by Generate KiwiSaver

By: Greg Smith

Before looking forward, it’s worth briefly reflecting on how we arrived here. 2025 was certainly one of the more extraordinary years investors have experienced in a long time. It may also however provide some important learnings for investors as we move forward through 2026.

As with the early days of 2026, markets faced no shortage of challenges last year. Trade tensions, tariffs and ongoing geopolitical noise were constant themes, yet despite all of this, it was a very strong year for investors.

Fresh record highs became a regular feature across many global indices. In the United States, the S&P 500 finished the year up around 16%, while the Nasdaq Composite gained 20%. Many markets in Europe (the IBEX in Spain soared 49%) and Asia (South Korea’s KOSPI soared 76%). Technology once again led the way, driven by the ongoing artificial intelligence (AI) thematic - something that played out well given our strong exposure to the sector across our funds.

It wasn’t just technology that stood out. Precious metals also had an exceptional year, with both gold and silver performing very strongly. That flowed through to two gold mining companies held in Generate’s funds, both of which more than doubled over the year. As a “side bar,” gold and silver have pushed further into record territory at the start of 2026 amid geopolitical and political uncertainty. Gold prices are now up around 70% over the past 12 months, while silver prices have trebled.

Closer to home, New Zealand and Australian markets didn’t match the strength of the US, but still delivered positive returns and pushed to new record highs. There were also some standout individual stock performances. A2 Milk surged around 70%, Freightways rose more than 35%, and both are held in Generate’s portfolios. Across the Tasman, property group Charter Hall climbed roughly 35% after being added to the portfolio in May.

Overall, 2025 was a fascinating year for markets, and once again highlighted the benefits of an active approach to investing.

Looking ahead, 2026 is already shaping up to be another interesting year, and it has certainly started that way. US President Donald Trump wasted no time making headlines, from orchestrating the capture of Venezuela’s president to floating the idea of the United States acquiring Greenland.

This has seen last year’s trade tensions between the US and Europe boil back to the surface, with both sides threatening to implement fresh tariffs in response, and potentially unravelling the EU/US agreement struck last August. Beyond that it has also thrown into question the future of other alliances, including NATO.

Meanwhile, the US Justice Department has recently opened a criminal investigation into Federal Reserve chair Jerome Powell. This centres on the US$2.5 billion renovation of the Fed’s Washington headquarters and US$700 million in cost overruns.

Powell denies misleading lawmakers in statements made to the Senate last year and says the issue is “not really about concrete or steel.” Many agree, viewing this as the strongest attempt yet to apply political pressure on the Fed to cut rates faster than it currently intends.

The timing is interesting, given Powell steps down as Chair in May (with former Federal Reserve Governor Kevin Warsh the favourite to be nominated by Trump). Some suggest this may be public punishment for defying the White House’s wishes. Another possibility is that it is an attempt to push Powell out, given he could otherwise remain a Governor until 2028 and, while holding only one vote, remain an influential voice. There is also the argument that this is genuinely about budgetary accountability. Central banks don’t have CEOs, so operational responsibility ultimately rests with the Chair.

The Fed is also not the first central bank to be publicly criticised for cost overruns on a major project.

There is, however, the prospect that this is more about polls than plaster. President Trump’s approval ratings (for what they are worth) are low, and cost-of-living pressures will be a key focus ahead of the mid-term elections later this year. It may well be that the move is designed to intimidate policymakers. Investors will no doubt be watching closely as events unfold over the coming months.

The Fed meets this week, and no move is expected. The personal consumption expenditures index (the Fed’s preferred inflation gauge) is released later this week.

While the headlines can be noisy, stepping back reveals several important themes emerging beneath the surface.

Taking a broader view on 2026, we see global equity markets continuing to push higher over the course of the year. Our base case is that a US recession is avoided, while central banks remain broadly supportive. Even with inflation still sitting above target, we expect a newly appointed Trump-backed Federal Reserve Chair to help direct two rate cuts during 2026.

Inflation itself has taken on a new dimension. President Trump has flagged his intention to exert control over Venezuela’s oil reserves, the largest in the world. How this situation evolves remains uncertain, but it reinforces the idea that geopolitics will once again be something investors need to navigate carefully.

For some investors, heightened geopolitical tensions can feel unsettling, but periods of volatility often create opportunities for active managers to take advantage of temporary market dislocations and shifting sector dynamics in ways that passive approaches simply cannot.

Despite these risks, we expect investor confidence to remain reasonably robust. 2026 could also be a year when merger and acquisition activity picks up, particularly within the technology sector.

While we don’t believe the AI narrative is about to burst, we do think the distinction between winners and losers will become much clearer. While a rising tide has lifted many boats in the sea of AI names, execution will matter far much more from here – and those that don’t do this well could be in for choppier waters.

This is while valuations in parts of the market (particularly US mega-cap technology) are no longer cheap. That reinforces our focus on selectivity and active positioning rather than broad, indiscriminate exposure.

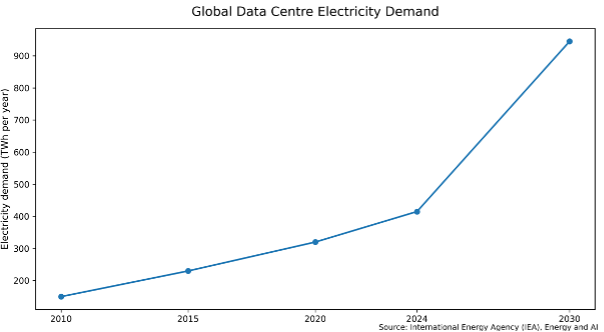

Nonetheless as a narrative, AI is set to remain dominant, as are themes around it. One of these is power, which AI requires enormous amounts of. We see power generation and energy infrastructure as major beneficiaries as hyper-scalers such as Microsoft, Amazon and Google continue to expand data-centre capacity at pace. Demand for reliable, scalable energy solutions is only just beginning, and we believe we are still in the very early stages of products and services being built on this technology.

Another area we see gaining real momentum is robotics. Automation is becoming essential for lifting productivity, reducing costs and addressing labour shortages across a wide range of industries, and we see robotics having a potential breakout year.

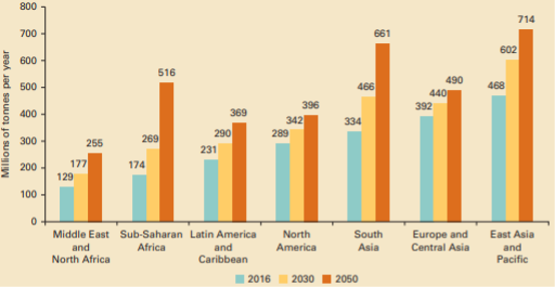

Outside of technology (although there is a relationship of sorts), waste management is another theme we find increasingly attractive. Global waste volumes are expected to increase by around 70% by 2050 if current trends continue, driving long-term demand for more efficient recovery, recycling and waste-to-energy solutions.

Source: World Bank

Closer to home, we see the Australian market pushing to new record highs. The Reserve Bank of Australia is expected to begin its rate-cutting cycle against the backdrop of a relatively resilient economy, supported by a recovery in China that could surprise on the upside.

In New Zealand, we also expect the market to make new highs. Investor appetite is likely to grow for electricity companies, property and cyclicals that appear to have bottomed. The dividend appeal of the local market should also come back into focus, particularly with interest rates expected to remain relatively low.

There is a new Governor at the Reserve Bank of New Zealand, and we expect Ana Breman to make her mark alongside a refreshed leadership team. Offshore pressures pushing borrowing rates higher remain a risk, and in our base case the RBNZ keeps rates on hold this year. That said, if the recovery stumbles, we wouldn’t rule out another rate cut in the first quarter.

Looking further ahead, we expect the New Zealand economy to show a much stronger second half, as early green shoots become more visible. The Fonterra payout and its flow-on effects should also provide support.

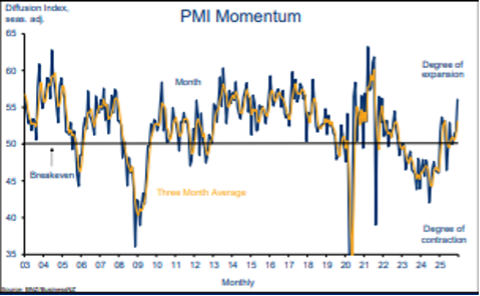

And as we start 2026, the green shoots we have been flagging in the kiwi economy appear to be pushing through the soil. The BNZ–Business NZ Performance of Manufacturing Index has come in at the strongest in four years. New Zealand is also outperforming globally - the PMI exceeded the global average of 50.4 and Australia’s 51.6.

Source: BNZ/Business NZ

Rate cuts over the past year are now feeding through more meaningfully. Other surveys support this improvement. The Quarterly Survey of Business Opinion showed a strong lift in confidence in the December quarter, with business confidence at an 11-year high. A net 39% of firms expect an improvement in general economic conditions, up from a net 17% previously.

Hiring and investment intentions are also improving. Overall, this points to upside risk for GDP.

And of course, it’s an election year. We expect a tightly contested race, with capital gains tax and potential KiwiSaver reforms shaping up as key areas of debate.

For KiwiSaver members and long-term investors, the key takeaway for this year again is not to be distracted by short-term noise. Markets will continue to react to headlines around politics, inflation and geopolitics, but retirement savings are built over decades, not months.

With interest rates expected to remain relatively low, the case for maintaining exposure to growth assets such as shares remains strong, particularly for those with longer time horizons. At the same time, higher market valuations and greater dispersion between winners and losers reinforce the importance of diversification and active management. Staying invested, regularly reviewing fund settings, and ensuring portfolios are positioned for long-term themes (rather than just chasing last year’s winners) is likely to be far more important than trying to time markets in the year ahead.

Generate is a New Zealand-owned KiwiSaver and Managed Fund provider managing over $8 billion on behalf of more than 180,000 New Zealanders. With a team of specialist advisers and a track record of strong long-term performance, Generate aims to help Kiwis make informed decisions and build a stronger financial future.

This article is intended for general information only and should not be considered financial advice. All investments carry risk, and past performance is not indicative of future results. To view Generate’s Financial Advice Provider Disclosure Statement or Product Disclosure Statement, visit www.generatewealth.co.nz/advertising-disclosures. The issuer is Generate Investment Management Ltd.

| « Outlook for 2026: Not Pear-Shaped but K-shaped |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved