Effective vaccine, better earnings spur on markets

The Harbour Investment Outlook summarises recent market developments, what we are monitoring closely and our key views on the outlook for fixed interest, credit and equity markets.

Monday, January 18th 2021, 6:23AM

by Harbour Asset Management

Key points

• COVID-19 hospitalisations continued to increase globally with new strict lockdowns in the UK. However, countries have moved to fast-track vaccines to manage the pandemic. At the time of writing 24 million doses of COVID-19 vaccines have been administered across 41 countries including 7.7 million in the US and 1.5 million in the UK.

• Just before Christmas, the US approved USD900bn of additional fiscal stimulus (about 4% of GDP), much larger than the USD500bn expected by most analysts after the election resulted in a split Congress.

• The Democrats took control of the US Senate, by winning both seats at the January 5th Georgia runoff, increasing the prospect of large additional fiscal stimulus, increased corporate tax rates and further regulation.

• New Zealand Quarter 3 GDP data confirmed that economic activity has returned to pre-COVID-19 levels, consistent with high frequency activity indicators.

Key developments

Global equity markets were again strong over the month with the MSCI World returning 4.1% in US dollars. Unlike November, where markets saw a strong re-opening trade due to positive vaccine news, December’s gains were broader based. The New Zealand equity market (S&P/NZX 50 Gross with imputation) finished the month up 2.5% while the Australian equity market (S&P ASX 200) rose 1.2% for the month (+3% in New Zealand dollar). Government bond yields moved higher (New Zealand 10-year up from 0.85% to 0.99%) on an improving economic outlook and potential re-opening of economies, whilst in currencies a weaker US dollar saw both the New Zealand dollar (+2.4%) and Australian dollar (+4.8%) stronger.

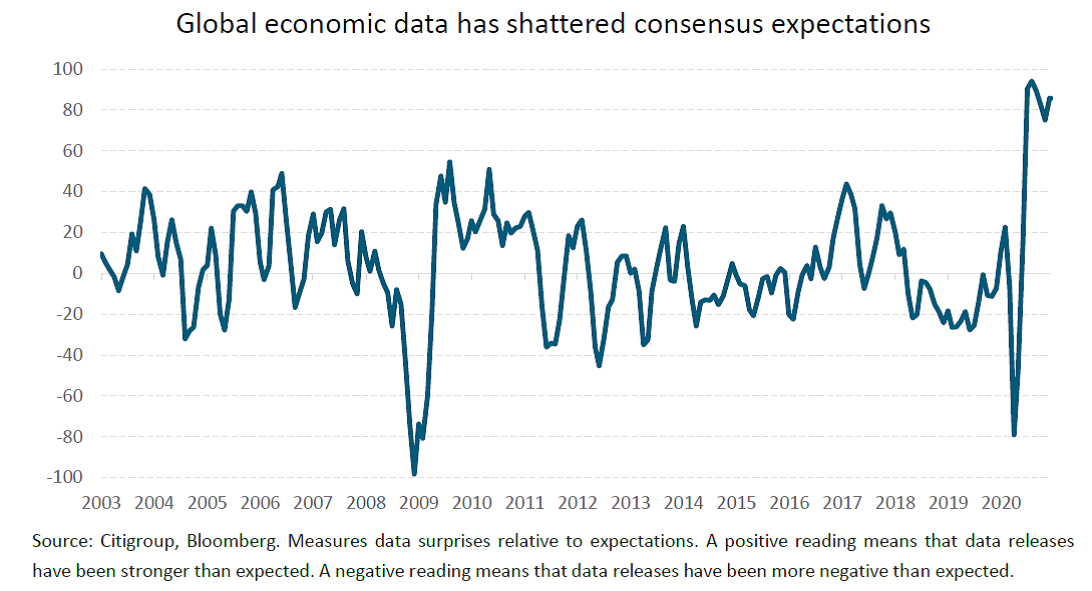

Over recent months, markets have had to grapple with concerning headlines around COVID-19 hospitalisations, which has led to heightened mobility restrictions in Europe. These negative headlines have been outweighed by an improving longer-term picture as vaccine rollout programmes have moved into gear while governments and central banks have remained supportive. The other key variable has been the extent to which both earnings and economic data has surprised to the upside of conservative consensus forecasts keeping sentiment positive.

Just before Christmas, the US approved USD900bn of additional fiscal stimulus (about 4% of GDP), larger than the USD500bn expected by most analysts after the election resulted in a split Congress. The Democrats took control of the US Senate by winning both seats at the January 5th Georgia runoff. The Democratic Senate gives the party greater power to pass large additional fiscal stimulus, increase corporate tax rates and introduce regulation. The narrow majorities in both houses could be a moderating factor to passing laws and President-elect Biden’s nearer term priority will be to manage the COVID-19 response and vaccine rollout amid still surging infections.

New Zealand Q3 GDP data confirmed that economic activity has returned to pre-COVID-19 levels, consistent with high frequency activity indicators. The economy is in a much better state than many had anticipated earlier this year (including the Reserve Bank of New Zealand), particularly the labour and housing markets. Economic activity remains below potential, however, and will likely act as a disinflationary force over the coming year. Credit growth outside of housing is weak and the tourism industry will miss the normal influx of foreign visitors over summer.

What to watch

In our view, looking into 2021 markets will be influenced by the R’s:

• Reflation

• Re-opening

• Re-acceleration

• Rotation

We may see stock markets remaining volatile reflecting economic re-opening, economic re-acceleration and rotation between stock market sectors that are or are not economically sensitive, particularly given the tricky nature of COVID-19. With central banks globally actively implementing policies that advocate a degree of inflation, a modest increase in inflation is unlikely to see a rapid unwinding of stimulatory monetary policy which is keeping interest rates low. In our view, equities should continue to deliver higher real returns than bonds (negative stock-bond correlation) as economies remain in a reflationary phase with inflation rising from low levels.

However, markets look forward and we are vigilant for the potential for long term bond rates to creep up as activity and inflation increases (current disinflationary impulses decrease) and markets anticipate a tapering of stimulus, with implications for the valuations of stocks where earnings are not growing in-line with activity and inflation. The current full pricing of long bond yield sensitive stocks will react negatively to any ‘taper tantrum’. We are also alert to investor positioning that has moved from being wary and conservative to increasingly favouring equities, taking market valuations to full levels, which may increase volatility should earnings growth disappoint (given current valuations missing earnings may be heavily punished).

Market outlook and positioning

Over the last quarter the resilience of the domestic economy has caused us to question the rationale for the Reserve Bank to cut the OCR into negative territory. We had also observed the expensive valuation of New Zealand bonds, both on a real basis (relative to inflation) and relative to other bond markets. This led us to expect bond yields to rise for maturities from two years out to twenty years. The COVID-19 vaccine news has also raised the prospect of stronger global activity as the year progresses. Phenomenal fiscal and monetary policy support continue to underwrite an economic recovery.

This combination has us now expecting that 10-year bond yields will not fall back towards the record low of 0.45%, seen in September. It seems quite possible to us that this will mark the low point in the fall in long-term interest rates that we have experienced in New Zealand since the 1980s. Central banks are now emphasising a focus on average inflation targeting. The US Federal Reserve has been explicit about this. The implications are that they will keep the cash rate low for quite some time, but not enough to hold 10-year yields near 0.5%.

Within fixed Interest portfolios, we don’t expect bond yields to rise massively. The western world is too indebted to cope with that. Our view is that it is more likely that, through 2021, an economic recovery will cause bond yields to push higher, but at this stage we think a move to 2% on 10-year bonds might be a stretch. However, the asymmetric outlook argues for us to hold a short duration position, to protect investors from the capital losses and poor performance that would arise if yields keep rising.

Our equity growth portfolios remain anchored in the healthcare, technology and consumer staples sectors reflecting secular trends. The portfolios also have a modest barbell investment in cyclical growth stocks (mainly through Australian banks and resource stocks), where supported by structural change. The 2021 year is likely to reflect the influence of news on COVID-19 vaccine rollouts and herd immunity rates, political risk, economic recovery, perspectives on the re-opening of economies and potential for changes in monetary policy settings. Corporate earnings guidance may continue to be mixed near term, but we expect greater clarity as evidence emerges on a continued economic recovery, with the potential for medium term earnings to be boosted by economic normalisation and business changes made post-COVID-19 that may ‘turbo charge’ earnings for some stocks in the near term and extend the growth path for others over the medium term.

In growth-focussed, multi-asset portfolios, exposure to share markets are near benchmark levels. Reflecting that, while we are not bearish, sentiment has reached more elevated levels which provides less of a cushion in the event of a drawdown. The existence of a strong equity risk premium prevents us from adopting more cautious positioning.

The Income Fund strategy is quite closely aligned with the multi-asset portfolios at present, moving to a modest underweight position to equities in early January. Reducing equity exposure in the Income Fund at the current level reflects the mindset we have about capital stability and a desire to reduce exposure when strong forward-looking returns are less prospective.

This does not constitute advice to any person. http://www.harbourasset.co.nz/disclaimer

Important disclaimer information

| « Five reasons why responsible investment will keep growing | On the industry play-list: four chart-topping regulations for 2021 » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |