by Eric Frykberg

Xceda was once Asset Finance. It took the new name in October to reflect its identity as a focussed lender that combines tech-based lending with old fashioned bricks and mortar, and a source of income based entirely on local depositors.

The company dates back to 1989. It started in Whakatane as a business selling spare parts for machinery such as trailers and logging equipment.

But to help its customers pay for often expensive equipment, it began offering financing arrangements and this gradually displaced the company's original role.

“It morphed into a company providing business loans and personal loans and then became a true finance company,” chief executive Daniel McGrath says.

In 2018 the company was acquired by British finance firm Blackstar Capital Group. It is now owned by interests associated with McGrath.

Xceda still maintains operations in Whakatane, though McGrath is based in Parnell. Other branches are in Papatoetoe, Palmerston North and Masterton. It has more than 20 employees.

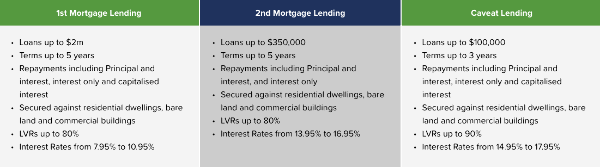

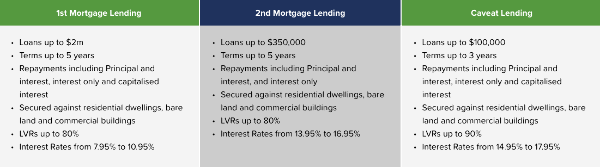

The company focusses on three areas of lending - personal loans up to $50,000, SME loans up to $500,000 and property loans, mainly for bridging finance up to $2 million.

It does not provide long-term mortgages because they do not fit with the company's main method of raising capital: people depositing money.

“The maximum term of a deposit is five years,” says McGrath.

“That is the only source of funding for us, alongside shareholder capital, so we will only lend money for five years.”

This pattern gives Xceda an old fashioned quality, quite different from big companies such as banks that are deeply involved in international money markets.

It also puts it under strict observation from the Reserve Bank's Non-Bank Deposit Taker (NBDT) regime. There are 20 institutions operating under this system, but most are small organisations such as workplace or regionally based credit unions.

Xceda is one of only seven finance companies on the list, and has a credit rating of B stable.

Reserve Bank oversight requires frequent audits which are comprehensive, but McGrath says it is worthwhile because it suits the company's identity and public face.

In its 32 years, the firm has made 40,000 loans.

| « Westpac's governance problems detailed | Vincent Capital adds a South Island BDM » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved