by Jenny Ruth

However, the full regulatory impact statement (RIS), a detailed implementation plan and other technical papers won’t be released until February.

The summary of the cost-benefit analysis (CBA) released today found that the net annual benefit to the New Zealand economy will range between 0.2% and 0.19% with a central estimate of 0.12%.

The size of NZ’s economy at June 30 was about $435 billion.

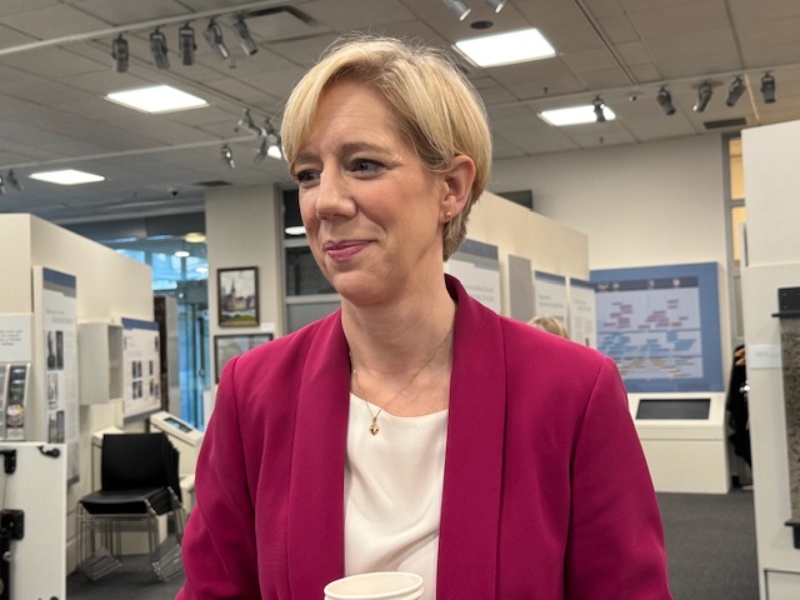

The smaller and mid-sized deposit takers should see a proportionately larger reduction than the four largest banks, says RBNZ governor Anna Breman.

Prudential policy director Jess Rowe told journalists that smaller banks which are currently capital constrained may be able to lend more as a result of the new rules and that could also apply competitive pressure on the interest rates banks charge.

The minimum amount of capital each deposit taker has to hold is determined by risk weights against different types of lending – the higher the risk weight, the more capital is required.

While the big four are able to apply risk weights based on their own lending experience with a floor under the degree of benefit they can achieve, all other deposit takers must use standardised risk weights and these weights have been drastically reduced for mortgage lending.

The standardised risk weights are even lower than RBNZ proposed in its discussion document released in August.

For example, for owner-occupied residential mortgages with loan-to-valuation ratios (LVRs) of 50% or lower, the risk weighting will drop to 20% compa4red with 35% currently and the 25% proposed in August.

For investors with LVRs equal to or lower than 50%, the risk weighting will be 25%.

Required standardised risk weights on lending to businesses and agriculture have also been reduced.

The CBA shows RBNZ expects lenders to reduce the interest rates they charge by between 7 and 19 basis points compared to what they would have charged in 2028, the date when the previous rules were to have been fully implemented.

“This is because deposit takers are able to have less high-cost common equity capital as compared to the status quo,” the CBA says.

“We expect lower lending rates should marginally increase investment in NZ in the long run and lower interest costs to households and businesses,” it says.

However, the costs of a banking crisis is expected to worsen while still remaining within RBNZ’s risk appetite, and is expected to rise by between 0.11% and 0.16% of GDP.

“We assess that our capital requirements remain strong on an internationally comparable basis,” it says.

“Overall, we expect the higher costs of crisis to be smaller than the benefit of lower lending rates to New Zealanders.”

RBNZ released a range of papers, including from three independent experts and a paper by accounting firm EY which said only NZ’s largest four banks are covering their cost of equity currently.

The central bank currently expects the new capital rules to take effect from Oct 1 next year.

| « Opes censured by FMA for poor practices | Reflecting back on 2025 » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

It's bizarre that the central estimate would be outside the range. Based on info later in the article I wonder whether the 0.2% should have been 0.07%.