Described as the “city with 100 beaches”, Whangārei has attracted property investors, retirees and first home buyers alike. For the price of an Auckland house two could be snapped up in Whangārei.

Internal migration and returning expats have sustained Whangārei’s recent growth along with the plethora of small businesses, but this expansion has now meant a massive housing shortage and not a fix in sight.

There are simply not enough houses to buy or rent, a dearth of new homes and builders booked up to two years in advance, according to local agents.

Total housing stock for sale in May was 638 houses compared with 1,086 in May last year, a drop of 41.2% in Whangārei. Across Northland there is just 13 weeks of housing stock for sale.

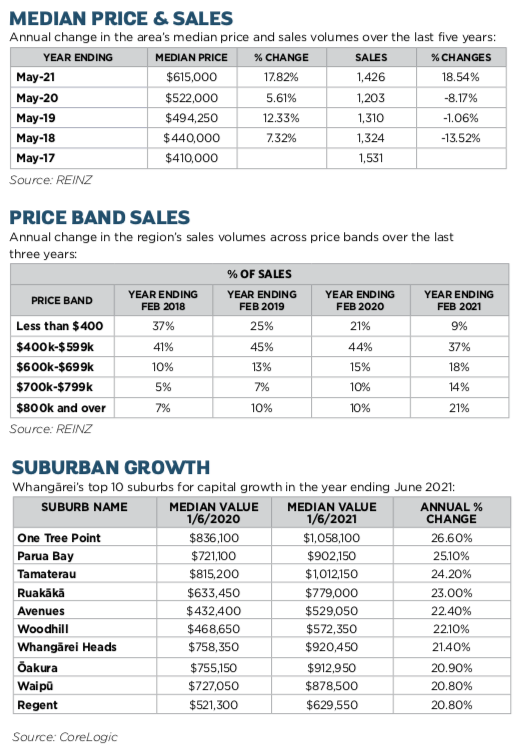

A lack of stock means average house prices have been increasing at a rapid rate. Increasing values were led by One Tree Point with a year-on-year rise of 26.6% to $1.058 million from $836,100 at June 1 last year, according to CoreLogic data.

Following closely behind is Parua Bay with an increase of 25.1% to $902,150 from $721,100 during the same period, while prices have soared 24.2% at Tamaterau to $1.012 million from $815,200 at June 1 last year. In popular Ruakākā prices rose 23% over a one year period to $779,000 from $633,450.

While property listings have slumped so have rentals on the market. One property management company has just four houses for rent from a stock of 500. More than 100 people apply for every rental that comes to the market.

INVESTOR INTEREST FALLING

However, tempering the market is the falling away of investor interest in the past couple of months, says Martin Dear, branch manager Barfoot & Thompson Whangārei.

“Investor interest has definitely waned with a 30-40% drop at open homes and a decline of bidders at auctions in light of the 40% deposit requirement under the Reserve Bank’s loan-to-value (LVR) restrictions, the Government’s removal of tax deductibility to be phased in over four years and the Healthy Homes legislation,” says Dear.

Most investors are from Auckland and while some are selling up because of law and tax changes, it is also because they can still get a good price for their property.

Dear says it is still a seller’s market and the battle is between investors and owner-occupiers for good property. Generally, investors will look at property under $700,000 and owner occupiers will buy up to $1.2 million.

“It is relative to the low mortgage interest rates. Since the early stage of the Covid-19 pandemic properties for sale have been tight. Good properties are selling in seven to 14 days, while some sell privately off-market.”

About 40% are selling to investors and 60% to owner occupiers. Because there are so few houses for sale, Dear says people are looking anywhere and everywhere but the coastal areas of Bream Bay, Tutukaka and Whangārei Heads are popular. “There was a run on houses under $1 million and they have mostly sold.”

He says Investors are buying in the cheaper areas to get better returns. “Whangārei is an advantageous place to be price wise compared to Auckland. Most investors want cashflow and returns and other buyers just want lifestyle or retirement properties.

“Recently, four-bedroom properties up to $1.5 million have been snapped up by retirees. People want to buy now for retirement and typically rent them for two to four years until they are ready for the shift.”

Dear says despite the headwinds for investors, he expects the market to stay steady and believes investor numbers will come back up, as Whangārei landlords are still able to get up to a

6% return, even with the looming tax changes.

PULLING OUT

Many property investors are likely to pull out of the market in light of the changes in the past year, says Mike Tasker, Northland Property Investors’ Association president. In his 13 years as a Whangārei property investor with nine properties and 15 income streams, Tasker says the tax deductibility rules have been the last straw after tenants were given more rights than landlords.

He says while his portfolio could stand to pay the extra tax, he doesn’t want to be continually hit by new rules and regulations designed to “belt” landlords, particularly the 85% of Whangārei’s small investors who top up their mortgages.

He is selling all his properties and investing in commercial real estate. Three have already been sold – two sold without being listed. The three have gone to other property investors. Tasker doesn’t think investors are going to keep buying, particularly those who are highly leveraged. He says the majority have four years before the full effect of the tax deductibility rules start biting. “Most will sit and wait and there are still 12 months before there is any pinch at all.”

However, he says if house prices drop many investors will start selling before the extra tax kicks in. He knows of landlords who have evicted tenants to renovate their properties to take advantage of rising rents. Landlords are going to capitalise on rents to help offset the extra tax. Nobody is happy about it.

“If rents go up the Government is going to pay for many tenants to have a roof over their heads through increased accommodation allowances. It’s obvious there has been no thought given to the policies and/or there has been no advice from bureaucrats or the advice has been ignored. It doesn’t make sense.”

Popular areas for Whangārei investors include Kamo West and Whau Valley. Tasker believes it is better to buy for capital gains rather than cashflow. “Houses have been going up $100,000 a year recently. No landlord is going to get that in rent.”

Another major problem is nobody can build enough new homes fast enough. “The Government had a go and failed miserably, so why should society in general pick up the slack.”

EXTREMELY TIGHT

Whangārei’s rental market is so tight more than 100 people are scrapping over every single property coming to the market, says Eves Whangārei general manager Tanya Swain. The lack of properties for rent has been a major problem since March last year. “More people are moving to Whangārei from Auckland and Tauranga and the hospital is growing and hiring more staff, which hasn’t helped.”

While Eves has not seen the number of properties in its management portfolio drop, it has also not gained any new tenancies. “It just shows investors are not buying and some are pulling out because of the change in laws and that is having an effect at the lower end of the rental market.”

She says renters have given up looking to live in specific areas of Whangārei anymore. “They are just concentrating on getting a house or flat anywhere. They are not even worrying about the number of bedrooms of a property. The overriding fear is having nowhere to live.”

Swain says the average rent is $300 for a one-bedroom flat, $400 for two bedrooms, late-$400s to $500 for a three-bedroom house and for more upmarket properties rents range from $650-$700 a week.

“Rents are rising but it depends on the landlord. Some will put rents up and others won’t because the rules around tax deductibility don’t kick in straight away.

“We are finding the majority of landlords are fair and reasonable, even though they have been hit in the past few years with changes to the Residential Tenancies Act, Healthy Homes legislation ... the bright-line test being extended and their ability to deduct mortgage interest payments against their income being phased out over four years.”

FIND OUT MORE:

INVESTING IN WHANGĀREI

Northland Property Investors Association holds regular events and is a great source of information about the Whangārei market. See https://northland. nzpif.org.nz for more information.

| « Tale of two lakes | Top city - top prices » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2024 Tarawera Publishing Ltd. All Rights Reserved