Reflation, renewables and the road ahead: three predictions for global listed infrastructure

As the world emerges from COVID-19, infrastructure offers investors many opportunities. Below are three observations about the current market conditions.

Friday, October 15th 2021, 11:07AM

1. The valuation gap is closing

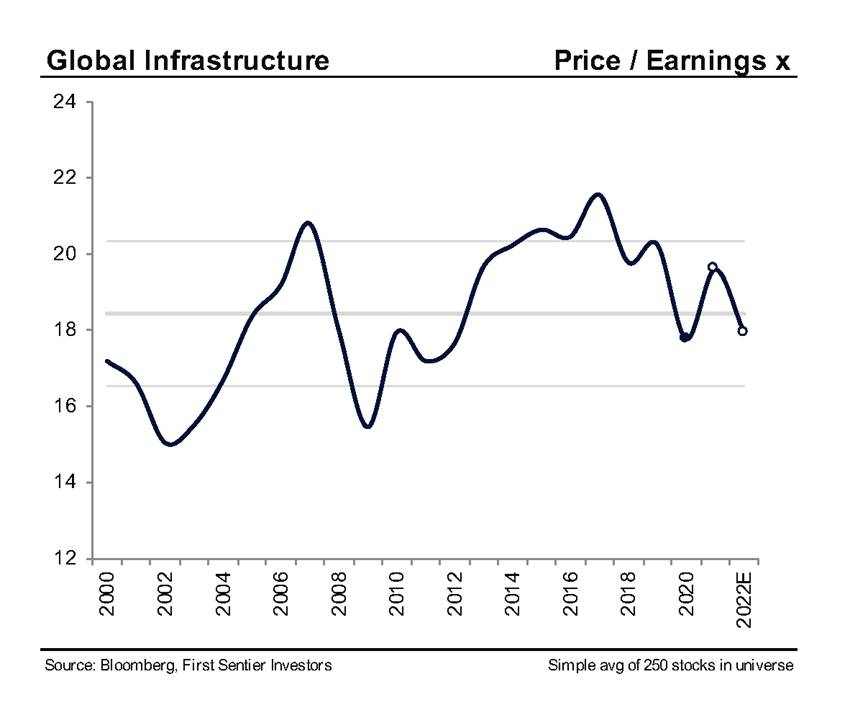

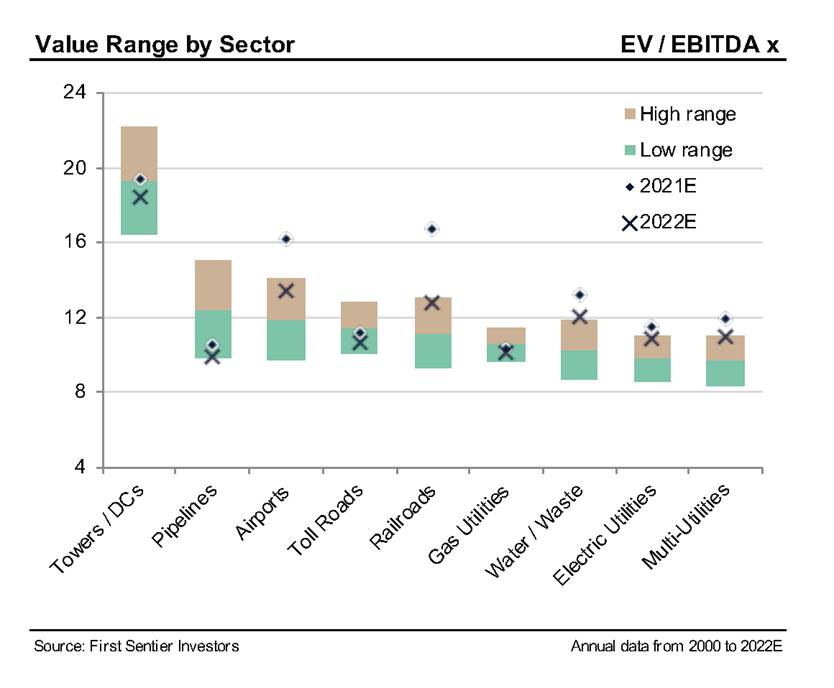

The past 18 months have been particularly challenging for global listed infrastructure, as 2020 was only the second time in the past 15 years that the asset class underperformed both global equities and bonds over a calendar year. We believe that a lot of risks, such as rising interest rates, have now been priced in. There is now a compelling valuation gap, although we don’t expect it to last.

Our view is that the asset class is well positioned to provide investors with income and steady earnings growth for many years to come.

Chart 1: Price/Earnings for Global Infrastructure

Chart 2: Value Range by Sector

2. There’s no need to fear rising inflation

There's no doubt that low interest rates have been a tailwind for income producing assets like infrastructure. Now expectations have started to shift towards higher interest rates, given the generous stimulus measures and strong economic recovery. It's understandable that investors may see that as a headwind, but in our view, it's important to look at what's really driving that interest rate increase.

If it's being driven by higher inflation, we think infrastructure assets are well positioned. Most concession agreements are long-term contracts that allow owners to pass inflation through to the end customer. In fact, we estimate that more than 70 per cent of our investable universe has the ability to pass through inflation.

But even in sectors where we don't necessarily have that explicit link – and freight rail is a good example – factors like high barriers to entry give companies good pricing power.

3. There is a decade-by-decade path to Net Zero Emissions

The first decade will be more of what we are already seeing in developed countries: the decarbonisation of the power generation sector. That includes replacing old, inefficient coal plants with renewable energy, and innovations in battery technology that will make renewables competitive with the gas system.

The second decade is about the electrification of transport, which is the largest emitter of carbon in today’s world. Infrastructure providers can achieve this through investment in transmission and distribution assets, pulling energy to centrally located hubs that charging stations can connect to. That will require further investment in renewables, and in transmission and distribution technology.

The 2040s will be focused on tackling those hard-to-abate sectors through step changes in technology. Essentially, we will leave the hardest challenges until last. That includes reducing the cost curves of things like green hydrogen and sustainable aviation fuels. Almost all the strategies to reach net zero require infrastructure investment, so as investors, we have an important role to play in addressing climate change.

To find out more about opportunities in global listed infrastructure with First Sentier Investors, please contact:

Quin Smith,

Key Account Manager

Phone: +61 455 095 505

Email: Quin.Smith@firstsentier.com

| « Can infrastructure investments provide protection from rising inflation? | Blanket wraps up domestic insurance for IFAs » |

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |