by Stephen Bennie

This time last year it felt like we had been through a year for the ages and that some calm surely had to lie ahead. Sadly 2021 turned out to be another torrid year, with central banks and governments fighting to fend off the impact of the Delta wave.

The extra spice in 2021 was that they were doing this in a backdrop of rising prices and a stirring of the inflation bogeyman, a financial villain that has not been sighted in decades.

In a world where zero-interest rates have become the dominant metric for pricing asset classes, inflation threatens to break the code and force dramatic repricing.

For example, in a zero-interest rate regime, current corporate earnings take a very distant second place to potentially large future earnings. A portfolio of companies that have exciting prospects can perform extremely well in that regime, despite potentially currently earning very little.

A prime example of this has been ARK, the ARK Innovation ETF, which the chap below is being kind enough to model. It should be noted that even rocket ships have to re-enter earth’s atmosphere at some point. Especially those fuelled by zero-interest rates in a rising interest rate environment.

A Sign of the Times?

Another follow through from 2020 that has been a major force in 2021, has been the surge in consumer led demand. By now readers will have likely heard of the “bullwhip” effect, the magnification of the demand surge as it passes through the supply chain. And this has been a major contributor to higher than expected price increases through the year.

Rising prices and increasing interest rates have also flowed through into a supportive narrative for cryptocurrencies. Since its origin in 2008, there has been one constant factor regarding Bitcoin, controversy.

To some it is the “currency of the future” while to others it is “disgusting and contrary to interests of civilisation”.

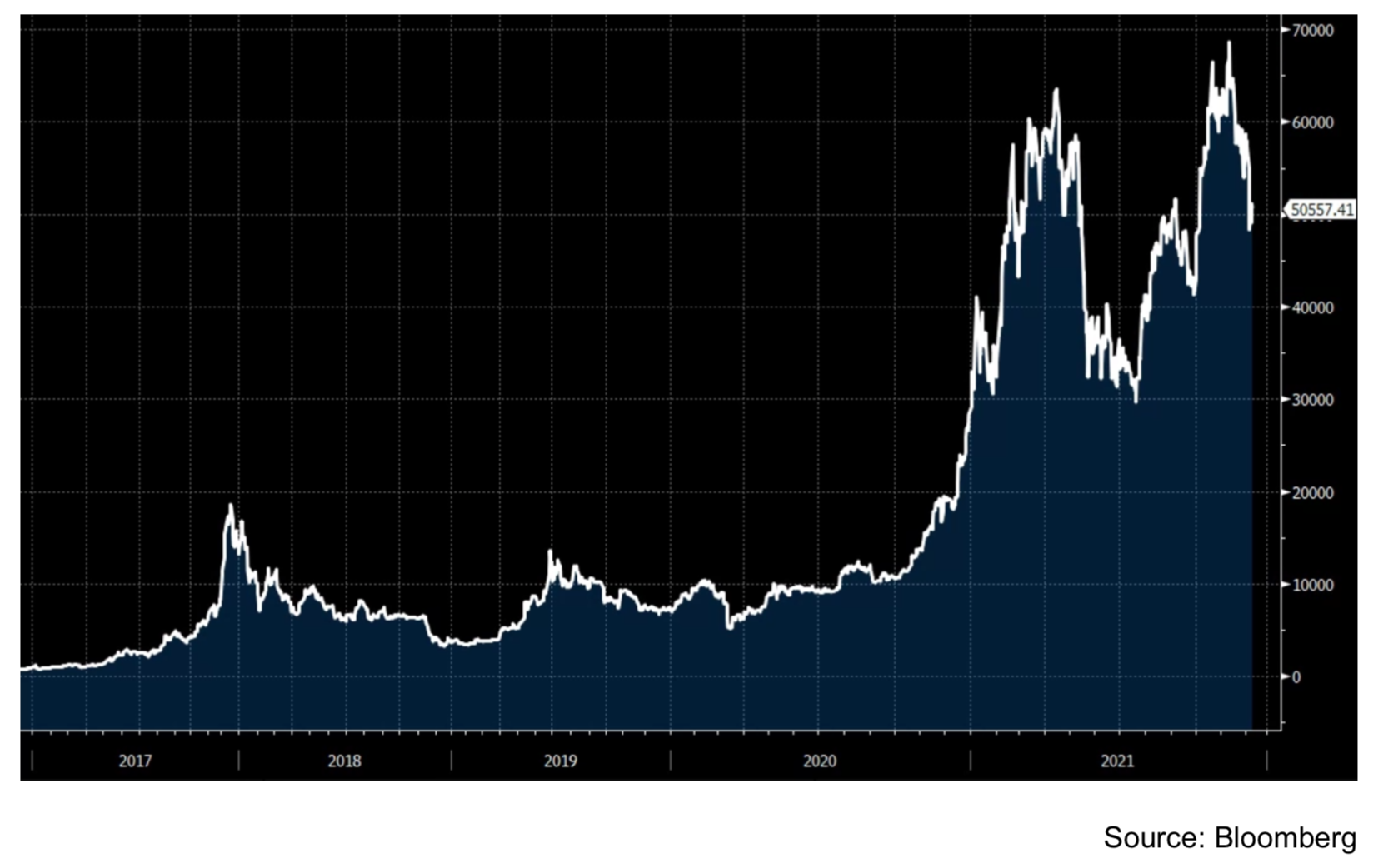

Regardless of your view, the price of Bitcoin doubled again in 2021 after it had trebled in 2020. While I personally have no view on the merits or otherwise of Bitcoin, it is fair to say that new asset classes that have increased by over 10,000% in a few short years deserve some caution from investors; a bubble may have formed.

Chart showing Bitcoin doubling again in 2021

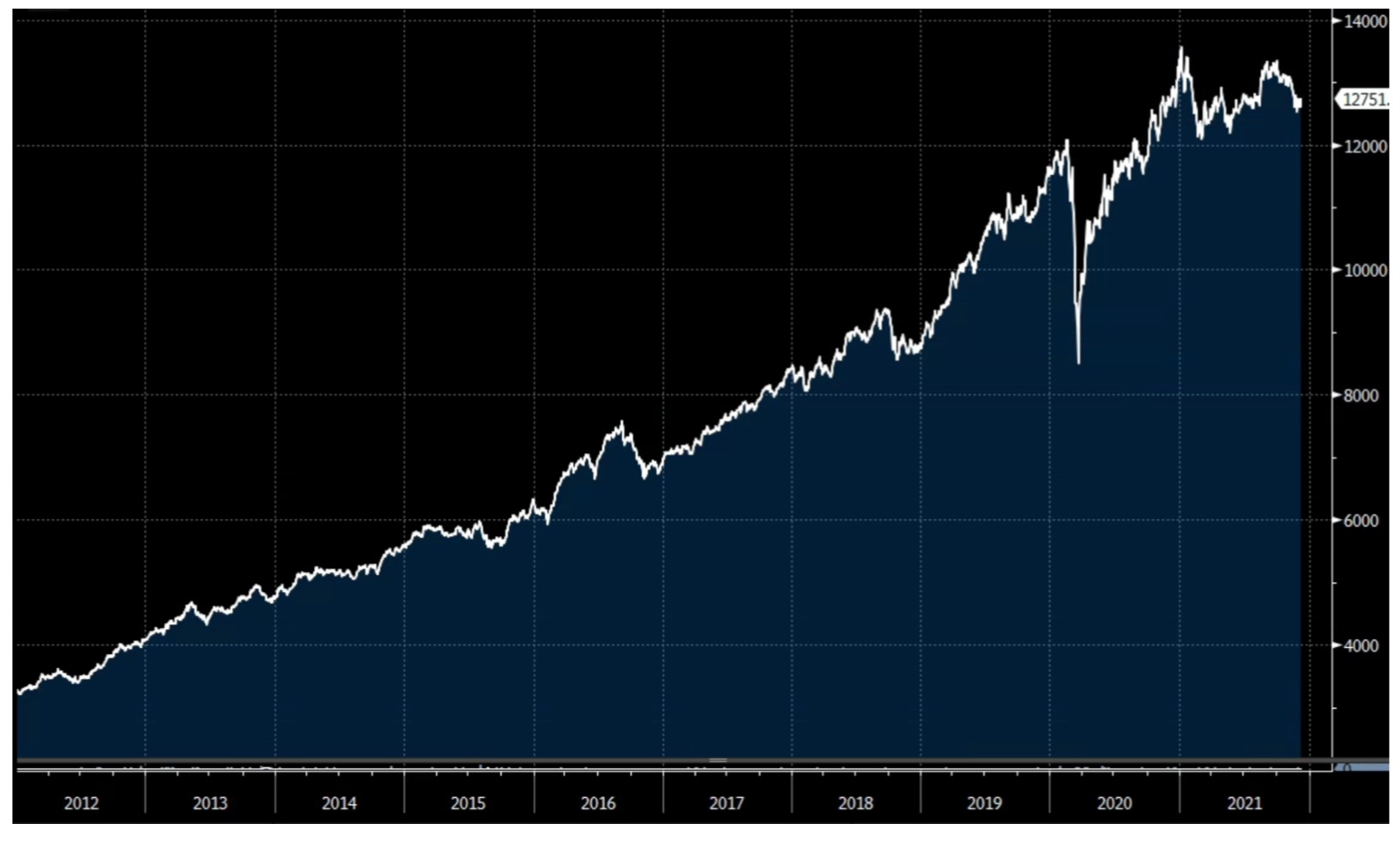

More locally, 2021 looks to be the year that finally breaks the S&P/NZX50 index’s winning streak.

The last calendar year that the main New Zealand benchmark did not post a positive return was 2011. Since then, the index has been on a superb run, nine years in a row of positive returns with a cumulative gain of 300%.

With three weeks to go the index is sitting down 2.5% for the year to date, so barring a late Santa rally it looks like 2021 will be a modest negative.

Strong gains for Mainfreight and Fletcher Building have been cancelled out by soggy performance from “bond proxies”, principally the property trusts and the gentailers.

But the real damage has been the dramatic fall from grace of The a2 Milk Company which has fallen by over 50% this year, contributing -3.3% at an index level.

Chart showing the S&P/NZX50 Index since December 2011

In the context of another challenging year, a modest negative could well be considered a decent outcome, especially given the impact of lockdowns in the second half of the year.

New Zealand went from global leader with regard to virus management to being lapped by the field in 2021. It was at times surreal to be stuck in one of the world’s longest lockdowns while the rest of the world was opening up.

However, it appears that other than a bundle of grumpy citizens and several nasty road rage incidents, the economy has not suffered any lasting damage.

Indeed 2022 may see a boost as New Zealand reopens for business closer to the usual. Certainly, from a New Zealand share market point of view a positive is the likely boost in activity from reopening which could more than offset any headwind from further interest rate rises over the next 12 months.

Hopefully that would be the beginning of another long a fruitful run of positive annual returns for the S&P/NZX50 index.

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience

and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

More information can be found at: www.castlepointfunds.com.

| « Classic hits of 2021 revisited (plus all the new releases) | In defence of Magellan: Editor's Note » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved