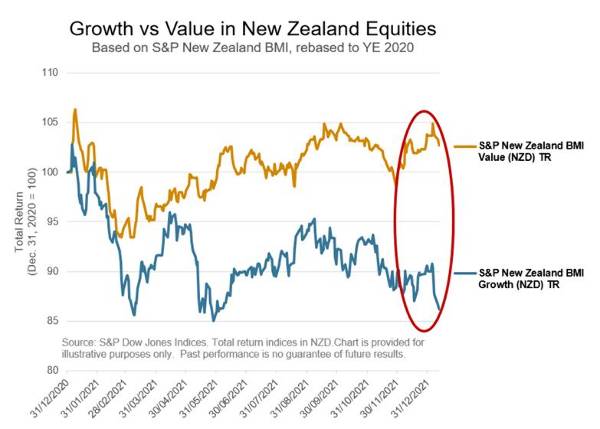

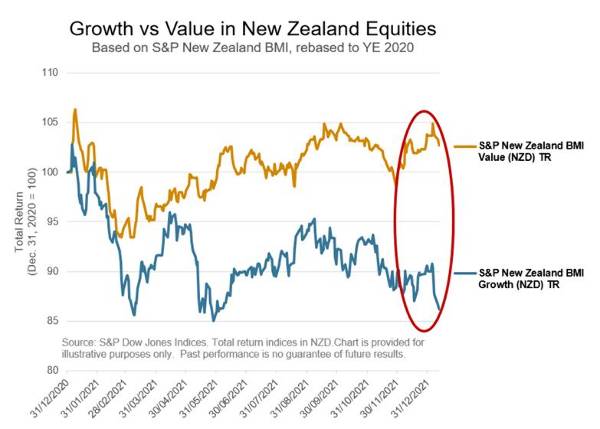

S&P Dow Jones Indices says in the past year value investing completed its first year of outperformance in five; and the second year of outperformance in the past 10 years. An analysis of the New Zealand market (see graph below) shows that value outperformed last year.

PM Capital founder and chief investment officer, Paul Moore, firmly believes that value is about to become the investment style to follow. He says the results from last year show that the shift to value is just starting.

“We believe a major rotation from growth to value stocks is in its infancy – and that this opportunity will play out over a typical 10-year cycle.

“We continue to see opportunities in value segments of the market, notably banks and commodity stocks, some of which trade at record-low relative valuations.”

He says that PM Capital expect growth stocks, including those in the technology sector, on aggregate to underperform value-focused sectors, such as banking, over the coming decade.

“This rotation from growth to value stocks will ebb and flow. No change in market leadership is orderly. The first leg of the value rotation began in early FY21, driving strong performance. But growth stocks returned to favour in the latter part of last year as fears of the Delta Covid-19 variant resurfaced, and as the Omicron variant emerged.”

He says this short-lived move back to growth stocks, at the expense of value stocks, meant value managers like PM Capital could buy high-quality companies at bottom-quartile valuations.

Driving this rotation is a significant move in long-term interest rates asrising interest rates are a bigger headwind for the growth stocks, which typically have higher relative valuations.

Moore says there are other notable economic and market developments to support his view including a signs of wages growth in the US, a surge in Germany’s benchmark Bund yield towards zero, potential for orderly rate rises in Europe and the US, elevated commodity prices.

Moore says, PM Capital’s long-term thesis for a decade-long rotation from growth to value stocks “remains firmly intact.”

“Market action so far this year adds to our conviction.”

He warns investors that future returns will be lower in the next few years compaed to recent years as interest rates rise.

“Gains from global equities since the March 2020 low are unlikely to repeat anytime soon.”

| « Ignite Advisers look to the future | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved