by Matthew Martin

According to new research carried out by Kantar Public (Colmar Brunton) for the Financial Markets Authority (FMA), eight out of 10 Kiwi investors have a more favourable view of investing and financial markets after using online investing platforms.

The research into retail investment platforms was released this morning and shows the retail investor landscape is changing rapidly.

"New platforms, new products and new investors are entering the market, reshaping both traditional market dynamics and the typical profile of investors," the reports states.

Two thousand members of Sharesies, InvestNow, Hatch, and the New Zealand Shareholders’ Association took part in an online survey in June this year after the FMA wanted to "better understand the behaviours and intentions of the large number of new investors who had started investing over the past couple of years".

FMA chief executive Rob Everett says online platforms have made it easier for people to access the markets and learn about investing with 34% of investors saying they now have a better understanding of markets after using the platforms.

“We’re encouraged to see that most investors have good intentions around how they should invest, with around 80 per cent buying shares or other investments and holding them for the long term,” says Everett.

“But, while they have good intentions, FOMO (fear of missing out) is still a driver. Almost one-third of investors said they’d jumped into an investment in the last two years because they didn’t want to miss out.

“And, 14% of investors are looking for a ‘moon shot', indicating they are okay with risking a lot of money if there is a big reward.”

However, the survey also found less than 8% of respondents used the services of a financial adviser.

The research found social media has a large part to play with new investors more likely to be influenced by online forums and an emotional connection with a company’s brand rather than their financial reports and disclosures.

A total of 27% of investors said they had invested based on a recommendation from someone they knew without doing their own research.

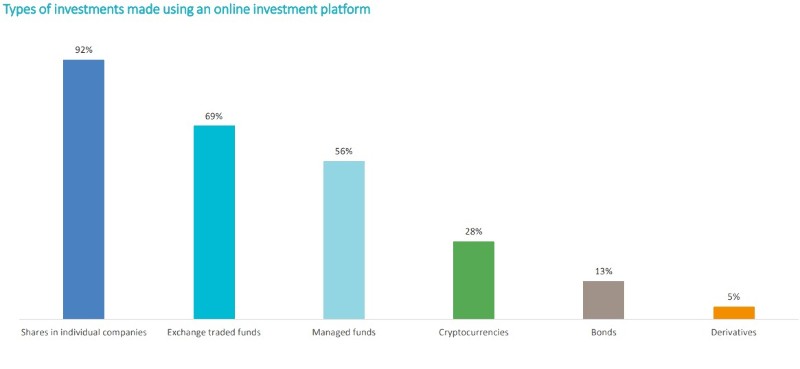

Everett says the research indicated that most investors had a strategy and planned to stick with it over the next 12 months by continuing to invest in shares or ETFs (Exchange Traded Funds).

“That said, six per cent of investors said they intend to invest in cryptocurrency in the next 12 months, lifting the proportion of surveyed investors with an investment in cryptocurrency to 34 per cent.

“A further four per cent of investors are considering investing in derivatives. While small in numbers, the risk in derivatives is considerable so we’ll be keeping an eye on this.”

Investors are more likely to be male, young, and have a higher than average income.

“It’s great to see such enthusiasm from new investors – they’ve had a great run and seen their investments grow on the back of a big market rally,” says Everett.

“The big challenge is to ensure they are well equipped to make good decisions when markets head the other way.”

Most common investing goals:

- Do more with your money 59%

- Financial freedom 53%

- Learn about investing 50%

- Have some fun 34%

- Fund retirement 45%

- Fund a house deposit 23%

More than 330 people surveyed are users of the investment platform Hatch with co-founder and Hatch general manager Kristen Lunman saying there were a lot of positives to take from the report.

"We are encouraged that Kiwis now recognise other options to grow wealth other than with property or low-interest savings accounts.

"If we look back three years, this access was reserved for the financial elite, so we've seen an enormous landscape shift."

Lunman says when it comes to investing, technology and innovation have democratised wealth building and management.

"Investors are now part of social communities to further educate themselves on putting their money to work and build long-term sustainable wealth.

"Armed with this knowledge, they’re now able to invest via platforms offering a simple and affordable experience, straightforward education, thoughtfully created products with quick access to markets."

She says while the research mostly shows the right behaviours when investing, Hatch will look to develop tools to influence solid investing habits.

"Technology can do this, and at scale. We're thrilled to be building confidence with a growing pool of new investors in the market and the exciting challenge ahead of us."

| « Milford remains the gorilla of the funds management industry; others bleed | Mann on a mission to diversify financial advice » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

I'm not sure that the label "Dabbler" marries up that well with the description in the FMA survey. The description reads like someone who makes cautious/considered decisions from a position of knowledge, looking for a favourable outcome, whereas the Cambridge English Dictionary defines a dabbler as "someone who takes a slight and not very serious interest in a subject, or tries a particular activity for a short period"