by Matthew Martin

John Botica.

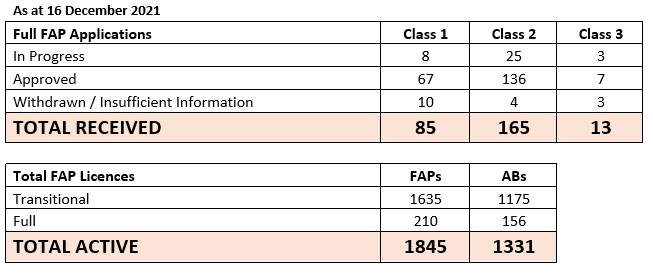

According to the latest statistics, the FMA has approved 210 full FAP licences (see table below) since the new licencing regime came into force on March 15, 2021.

Of those licences, 67 were for Class 1 (sole advisers), 136 were for Class 2 (more than one adviser, plus authorised bodies) and 7 Class 3 licences (multiple advisers, authorised bodies and nominated representatives).

This is more than double the 80 full licences approved by the FMA as of September 21, 2021, and there are still 1635 transitional FAP licence holders and 1175 authorised bodies yet to apply for a full licence.

A further 17 applications have been either withdrawn or sent back to applicants for more information.

The FMA's director of market engagement John Botica says with more than 80% of providers still to transition to a full licence there is much more work ahead.

For many in the financial advice sector, the next milestone will be preparing to submit a full licence application by the target date of September 30, 2022 (for Class 1 and 2 licences).

Botica says many lessons have been learned in the first nine months of the new regime and he acknowledges the efforts of the industry "...who stepped up to welcome the new era of licensing against some pretty tough odds".

"We want New Zealanders to trust the financial advice sector, we want to promote advisers as true professionals and to encourage more people to engage in their financial futures.

"In our mid-year report, we noted that a few full licence applicants had rushed in at the gate, reading the application guide and then pasting our sample answers into the online application form.

"They did not pass Go and were sent back to the start.

"More recently, we’re pleased to say the quality of most applications has improved as you focus on just telling it like it is, documenting how you run your businesses – and care for your clients – in your own words because you know your business best."

| « Ignite Advisers look to the future | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

Not like we all had much else going on, eh...

Contrary to FMA belief, my next major milestone will be survival of 2022. I barely achieved that last year and this year.

*edited*