Net profit after tax was flat at $10.34 million for the 12 months to March 31, due primarily to margin pressure. The bank managed to grow income by 3.0% and expenses were contained to an increase of 1.1%.

The bank’s strong lending growth, offset by industry margin compression, saw a net interest income rise of 1.1% to $52 million.

The Co-operative Bank differs from its competitors as its lending is 100% funded from retail funding.

Among the positive numbers:

As the bank is a co-operative it pays a rebate to its customers, who are the owners, rather than shareholders. A total of $2.1 million will be paid as a rebate this year - the figure is the same as last year due to the overall profit being pretty much the same.

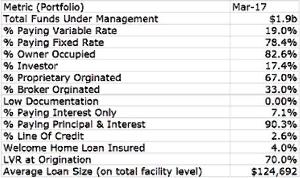

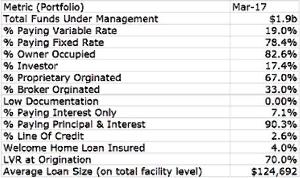

At the March 31 balance date, the bank's gross residential lending book sat at $1.954 billion. Since then it has passed the $2 billion and mortgage advisers make up around 33% of all home loans written.

"We continue to focus on growth, which means not only attracting new customers but, equally as important, growing our relationships with existing customers, increasingly via digital channels,” newly-appointed chief executive David Cunningham says in a statement.

Cunningham says during the year there was a 35% increase in the number of customers who held three or more products with the bank. "This is very important because it shows we are meeting more of the needs of our existing customers, and they are comfortable to have these services provided by us,” he said.

Its new Fair Rate Credit Card has performed above expectations, and more than 9,000 cards have been issued and lending on the product sits at around $20 million.

| « Westpac scraps online app process | Vincent Capital adds a South Island BDM » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved