Is Value back, or do Growth managers still reign?

Grant Pearson revisits one of the great investment arguments - what's the best investment strategy, growth or value?

Tuesday, February 23rd 2021, 12:21PM

by Grant Pearson

There is talk about how Value managers are back in vogue since Covid-19 impacted markets. Choosing undervalued stocks was made easier in the wake of a 30% market plunge. Even so-called Blue-Chip stocks were trading at prices not seen since 2008. Later in the year, on the back of vaccine announcements, cyclicals and other beloved sectors of the Value approach rose to lofty heights well ahead of the bottom-line impacts to companies. Growth is dead. Long live Value!

Or is it?

What we do know is that Value management traditionally performs well through periods of economic activity and potentially rising inflation; yet this is not what we are seeing globally despite the excessive central bank stimulus in the wake of the pandemic. Pundits generally agree that this is due to the nature of government spending. This has largely been targeted at welfare and job security rather than economic stimulus and infrastructure. Inflation should be rising but it is not. The velocity of money in respective economies has also not significantly increased. What is stopping these otherwise supportive factors for Value to flourish?

The answer lies in the structural headwinds facing the ‘reflation story’ which would otherwise benefit Value managers. Two of these being Demographics and the accelerating Fourth Industrial Revolution. This raises an obvious question. Should investors and advisers ignore the short ‘time in the sun’ Value managers are enjoying today? Should they stay with the Growth managers that have generally outperformed over the past decade?

The traditional notion that we are just in the regular economic cycle of one investment style being favoured over another, may be flawed thinking for the future. To many this might sound like heresy. It would be arrogant of us however to assume that despite business always being in constant change, and now facing accelerating extreme change, that there are ‘laws’ (like Newtons Laws in physics) governing the norms of investing too. The conditions we face from Covid haven’t been present for over 100 years. The two large structural headwinds impacting global economies are both world firsts. It is hard to see economic activity increasing massively, even in the medium term to support a Value argument.

Consumer demand is not bridging the excess in production capacity. Any expectation that activity will underpin a sustained period of broad growth to produce high short-term results for businesses is unlikely. The past year generated interest in changes to consumer patterns. Covid-19 accelerated the trend of the flight to online shopping and banking as examples. Communication and media technologies along with food delivery services also boomed. These are hallmarks not of a Value uptick but of the Fourth Industrial Revolution.

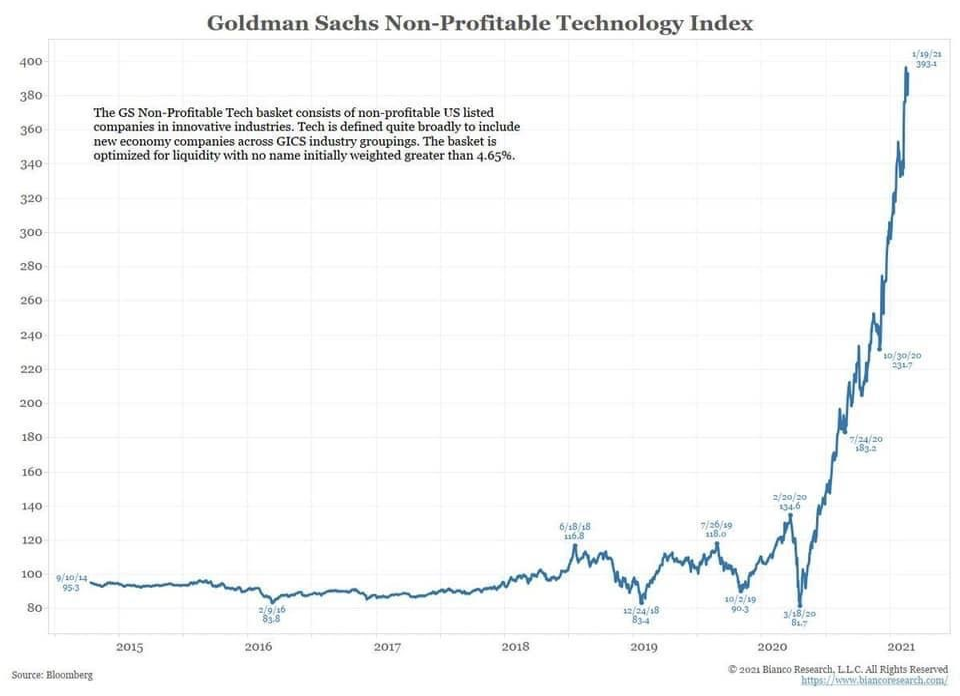

Does this mean Growth rules? 2020 delivered outstanding results for some pure Growth managers that also usually held strong Momentum stocks. These few were heavily tilted toward quick growing but often low profitability stocks, as borne out by the following graph. It is hard to believe such results will continue given the multiple many of those stocks are now trading on, given the level of economic activity.

Searching for the highest growth stocks based on ‘sales uplift’ numbers can be generally agreed as imprudent. It requires amazing and consistent timing skills on behalf of the manager. Investing for longer duration outcomes is what many global managers ignore. Instead, they’re focused on the quick and near-term gain in trying to attract your support.

So, is it Growth and Value? The knee-jerk response to avoiding the challenge above is to have a bet each way; relying on ‘when one is down- don’t worry the other will likely be up’. This however acts as drag on investor portfolio returns (although effectively hidden from clients). It is not an efficient deployment of client capital. Accepting that a large majority of an investor’s money will be significantly underperforming today in the hope that in the future it might average out beyond an index, is a big and expensive bet for an adviser to take.

Perhaps Growth or Value? There may also be a risk in aligning your portfolio with pure Growth managers too. As mentioned, approaches focussed on sales acceleration or price momentum rather than sustainable growth and profitability present higher risks. This ‘either/or’ approach implies making ‘switching calls’ between styles, thus the timing risk is considerable. There is little evidence to support anyone getting this right enough over time and better than when they get it wrong.

Studying a manager’s transactions closely over time is quite revealing- few bother but here lays the allocation ‘key’ for advisers. Other ‘style’ approaches do exist that overcome these issues, although the whole concept of ‘style’ itself may need reviewing. This leaves a conundrum for advisers in portfolio construction using ‘style’ to allocate assets. Use both styles and one creates an effective hidden tax on investors; choose one over the other and large timing risks are incurred. A third path is perhaps more prudent, one that focuses on how they make specific stock decisions over long periods of time, and disregarding industry labels. Hidden within both ‘categories’ are approaches that address this conundrum very well; neither ‘Growth’ nor ‘Value’.

Grant Pearson: Head of Strategy for Insync Funds Management www.insyncfm.com.au

Head of Strategy for Insync Funds Management

| « What Elon Musk’s new title might mean for markets Or … Tesla’s share price, intrinsic value or market madness | Effective vaccine, better earnings spur on markets » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |