by Devon Funds

By Greg Smith, Head of Retail at Devon Funds

Unprecedented levels of stimulus and ultra-low interest rates, along with better than feared economic outcomes, saw many stock-markets scale new record highs. Valuations were propelled higher as investors saw the stay-at-home thematic turbo-charging the growth prospects of many industries, and the technology sector in particular.

The lift-off in interest rates, which New Zealand saw last October, and the rest of the world is seeing now, has seen optimism fade on a number of counts. The inflation that has emerged as a consequence of the financial stimulus administered during the pandemic response has been propelled further by the war, ongoing supply chain blockages and labour market tightness. Central banks are doing their best to douse the flames, and as such investors are concerned about whether economies will be able to withstand this or will suffer significantly as a result.

Many commentators are also coming out and making predictions around a recession, hitting on the fairly obvious notion that higher lending rates will hit consumers and businesses hard, compounding the existing ill effects of inflation. Markets generally appear to be pricing in the “R” word, and this has arguably driven much of recent volatility.

After becoming overly exuberant last year (and blissfully ignorant of the oncoming tide of monetary tightening), have markets gone too far the other way? A recession certainly hasn’t happened yet, and it is also worth remembering that stock markets have not been great at predicting them. This has been the case throughout history. Many will know the famous quip by Nobel Prize winning economist Paul Samuelson that “the stock market has forecast nine of the last five recessions.”

Whether history is repeating only time will tell, but there are some definitive signs that “all is not lost.” Recent economic data has been generally resilient, employment markets are robust, consumers are still in good financial shape (even if optimism is waning in some cases), and company earnings (as shown in recent reporting) have generally been coming out on the right side of the ledger.

Corporate optimism on the outlook is also coming through in recent levels of M&A (mergers and acquisitions activity). This is not back at the levels of 2021, but the size of deals highlights the still significant level of financial liquidity on the side-lines, and an arguably more varied array of industry targets (rather than just tech) shows there is confidence over the wider economic environment.

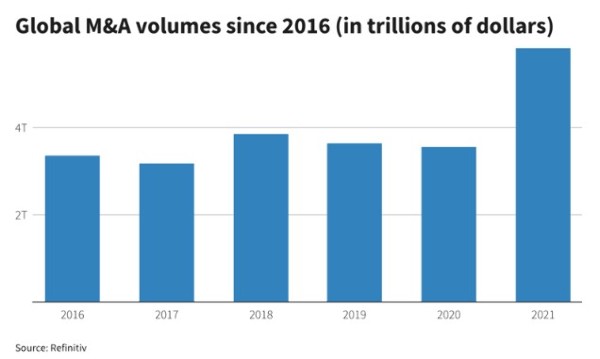

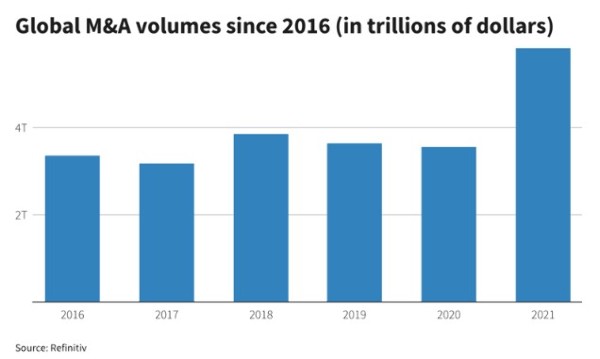

Last year was of course an unprecedented year for M&A. The easy availability of cheap financing and booming stock markets saw global M&A volumes breach US$5 trillion for the first time ever (up from the previous record of US$4.55 trillion set in 2007). The overall value of M&A stood at US$5.9 trillion in 2021, up over 60% from a year earlier, according to Refinitiv. Large buyout funds, corporates and financiers struck 62,193 deals last year. The United States led the way for M&A, accounting for nearly half of global volumes.

It was always going to be tough ask to beat, and the start of the great tightening journey by the world’s central banks, along with the war in Russia, has certainly put a dampener on proceedings. According to Dealogic, the value of global M&A activity took a 29% hit in the first quarter of 2022. In the first three months of the year, there have been 6,436 announced global combinations, totalling US$989.4 billion. This compares to 9,022 announced global transactions, valued at US$1.4 trillion, for the same period last year.

So M&A numbers are down on 2021, but that was always a tough comparative, and stepping back, activity remains very robust from an historical perspective.

Certainly, there are still some big transactions underway. In fact, the number of transactions in the first quarter, worth more than US$10 billion, was up to 13 from 12 in the same quarter of last year. Companies and private equity firms did not shy away from pursuing larger deals.

Last week we saw chip-maker Broadcom announce plans to buy cloud company VMware in a US$61 billion deal, which would be one of the biggest tech acquisitions of all time. Broadcom has been a serial acquirer over the years but has not made a large acquisition since 2019.

We also still have Microsoft trying to push ahead with a US$75 billion acquisition of game maker Activision Blizzard. Microsoft (held in the Devon Global Sustainability Fund) epitomises the current high level of corporate liquidity and is looking to buy the company behind the Call of Duty franchise in an all-cash deal. Elsewhere, Elon Musk, it seems, is also still serious about buying Twitter for US$44 billion, and a host of other multi-billion-dollar takeover deals have been announced or are in the works globally.

Downunder, M&A activity has also been strong in New Zealand and Australia, despite what the stock market appears to be saying about the economic outlook.

On the NZX, Pushpay (held in the Devon Trans-Tasman Fund) announced in late April that it had received takeover interest. The digital church donation software provider has since revealed that existing shareholders, US-based Sixth Street Partners and fellow private equity firm Australia’s BGH Capital, are working towards a potential takeover bid - the main unknown at this point being the price. The bidders however look to have been drawn in what they see as the strong long-term prospects for the company in the key US faith sector, and the fact that their shares are trading well below their 2020 pandemic highs (even following a 50%+ rally since takeover news broke).

While a lone story on the NZX, there could well be more to come given where valuations sit, and also with the currency still low from an historical perspective. Indeed, looking beyond our public markets, there has been plenty of M&A interest in kiwi businesses during this year, despite unease over higher interest rates, inflation and geopolitics.

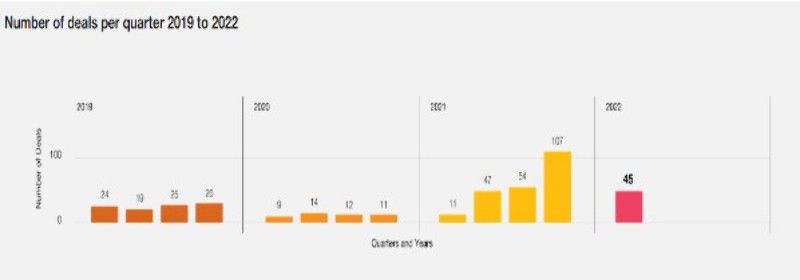

The recent quarterly M&A report from PricewaterhouseCoopers showed there were 45 deals announced or completed in the first three months of the year in NZ, compared with just 11 for the same period last year. Foreign buying from the US and Australia has accounted for a third of the deals in the first quarter. This is down from 107 deals in the final quarter of last year, but still well above pre-Covid-19 levels. Notably, PWC said it expects to see “robust deal activity continue throughout 2022 due to the significant amounts of capital still available in the market”, and note that “well-capitalised private equity firms remain a central driving force for deal flow.”

Source: PWC

Private equity has certainly been making its name felt across the Tasman, with an increasing number of ‘old-economy’ businesses in the frame, in addition to technology plays. Last year M&A was on a tear, with a total of US$256 billion in deals announced during the year, far and away the highest annual value on record, more than doubling 2007’s previous high. But there has also been plenty of action in 2022, despite the correction in global markets. a

In April, hospital operator Ramsay Healthcare confirmed it was in receipt of a A$20 billon+ bid from private equity group KKR. The Devon investment team have been positive on the value inherent in Ramsay, which is now being recognized by one of the world’s largest private equity groups. Ramsay has a great business with strong cashflows, and part of the logic for the deal may be to unlock value in the hospital assets through a sale and leaseback arrangement of their properties. The offer price is 40% above where the shares were sitting pre the takeover news. The Devon funds had a strong positioning on Ramsay pre the takeover announcement.

The Ramsay deal is set to be the biggest leveraged buy-out by a global private equity firm in Australia, but there has been plenty of other action elsewhere.

Brambles (also held in the Devon funds), the logistics giant firm was also recently the recipient of bid interest. Private equity firm CVC ultimately walked away from a bid for the pallet supplier, citing market volatility, but this nonetheless shows that real businesses are attracting strong interest from suitors. It is also possible that many private equity bidders are still keen, and positive on the outlook, but just keeping their “powder dry” and waiting for recent market ‘choppiness’ to subside.

Buyers are though, also perhaps becoming more ‘choosy,’ particularly around deals within the technology sector which led the way in terms of volumes last year. Shares in data company Appen recently surged 29% before collapsing after Canadian bidder Telus International walked away from a potential A$1.2 billion takeover offer.

Other takeover moves across the Tasman that have unfolded this year have included an A$8 billion bid for AGL Energy in March from a consortium led by Brookfield. Speculation continues to swirl around moves for a number of other big blue-chip names, including infrastructure plays such as pipeline group APA Group which has a market cap of over A$13 billion.

What corporate targets could be next? It is fair to say that size it not a barrier, and any industry could be ‘fair game,’ if the price is right. Regulatory risks have certainly not detracted given the goings-on in the casino sector. The troubled Crown Resorts is being taken over by Blackstone in a A$8.9 billion deal. Star Entertainment has also been suggested as the next to fall into the sights of predators, but what about a company less exposed to recent regulatory failing across this sector. Sky City Entertainment anyone?

And it is just not private equity players that are flush with cash. Corporate levels of liquidity remain elevated from a historical perspective. In some sectors it is at record levels, including in biopharma where the cash balance of the world’s top 20 companies combined is over US$300 billion. This is enough to buy out the entire universe of every other small to mid-cap biotech company globally.

So, are PE and corporate buyers just biding their time, and poised to move in the next phase of M&A? Some already are. And in so doing they appear to be sending different signals about the outlook of the economy and the market, or at the very least taking a longer-term view and looking through recent short-term market noise/volatility.

Interestingly participants at the recent World Economic Forum in Davos expect another wave of M&A, driven in part by the need for technological innovation, and a new entrepreneurial spirit that emerged in the post-Covid era. Challenges around the supply chain due to Covid and the war are also expected to drive a greater desire for strategic autonomy which could also see infrastructure companies remaining in the cross hairs. Stay tuned!

Devon Funds Management is an independent investment management business that specialises in building investment portfolios for its clients. Devon was established in March 2010 following the acquisition of the asset management business of Goldman Sachs JBWere NZ Limited. Devon operates a value-oriented investment style, with a strong focus on responsible investing. Devon manages six retail funds covering across the universe of New Zealand and Australian, equities and has three relatively new international strategies with a heavy ESG tilt. For more information please visit www.devonfunds.co.nz

| « Allbirds, from darling to disaster | How do we improve the retirement gap for women? » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved