by Castle Point Funds Management

By Stephen Bennie

In this month’s article, we thought it might be useful to share some analysis we did last month. This June was a memorably bad month and there was very negative price action across global share markets, the bulk of which dropped solidly into bear market territory (-20%) as the month progressed. Our flagship Ranger fund picked a bad year to have a poor first quarter, 3 holdings delivered disappointing news to the market and were summarily sold off which dragged the fund down over that quarter. That meant that when the broad risk off “sell everything” mode really kicked off in the second quarter and reached its crescendo in June, Ranger, also hit hard, was down around 30% for the year.

Clearly this has been an unpleasant and challenging situation for investors. It’s a significant drawdown, and one of the largest we’ve experienced. Especially when you consider that at the beginning of the year we were convinced that all of our circa 20 holdings in the fund were already trading significantly below their medium-term intrinsic value and represented great value. Nonetheless they got a lot cheaper as the year progressed, as share markets across the globe de-rated significantly.

Drawdowns happen, the key consideration for investors is do they hold an interest in a substantial business that will survive and in due course thrive or do they hold an interest in a highly speculative business whose future is very uncertain. In a sharp “sell everything” indiscriminate share market drop, it can initially be difficult to tell which is which because the price action of both can look very similar, they can both be down a lot. The difference of course is that the investor holding a business of substance will see their investment recover, due to its strong fundamentals, while the investor that invested in a speculative venture may never see their investment recover, due to its lack of good fundamentals.

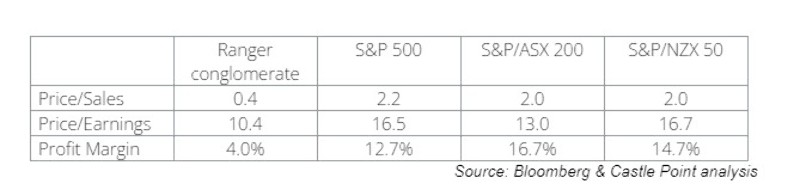

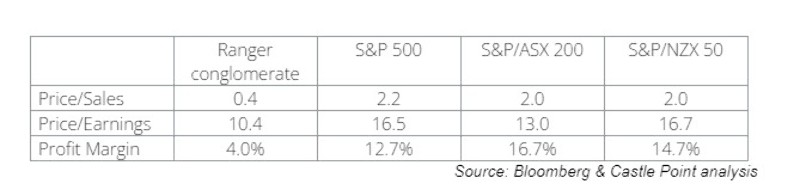

So how can investor tell which camp they are in. There are a few fundamentals that give a strong indication of whether you own a business of substance or an expensive speculative venture. And this is the exercise we did in June, we calculated statistics for the circa twenty companies in the Ranger fund as if they were a single business, essentially looking at them as if they were the “Ranger conglomerate” that owned and ran these companies. The numbers that exercise generated strongly indicated that the “Ranger conglomerate” was a substantial business that generated significant revenue and was priced at a very attractive multiple with plenty of scope to further improve its profitability. The table below summarizes our analysis.

Table comparing Ranger conglomerate fundamentals to the US, Oz and Kiwi markets

The first row highlights that the Ranger conglomerate generates a healthy level of sales. For every $100 of Ranger conglomerate $250 of revenue is generated by the business. This is a significantly higher level of sales than an investor receives from other broader share market exposures, for example $100 invested in the S&P/NZX 50 index sees you earn just $50 in revenues. That’s a mere fraction of $250.

The next row looks at the amount of profit the Ranger conglomerate delivers from those sales. This statistic is a little less sparkling as its profit margin in 2022 is a modest 4%. As mentioned, a couple of divisions have struggled in 2022, however it still generates a little over $10 of earnings for every $100 of Ranger conglomerate. That is still significantly higher than the $7.35 that the $100 in the S&P/NZX 50 index will generate in 2022.

Optimism is in very short supply this year, but our view is that the Ranger conglomerate can significantly improve on that 4% profit margin in 2023 and beyond. And the one plus of such a modest current profit margin is that even improving it to 6% is a 50% increase in earnings. Such a level is one we believe can and will be achieved and exceeded, that is because we believe that the investments in the fund have strong fundamentals which will see them not just survive 2022 but thrive in the future.

Disclaimer

The following commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

About Castle Point Funds Management Limited

Castle Point is a New Zealand boutique fund manager, established in 2013 by Richard Stubbs, Stephen Bennie, Jamie Young and Gordon Sims. Castle Point’s investment philosophy is focused on long-term opportunities and investor alignment. Castle Point is Morningstar Fund Manager of the Year 2021 – Domestic Equities.

About Stephen Bennie

Stephen is a co-founder of Castle Point. He has over 25 years of investments experience and 18 years of portfolio management experience in New Zealand and abroad. Stephen holds a Bachelor of Commerce (Hons) in Business Studies and Accounting from the University of Edinburgh in 1991 and is a CFA charterholder.

Stock photos can be found here:

https://castlepoint.sharepoint.com/:f:/s/Consultant/EsyXv-TcMlpDn8nDLVXk8tsBWBOMAeERgXPKwmjt8aVzeA?e=BJbuYg

More information can be found at:

http://www.castlepointfunds.com

| « History may not repeat but it can rhyme | Over the peak » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved