by Harbour Asset Management

Key points

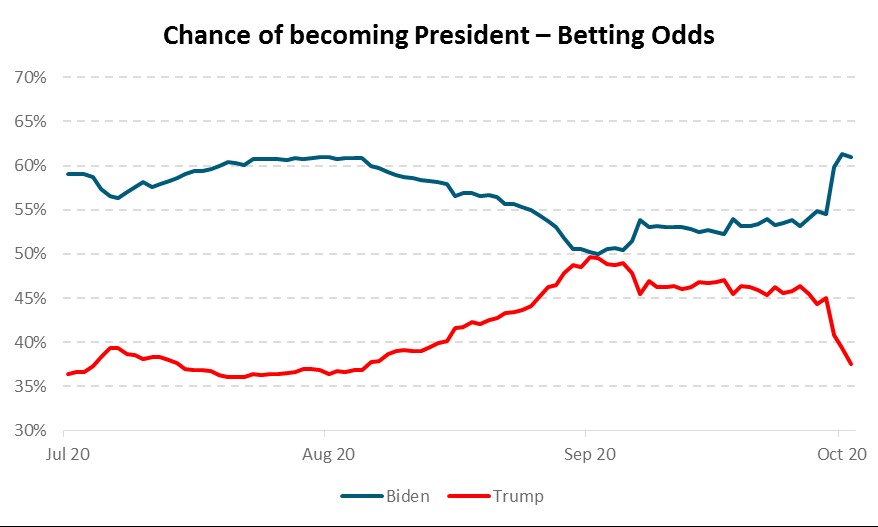

• Joe Biden is a firming favourite to become the 46th US President. If Biden wins but the Republicans retain the Senate, most analysts predict little aggregate market reaction. At present, this outcome is finely balanced. A Democrat clean sweep is viewed as a less market-friendly outcome.

• The easiest part of the economic recovery phase now appears to have passed. Investors are more likely to face waves of positive and negative data to anchor views. Economists have widely dispersed views on the near-term outlook for both the New Zealand and Australian economies.

• Looking forward, announcements from many of the nine current Covid-19 vaccine phase-three trials are likely this quarter. Already markets have reacted to both positive and negative news, indicating the strong influence that the results have on uncertainty.

Key developments

Equity markets generally continued to respond positively to ongoing monetary stimulus and the gradual re-opening of economies over the quarter.

Despite Covid-19 lockdowns in Auckland and Victoria the trend of better-than-feared economic and corporate news continued to be delivered.

Markets weakened towards quarter end, as leading indicators missed expectations triggering concerns of a global loss of growth momentum.

US fiscal support was delayed and policy and geopolitical risks increased.

A spike in European Covid-19 cases and Covid-19 containment also reminded investors of the risks to activity from Covid-19.

As a result, equity markets were weaker in September with the S&P/NZX 50 Index down -1.6% over the month and the MSCI All Country World Index (in USD) down -3.4% over the month. Both indices were up over the quarter, by 2.6% and 7.7% respectively.

The 10-year New Zealand Government Bond yield slipped to a record low 0.45% after touching 1.0% early in the quarter.

The quarter also marked the first time a nominal bond traded at a negative interest rate in New Zealand.

The overnight interest rate swap rate for periods beyond April 2020 dropped into negative territory early in the quarter, and was followed by government maturities out to five years trading at small negative rates.

It was against this backdrop that the Bloomberg NZ Composite Bond Index returned 0.67% in September and 2.13% over the quarter.

Covid-19 headlines continued to dominate throughout the quarter. Generally, the data are showing that while Covid-19 is being well-treated, it is still far from being contained.

Record progress is being made on both treatments and vaccines. Announcements from many of the nine current Covid-19 vaccine phase-three trials are likely this quarter.

Already markets have reacted to both positive and negative news, indicating the strong influence that the results have on uncertainty.

In September, we saw a pause to the Oxford/AstraZeneca trial. Experts have been clear that instances such as these are not uncommon nor unexpected.

Our view is that a number of these vaccine trials may provide news that could have a heavy influence on markets in the coming months.

The Reserve Bank of New Zealand (RBNZ) continues to view the balance of risks as skewed to the downside and wants retail interest rates to fall further.

After expanding its QE programme to $100 billion in August, the RBNZ is focusing on a negative official cash rate (OCR) and a Funding for Lending Programme (FLP) to provide further stimulus, if needed.

The FLP will provide direct lending to banks at a rate close to the OCR. Markets now price the OCR to be -0.20% in one year’s time.

What to watch

US Elections: The November 3 US election is also contributing to economic uncertainty with polls and bookmaker odds suggesting Democratic nominee, Joe Biden, is likely to become President but the currently Republican-controlled Senate is a toss-up.

If the Democrats win the Presidency and take the Senate, this will allow for a larger degree of policy change.

Source: RealClearPolitics. Average of betting markets.

Economic activity in New Zealand has bounced, but cliffs beckon: A reduction in New Zealand mobility restrictions – to alert level two in Auckland and alert level one elsewhere – allowed economic activity to increase again.

High frequency activity indicators have largely returned to normal.

The export sector is continuing to benefit from an improving global economy and well-supported export commodity prices.

A strong increase in population in the first half of the year and lower mortgage rates have encouraged an impressive rebound in the housing market. If sustained, this may boost consumption via a positive wealth effect, particularly for those with strong job security.

Real time Google data on mobility continues to provide a useful indicator for near-term trends. This is improving significantly, with New Zealand close to full domestic activity.

Xero’s Small Business Insights data appear to support that perspective, with New Zealand-wide revenue trends 4% higher in August and employment figures significantly stronger.

The recent expiry of wage subsidies, however, is likely to lead to higher unemployment and challenge the pace of economic recovery.

Wage subsidy programmes are currently supporting 120,000 jobs or 4.5% of the labour force, the application period for these has now ended. There are currently 146,000 people claiming unemployment benefits, consistent with an unemployment rate of 6.6%.

Market outlook and positioning

Covid-19 remains one of the most difficult challenges global policy makers have ever faced.

The policy response has so far delivered, by and large, better-than-expected health outcomes (at least in terms of the number of deaths), and far better-than-expected near-term economic outcomes.

Not only did policy bridge a huge potential void in demand as lockdowns limited activity, but fiscal and monetary policy, together with better health outcomes, delivered a very sharp V-shaped recovery.

Economic data have generally been far stronger than expected, and companies have reported better-than-expected sales and profits.

At the same time, interest rates are expected to stay very low for a long time. This environment is likely to encourage capital into higher risk assets over time.

Quality yielding equities, and stronger growth companies may continue to see investor interest, maintaining what appears to be relatively stretched valuations based purely on earnings or dividend trends.

Relative to bond yields or cash, however, we continue to see relative attraction in most parts of the equity market.

Equity growth portfolios remain anchored in the healthcare, technology and consumer staples sectors.

The balance of the 2020 year is likely to reflect the influence of political risk, economic trends, perspectives on the re-opening of economies and news on Covid-19 vaccines.

Corporate earnings guidance may continue to be difficult, but we expect greater clarity as evidence emerges on a continued economic recovery.

Within fixed interest portfolios our recent strategy has been to position for lower interest rates over the 0–3-year maturity bracket.

While there has been plenty of debate about the pros and cons of negative rates, the Reserve Bank has been quite clear in its plans to be ready for negative rates, should this be justified from April 2021 onwards.

The RBNZ has also been clear that they see risks skewed towards the downside for employment and inflation.

Using a “least regrets” framework, easier policy, including a negative OCR, becomes the logical pathway. The market has generally got on board with this idea and rates through the 0–3-year part of the yield curve have declined.

Easy monetary policy is also supportive for the corporate bond market. This happens as investors seek returns with abundant cash in the financial system increasing the size of the demand.

We have sought to add to credit exposure, predominantly in the high-grade sector and where exposure to Covid-19-related risks are minimal.

In growth-focussed, multi-asset portfolios we have maintained a modest overweight position to equities. While the rally in equity markets has been strong, attractive risk premia remain over bonds and cash.

In a year where we have seen wide divergence in the performance of equity market sectors and styles, we have added some exposure to global strategies that invest in areas of the market which have not fully participated in the market recovery.

This reflects our view that economies are adapting and could continue to adapt to Covid-19 quicker than originally expected.

The Income Fund strategy is quite closely aligned with the multi-asset portfolios at present.

It holds a modest overweight to equities, also reflecting the view that very supportive monetary policy can enable equities to outperform bonds and that the additional risk is acceptable.

Positioning is not aggressive, reflecting both the sense that the market already prices in a reasonable recovery and that political risk prompts some scope for volatility.

This does not constitute advice to any person. www.harbourasset.co.nz/disclaimer

Important disclaimer information

| « KiwiSaver supermarkets – real competition for corner dairy schemes | a2 Milk – growth stocks and downgrades don’t mix well » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved