by BusinessDesk

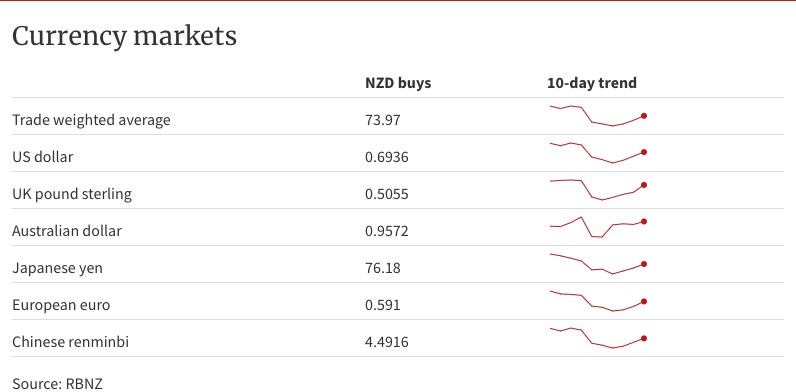

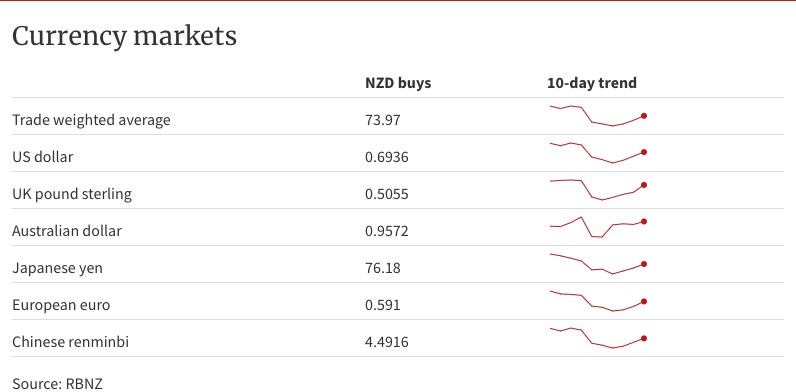

The kiwi dollar had been trading above 70 US cents prior to the central bank’s August policy statement, partly on the expectation of a 25-basis point rate hike.

Instead, the country was put into lockdown on the day of the policy review and the central bank abruptly halted its plans to tighten monetary policy, sending the kiwi tumbling as low as 68.1 US cents.

Overnight, the kiwi rallied from 68.9 US cents to roughly 69.5 US cents when Bloomberg published an interview quoting the governor saying it was only the bad timing that stopped the rate hike.

“For the first time, to our minds, Hawkesby also confirmed they may have hiked 50bps last week, absent lockdown,” said ASB economist Mike Jones.

Hawkesby said monetary policy decisions “aren’t going to be tightly linked to covid and whether we’re in lockdown or not”.

Market interest rates lifted 10 bps across the yield curve as traders reacted to RBNZ’s hawkish rhetoric.

These higher rates didn’t hold back the New Zealand share market which continued to run higher, propelled by strong earnings results.

The S&P/NZX 50 Index rose 101.62 points, or 0.8%, to 13,173.48. Turnover was $205 million.

Summerset Group led the market higher for a second day, up another 8.7% to $15 – in line with Jarden analyst’s target price after upgrading the stock this morning.

“We continue to view Summerset as our preferred listed retirement operator, given the company's large and diversified development pipeline, emerging growth opportunity in Australia and a flexible balance sheet underpinning the execution of its pipeline,” they said in a note.

Apple exporter Scales saw its shares jump 9.2% to $4.88 after it lifted its full-year guidance range off a solid jump in half-year net profit.

Underlying net profit is now expected to be between $32 million and $37m, up from $27.5m and $33.5m.

SkyCity Entertainment shares bounced back to above pre-lockdown levels, up 6.1% to $3.29, despite reporting a 33.7% drop in net profit.

The casino operator earned $156m in the June 2021 year, having taken a $79m hit from having its flagship operations in Auckland closed for a month.

Sky Network Television share fell 2.5% to 15.8 cents even as it said it expects revenue growth for the first time in more than five years after beating earnings guidance with a firm hand on reining in costs.

The pay-TV operator net profit more than doubled at $47.5 million as one-off costs the year-earlier washed through and the group benefited from lower production expenses and the sale of its outdoor broadcasting unit.

| « NZX50 holds at 13,000 after strong earnings results | NZ shares down as A2 Milk sheds $600m » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved