by Jenni McManus

Kiwi Wealth, our largest New Zealand-owned KiwiSaver fund, is the latest to add DGL Group to its exclusion list in response to what the fund manager’s CEO terms “offensive” and “misogynistic” comments made by DGL boss Simon Henry about celebrity chef Nadia Lim.

Kiwi Wealth’s move follows a similar ban yesterday by Simplicity chief executive Sam Stubbs. The CEO of a third KiwiSaver fund, Generate’s Henry Tongue, says Generate does not own any DGL stock “and if we did, it would be a serious ESG red flag”.

Similarly, Kiwi Wealth has no any investment in DGL Group, says CEO Rhiannon McKinnon, “but adding it to the exclusion list means that we won’t be adding it to our portfolios.” The comments raised concerns and red flags about DGL’s governance “so I think you’d need to see some changes at senior leadership level to take it off the list.”

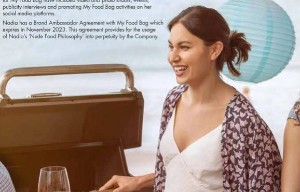

The furore arose after an interview Simon Henry did with NBR in which he made disparaging and racist comments about a photo of Lim in a prospectus issued by My Food Bag.

Describing Lim – one of My Food Bag’s founders – as “a little bit of Eurasian fluff”, Henry went on to complain that she was “showing some cleavage” and “showing off her sensuality to hock scrip”. Henry then invited the reporter to quote him.

McKinnon said she found these comments surprising. “It does seem unusual to specifically say ‘you can put this on the record’, given that the comments are so derogatory. They are deeply troubling in many ways.

“Part of the reason people are interested is that they haven’t seen this sort of reaction from KiwiSaver fund managers before so maybe he didn’t think there’d be any backlash of this nature,” she said.

Stubbs told Stuff yesterday he would blacklist the DGL Group until Henry retracted his remarks and “made amends”. Oliver Mander, CEO of the NZ Shareholders Association, said the comments were insulting to investors, as well as to Lim.

But while this type of backlash might be unusual for the New Zealand market, investors are making it clear that they will quit funds that don’t align with their ethics.

A recent survey by Mindful Money revealed that 73% of New Zealander want their funds to be invested responsibly and ethically and 56% said they would consider switching KiwiSaver funds if they considered their fund was investing in companies that did not reflect their values.

DGL Group, a chemicals manufacturing, warehousing and distribution business, says on its website, “We consider environmental, social and governance issues with every investment decision we make.”

It is listed on the NZX and ASX and closed 2.41% down, at $4.05, in New Zealand and 1.93% down in Australia (A$3.65) yesterday.

| « MMC now part of Apex | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved