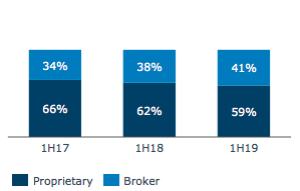

In the six months ending March 31, mortgage advisers accounted for 41% of home loans at ANZ, up from 38% in the corresponding period last year.

ANZ New Zealand chief executive David Hisco acknowledged mortgage advisers played an important role in originating loans for the bank.

However, he has no plans on changing the commission model ANZ uses with advisers.

Hisco ruled out introducing trail commissions while he leads the bank.

In Australia ANZ chief executive Shayne Elliott told analysts that he expects the rise in broker market share to continue.

“There is clearly a structural change happening in the marketplace,” he said.

“More and more Australians are choosing to use the broker channel. They see value in terms of ease but also in terms of price transparency.

“I can’t see that slowing anytime soon.”

"I think that trend will continue, and there are many markets around the world that have much higher penetration of brokers.

“Interestingly, we’ve seen the same trend – although much lower numbers – happening in New Zealand as well.”

ANZ's New Zealand home loan market share has stayed steady at 31%, however it has grown from 31,000 home loan accounts at the end of March last year to 37,000 accounts this year.

The average loan size over this period has decreased from $274,000 to $251,000, however there has been a slight uptick in investor loans. Currently 23% of the bank's book is to investors compared to 22% last year.

The trend away from variable loans to fixed term ones has also continued. Currently, 87% of loans are on fixed rate terms compared to 82% last year.

| « Advisers may be unprepared for new regime: Johnston | Vincent Capital adds a South Island BDM » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved