The FMA has grown in its first 10 years and had 242 employees on its books in the year to June 30, 21 its annual report shows. More than half of them, 142, were paid salaries of $100,000 or more.

The salary for the highest paid employee in the 2021 year was in the $570,000 - $580,000 band compared to $590,000 - $600,000 in the previous year.

The chief executive, Rob Everett, took a 20% pay cut for six months from June 1, 2020 as mandated by the government due to the Covid-19 pandemic.

Besides employees the FMA had a handful of contractors/temps and two secondees.

The average length of service as the authority has stayed static coming in at 3.2 years in 2021 and 3.3 years in 2020 and 3.4 years in 2019.

The number of staff who resigned in 2021 was 9.6% which is well down on previous years (2020: 13.8%, 2019: 22%).

One of the big changes in the past year has been where the FMA found its staff. Nearly half (48%) were internal appointments, while just 16% in 2020 were internal and 33% the previous year.

The second biggest source of staff was other government organisations (14%).

Some may be surprised that just 10% of new staff came from elsewhere in the financial services sectors. This has been static sitting at 9% in 2020 and 17% in 2019.

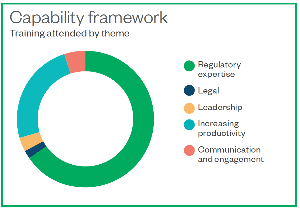

Under the heading "Capability framework, Training by theme" around two thirds had "regulatory expertise" and about one third were labelled as "increasing productivity". There are no numbers - see graph below.

The FMA, like many organisations in financial services, is not particularly representative of the population. Half of the staff identify as NZ European/Pakeha, 20% European, 17% Asian, including Indian and Middle Eastern), 4% Maori and 2% Pacific Islanders.

However, on a gender basis it was pretty even, 59% female/41% male.

During the year 7% of staff reported mental health issues and 2% had hearing/vision impairment.

| « [The Wrap] The year of the adviser | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved