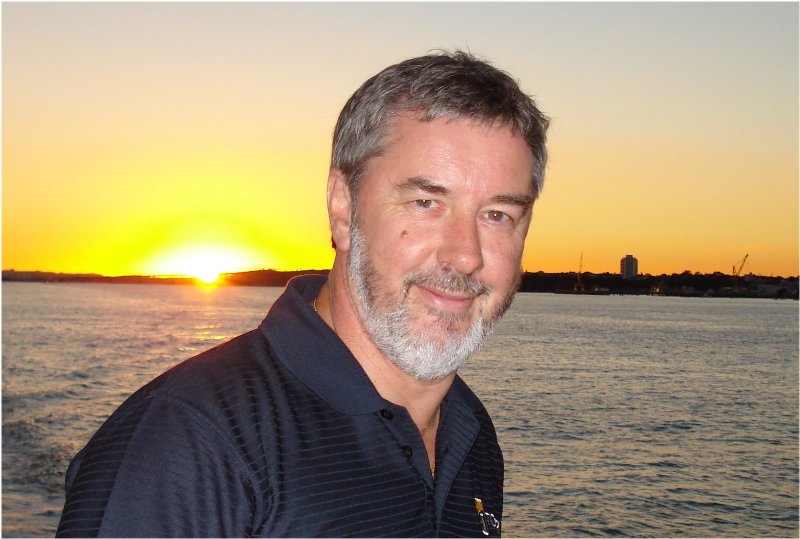

Getting to know...Fred Dodds

Today we launch a new weekly feature where you get to meet some of the key people in your industry. The first in our Getting to Know series is none other than IFA chief executive Fred Dodds.

Friday, March 13th 2015, 12:27PM

Who are you and what do you do?

I am Fred Dodds and I am the chief executive of the IFA – a position I have had now for some 15 months. It is challenging but there are some real neat people in this game. I am lucky to have been involved in most of the disciplines and have built some real good friendships with a lot of them.

How did you get into the advisory industry?

In 1977 I was a marketing manager for a farm equipment company in Gore!! Part of living in rural Southland was joining a service club – for me that was the Round Table. It had as member a National Mutual agent, MDRT qualifier who said I should become a life agent. He was persistent and so I decided I would give it a go but would do so in my home town of Dunedin.

My insurance agent was Ian Clark who was a Government Life agent and he got me into the Dunedin office where I was “recruited”. Then spent three days listening to Earl Nightingale tapes and learning how to drive a rather small rate boom and then put out on the street!! Well it was not quite that basic.

In those days along with the other mutuals you were sent away for a 10-day induction course before you were let loose on the public – not quite sure we do that today – FSPR, Disputes Resolution Scheme –Primary Disclosure Statement and away you go

For most of your career you’ve worked on the corporate side of the industry. Have you every wished that you’d rather have been an adviser?

Well I was an adviser for four years 1977 to 1981 when I was encouraged to become an Agency Manager and the rest is history really. I thoroughly enjoyed the Agency years – helping advisers get established and successful – many are still good friends today.

Looking back now though– yes staying an adviser would have been a good choice. I say that because the role of an adviser today is so wide ranging and whilst not there yet we will be recognised as a profession one day – advisers do a great job over all the life cycles in a person's life

You’ve got a pretty good reputation getting up in front of groups and being an MC. Where do you get all your gags from?

Not sure really – I suppose my makeup has a good lacing of humour built in. I am a good listener though and you would be surprised how many gags and one-liners just get produced out of matching conversation with individuals, companies and life situations. I also have been a bit of a conference junkie and have therefore heard some great gags from a lot of presenters – mmm I will store that one!!

If there is one thing you would like to change about the financial advice industry, what would it be?

To have the career and the job advisers do in financial services recognised by advisers, product producers the public and other professions as a “profession”.

Now that requires a raising of standards and attitudes by a lot of players – I might hang around for a while to see if I can help that happen!!

What’s the best advice you have ever received?

I can remember attending a LIMRA ( Life Insurance Market Research Association ) course to turn me into an amazing Agency Manager. One of the lecturers said two things that have stuck in my mind:

- Attitude counts far, far more than talent and

- Being negative doesn’t help others

I have pretty much got them into my DNA I think

Outside of work what do you do?

I live in Waikanae – Kapiti Coast – neat place. I am on the Executive Committee at the Chartered Club and that keeps me pretty busy with meetings.

I am also along with Mavienne a keen gardener and we have had a property in a promotional Garden Walk – like 2,000 people trampling over my groomed grass and asking dopy questions – no jokes there!!

And the odd game of golf – left hander – I have the best controlled banana slice on the coast

And with a son living in the UAE we get up there quite frequently – Mavienne and I love it up there. There is a Financial Planning fraternity up there – growing. I could go up and establish a business – I would only need one Sheikh!!

What’s one thing people may be surprised to know about you?

I was in another life a pretty keen snooker and billiards player – like NZ Champs etc. I have been playing again in recent years in local competitions with some success. Not quite Pot Black territory but I do have a handful of 100 plus snooker breaks to my credit

If you weren’t in this job what would you be doing?

Two things spring to mind.

Trainer – motivational speaker

Or – a career in Trade and Industry promoting this wonderful country we are lucky to live in

You're off to your son's wedding in Kenya. What's been easier to organise: A wedding in Africa or a joint conference in Auckland?

Now there’s a question. You can pretty much get advisers and product suppliers on side around a conference – they clearly see the end game.

A Kenyan wedding is fraught with tradition, culture and an attitude of - “it’s your marriage but our wedding” . Things like “ what do you mean a guest list” – “we always invite the whole village!!”

So – off Mavienne and I go next week to Lake Naivasha – about 120kms outside Nairobi where we will join daughter Toni for the marriage of our son Bevan to Abby Momanyi – it will be a great occasion.

Oops – I have to give a speech – better head off and find some gags!!

If you would like to be part of our Getting to Know series please drop an email to philip@goodreturns.co.nz

| « Programme fosters new advice talent | IFA working on pro-bono offering » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |