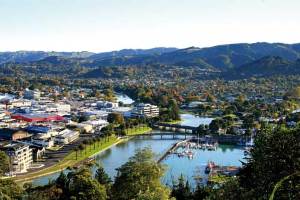

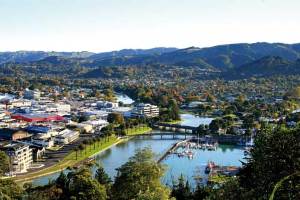

Gisborne

by Miriam Bell

Gisborne

There have been recent reports of notably high house price growth in small towns like Meremere, Waikato and Gate Pa, Tauranga.

And it has been a matter of public record for some time now that some regions – in particular Waikato, the Bay of Plenty, and Northland – are experiencing strong price and sales growth.

However, as landlords.co.nz has reported before, while growth might be strong in certain areas at the moment, it pays to think about how solid the foundations of that growth is.

Veteran property investor Olly Newland believes the current period of strong regional housing market growth in areas close to Auckland will be short-lived.

“In the long-term, the growth won’t be as spectacular as many people think. It will probably just level out. It’s a bit of a mud pool, with bubbles here and there. But they won’t last.”

In his view, the growth rates in some of the places cited as hot spots are simply not sustainable once local economic drivers are examined.

“House prices might be going up in those markets right now. But, in such areas, both incomes and job prospects are less than in Auckland.”

Further, the opportunity to benefit from strong growth in such regions has now passed, Newland said.

“If you got in early, then you might do OK. But, in a few months’ time, it will be too late for anything decent at all.

“We should be worried about prices levelling off and people who have bought in haste, late, getting caught out.”

BNZ chief economist Tony Alexander agreed.

Auckland investors are driving regional housing market growth – not the local economies - and it won’t last, he said in his latest newsletter.

As examples, he pointed to Taranaki which is being hit by downturns in dairying and energy, and Wellington where central government bureaucracy is a key element but no expansion phase has been entered into.

Alexander said regional housing markets have not soared because of changes in economies or their prospects.

“It is because investors have come out of Auckland looking for yield and lower prices.

"And local investors, seeing markets rising, have jumped on the bandwagon - after choosing to sit on their hands doing very little for a number of years moaning about the focus on Auckland and secretly wishing for Auckland’s Chinese buyers to come their way.”

This year the story is likely to remain one of Auckland having a rest and the rest of the country, bar Christchurch, seeing listings shortages and potentially rapidly rising prices, he said.

However, he has previously warned the current run of regional growth will peter out, possibly early in 2017, and that, unlike Auckland, many regional areas have an over-supply.

“If you are an Auckland investor jumping boots and all into the regions buying what you consider to be cheap properties with good yields be very, very careful.”

Meanwhile, recent realestate.co.nz data showed that Gisborne, followed by Otago and Manawatu/Wanganui provide the highest returns for landlord investors.

In January, Gisborne returned an average of 5.78%, while Otago returned 5.54%, and Manawatu/Wanganui returned 5.12%.

In comparison, January’s national average for rental property returns was 4.10%.

But NZ Property Investors Federation executive officer Andrew King said it wasn’t surprising that such areas would be the highest yielding areas.

Places like Gisborne and Invercargill tend to generate higher yields because they have significantly lower buying costs, as well as additional risks for investors.

While yields are always variable around the country, they tend to be lower in Auckland and higher elsewhere, and this hasn’t changed much despite price movements, he said.

Investors on the search for cash flow should always carefully analyse the risks found in many high yielding areas.

| « Decline in building consents | Free Investment Property Showcase Events: Auckland, Wellington and Christchurch » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved