by Jenny Ruth

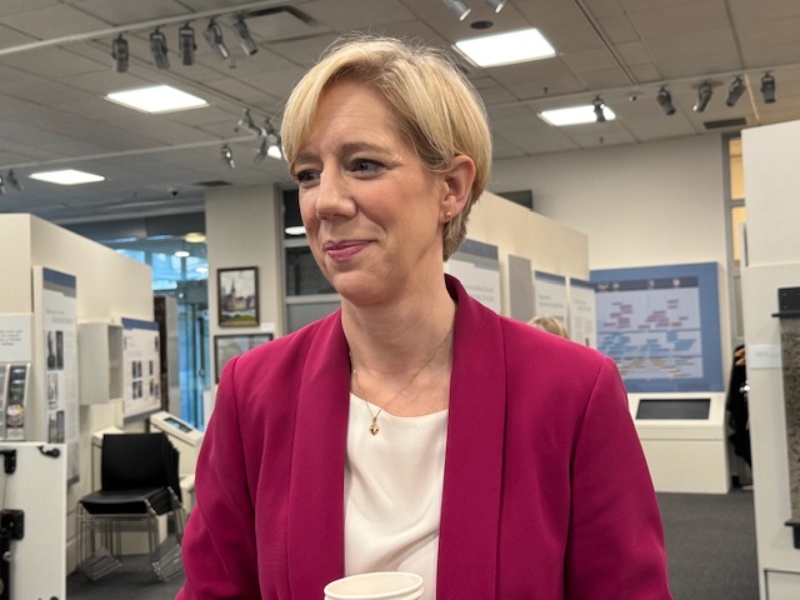

On her second day in the job, last week, she appeared before parliament’s finance and expenditure committee and then on day 10, she hosted a breakfast meeting for finance journalists, mingling and being personally introduced and then sitting for a half-hour Q and A session.

Breman certainly has plenty of monetary policy chops, having served six years at Sweden’s central bank, the Sveriges Riksbank, the last three as the first deputy governor, and she has a doctorate in economics from the Stockholm School of Economics, as well as having worked in the US.

It would be unfair to expect too much when she’s hardly had time to do much more than put her feet under her desk, but she is already projecting a friendly and relaxed persona.

I couldn’t help thinking about the contrast with the previous governor, Adrian Orr, who left the bank abruptly in March after refusing to accept the need for RBNZ’s bloated budget – expanded way beyond its remit – and the need to rein it in.

Orr’s first official appearance as governor in late March was conducted in the Beehive theatrette when he formally signed the monetary policy targets agreement with then finance minister Grant Robertson, which was before the current monetary policy committee was formed and when the governor had sole responsibility for setting monetary policy.

What is already clear is that Breman’s personality is very different to Orr’s rambunctious style and that she’s unlikely to be as thin-skinned.

Breman was careful to tick all the boxes, praising her staff: “I’m very impressed with the quality of the work being done here at the Reserve Bank,” praising the last monetary policy statement published last month as “well-written and well-argued,” and noting that the data flow will determine monetary policy: “There’s no pre-set course for monetary policy.”

She emphasized here commitment to “transparency, accountability and clear communication” and promised a “laser-focus” on keeping inflation low, ensuring financial stability and a safe and efficient payments system.

She noted the harm that high inflation inflicts on households and businesses and that she will be focused on achieving the mid-point of RBNZ’s 1% to 3% target range.

She easily fended off questions about how the RBNZ would cope with fiscal policy under her leadership, emphasizing that was the responsibility of elected officials, not the central bank.

While prudential regulation is now a major part of the RBNZ’s role, that’s an area Breman hasn’t previously had direct experience.

However, she noted that the Riksbank has responsibility for financial stability, as does RBNZ, and that she had been part of a group of regulators tha had included Sweden’s prudential supervisor, the Finansinspektionen.

“I feel very comfortable working on the prudential side here at the Reserve Bank,” she said.

| « Westpac asks RBNZ to comment on conditions | Robust recovery tipped by Kiwibank » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

The internal bench strength at RBNZ is probably at a 47 year low (the time I have been observing RBNZ) so I will be amazed if the Board doesn't look outside the current RBNZ staff.

It's often said great leaders surround themselves with talent greater than their own. On that ground alone the most recent permanent Governor was definitely not a great leader.