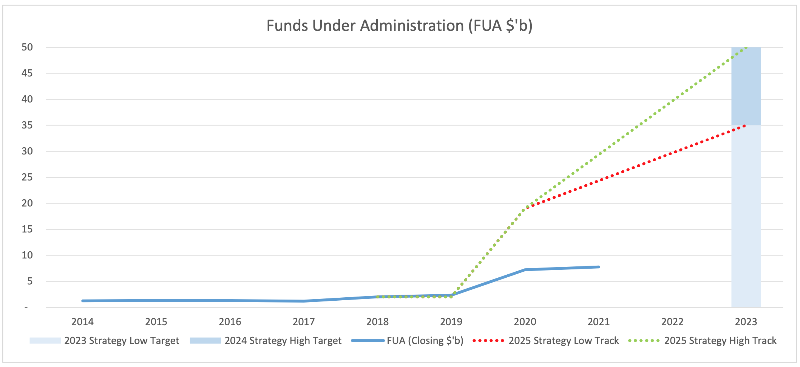

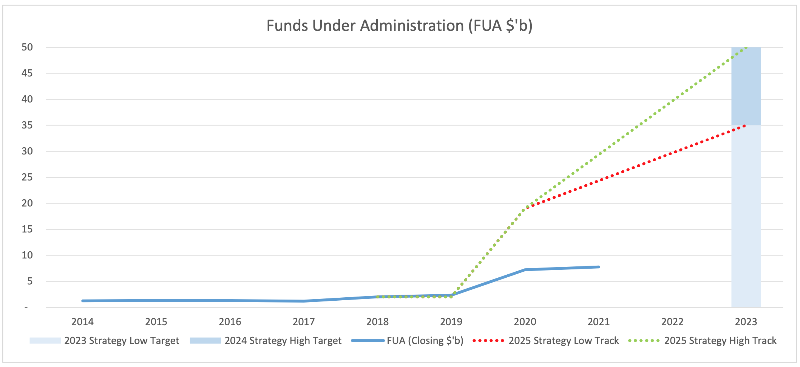

NZX Wealth Technologies grew strongly in the six months to June 30, but is still below its forecast targets. It says new clients helped funds under administration to increase by 151.1% on the same time last year to $7.73 billion.

It still expects to have $10 billion in FUA by year's end and between $35 billion and $50 billion by 2023.

The company says it has a strong pipeline for 2022 and "the 2023 aspirational targets remain valid".

NZX says the macro drivers of growth are increased compliance obligations which are forcing large adviser firms to upgrade their internal platforms, making the Wealth Technologies SaaS attractive.

Also the increasing cost to service clients is also impacting medium adviser firms making the Wealth Technologies option cost efficient, allowing scalable growth and reducing operational and compliance risks.

NZX says in its interim results that Wealth Technologies is now "now operating earnings positive" after years to losses and significant capital investment.

The platform has revenue of $2.074 million in period to June compared to $849,000 in the same period last year.

"To support growth, NZX has continued to invest in the platform technology and staffing capability to onboard and service our growing client base – with Public Trust, Hobson Wealth, Saturn Advice, JBWere and Craigs Investment Partners on the platform," it says.

NZX chief executive Mark Peterson said contracts had been signed with three new large-scale clients and onboarding is underway with two of these, which is expected to increase FUA to around $10 billion by the end of 2021.

“We will continue to invest in technology and other resources to support the growth and operational excellence that customers expect. While the scale of near-term projects will impact costs, the benefits are long term and value-adding to the business.”

Meanwhile its Smartshares business has seen strong growth, with funds under management up 44.3% on June 2020 to $5.69 billion.

Petersen says Smartshares has continued to see growth in member numbers and unitholders, with positive cash inflows of $383 million for the six months to June 2021, compared with $213 million in the corresponding period last year.

"A significant win for Smartshares was the selection of SuperLife as one of New Zealand’s six default KiwiSaver providers from 1 December 2021."

Peterson describes this as “a huge endorsement for what we offer”.

The SuperLife KiwiSaver scheme, which already cares for more than $1.32 billion on behalf of 31,350 New Zealanders, will have new members allocated to the scheme from December 1 contributing to further growth in member numbers and funds invested in the SuperLife KiwiSaver scheme.

This will more than double the number of members initially, and is expected to add around 10,000 new members each year of the seven-year term.

"The standout performance was the Smartshares division which continues to grow at an exceptional rate, aided by the ongoing growth of net cash inflows," Forsyth Barr says in a research note.

Peterson said a key element of NZX’s overall strategy is to build a more diversified financial services business.

“Our funds management and NZX Wealth Technologies businesses offer the potential for powerful synergies alongside our core market business. We continue to explore and leverage these possible opportunities. We will also continue to build upon the strategic partnerships in place for our dairy

derivatives and carbon businesses to pursue growth,” he said.

Funds management and Wealth Technologies account for 26% of the exchange's total revenue; up from 19.8% last year.

| « Fossil fuel investment drops 'but not fast enough' | Mann on a mission to diversify financial advice » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved