As demand for funding continues to grow, Prospa also announced that it has reached a key milestone of more than $500 million in originations since it launched in New Zealand, supporting thousands of small businesses across the country.

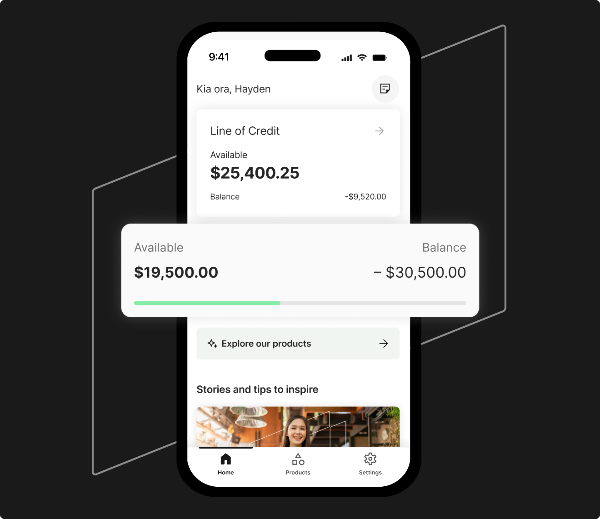

As business owners continue to grapple with market uncertainty and the rising cost of living, this new offering helps small businesses stay on top of their cash flow, allowing them to better manage expenses and repayments, so they can focus on running their business. Designed with simplicity and convenience in mind, the App offers 24/7 access to Prospa's suite of SME lending products on both Android and Apple iOS platforms, making it easier than ever for small business owners to stay on top of their business finances.

Prospa managing director Adrienne Begbie, says the App will be the first to offer SME customers, who are looking to fund and grow their business, a digital experience that’s tailored to them.

"With the new App, our customers can get instant clarity on their cash flow position, anytime, from their phone. It’s about enabling simple, seamless and stress-free financial management so they can focus on what matters most," Begbie said.

Existing customers will also be able to apply for funding faster and easier through express application. “Managing cash flow can be a pain point for many small business owners who are already strapped for time. Going into a bank branch or long call wait times can cause unnecessary stress and slow down SME growth.

"In response, we developed our express application. Because of the in-depth knowledge of our customers’ needs and preferences, the App is streamlined, so Prospa customers can access our lending solutions quicker and easier,” she said.

The App launch follows the success of the App in Australia and demonstrates Prospa’s commitment to investing in the local market.

"We’ve seen how well the Prospa App has been received in Australia. Since rolling out our express application in July 2023, $5 million in fresh funds have been originated in the App. We’re excited to

introduce this to our Kiwi customers to help them stay on top of their cash flow and repayments, particularly important as they head into the busy end of year period,” Begbie said.

| « Westpac's mortgage lending slowed in the second half | Vincent Capital adds a South Island BDM » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved