by Sally Lindsay

Independent economist Tony Alexander says buyers should not wait until prices have bottomed out as there is no way of knowing when a peak or trough occurs until it has been and gone. “These things cannot be reliably picked in advance and history is replete with people who ‘missed out’.

“For instance, there will be thousands of people owning property bemoaning the fact they have missed out on achieving an extremely high sale price because they did not sell before December.”

However, he says if a vendor is selling now for a price 10% less than what they were hoping for when they turned offers down in November, then they will be selling for the price they would have reasonably expected back in June.

“For the overwhelming majority of people even a 20% decline in prices will be meaningless. It will still leave average prices 13% above March 2020 levels.” Below is a graph showing the change in prices from March 2020 to a level 20% below the November 2021 nationwide peak for each region.

Auckland prices will still be 12% above March 2020 levels, Gisborne 20%, Canterbury 18%, but Dunedin just 2%.

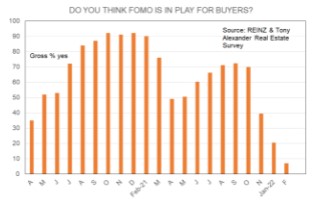

Alexander says the buying frenzy since June 2020, included more than 80% of the country’s real estate agents saying they could see buyers displaying fear of missing out (FOMO) between August 2020 and February 2021. “FOMO causes people to buy whatever they can as quickly as they can and that visceral drive to acquire means sacrifices are made.”

He says even if buyers did want to buy pre-Covid and have not done so, it still in their best interests to lock themselves into the housing market now as choices improve.

“Rather than the voyeuristic focus which people have on price changes, if an investor or owner-occupier were to buy now and prices fell another 10%, they wouldn’t feel like idiots, particularly if they focus be on holding the property for a number of years after which price changes this year would be lost in the wash as happens with share market fluctuations.”

Alexander says keeping a long-term hold focus and embracing the greater number and range of properties on offer this year and next plus the new townhouses headed for the market in Auckland particularly might be within reach now.

| « Residential property sales hit a trough | Earning power should stop huge house price falls » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved