I doubt many people in the financial services sector have been sitting at home twiddling their thumbs during the first two weeks of the lockdown. We certainly haven't; indeed it has been an incredibly busy time adapting to the changes.

It seems financial services, at this stage, is in a much better shape than other sectors of the economy. A trawl through Work and Income's wage subsidy database suggests very few organisations in the financial services have applied for the subsidy. That could of course change over coming weeks.

The two big advice groups who have salaried advisers; Lifetime and Advice First, appear not to have been granted a wage subsidiary. Searches for financial advisers and mortgage brokers bring up only a handful of results.

A couple of the dealer groups, and similar entities come up including Consilium, Kepa, Mortgage Link

The area which is likely to be hit hardest is mortgage advisers, especially those businesses which have relied on upfront commission rather than building trail into their operations. With the housing market dead, there is next to no new business. Plenty of advisers are busy with restructuring loans and helping clients understand their options, however generally the fee for a restructure is a mere $150.

Insurance advisers, although used to high up front commissions, are arguably better placed than their mortgage peers and investment advisers, especially ones charging fees should be well-placed to survive this period.

Situations like this lockdown, which are as we know is unprecedented, puts another perspective on the highly topical issue of commissions and how advisers are paid. Regulators may need to rethink their views on some of these issues. if the goal of regulatory changes is to ensure the New Zealand public have better access to advice, then these business models need to be considered.

In our search we could only find a couple of fund managers who had been granted the wage subsidy and no life companies.

Good Returns changes

We've been busy adopting to changes too. As our printers were deemed a non-essential service by the government, we've moved to digital distribution of all three of our magazines. During the week you should have received digital versions of ASSET and TMM.

If you haven't but would like to see them then please drop me an email; likewise if you have seen them it would be great to get your feedback. Email philip@goodreturns.co.nz

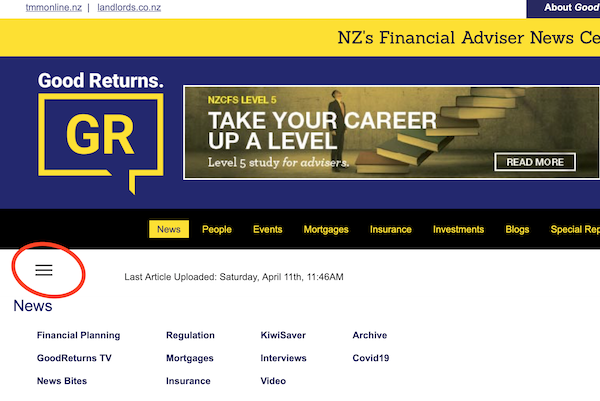

Also you may have seen we used out a little brand refresh before lockdown. This is part of our on-going development of Good Returns and there will be further enhancements during the year.

To get to the sub-sections of Good Returns use the Hamburger icon - see image below.

Situations like the Covid 19 pandemic create issues and also opportunities. Many businesses will look different after the event, and no doubt we will too.

| « FMA keeps close watch on Covid-19 misbehaviour | Mann on a mission to diversify financial advice » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved