For example, consumers have been provided not only with cuts in official interest rates but also with over a hundred billion dollars of tax rebates. Admittedly, it seems that many of the rebate cheques were saved rather than spent but they did at least provide some much-needed cash flow for the household sector.

In addition, the US household sector has also benefited from a large increase in public sector (or quasi public sector) mortgage advances. Freddie and Fannie (the big US mortgage lenders with an implicit, though not actual, government guarantee) were created after the Great Depression to act as an emergency banking system, in the event of a failure in the conventional system, they provided copious quantities of credit to households in late 2007 and early 2008.

This has apparently stressed their already weak balance sheets to the point of destruction. These lending activities did provide a useful – if temporary – lifeboat for consumers at the time. Had these institutions been better managed and regulated in the late 1990s, this lifeboat operation might have been able to persist for longer but nevertheless it did allow the spendthrift US consumer to continue a little longer and hence the US recession was postponed for a while.

Unfortunately, it now appears that time has run out for the US consumer. The tax rebate cheques have been sent, Freddie and Fannie are now perhaps mortally wounded and the conventional commercial banking system remains in a very impaired state. Moreover, even the new investment bank-sponsored credit channels appear to have been compromised and, consequently, we see little left that can insulate the US consumer from its 'day of reckoning'.

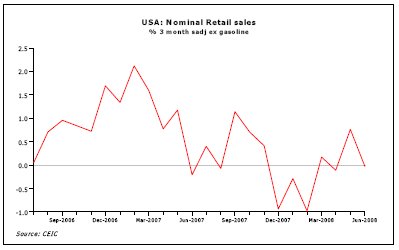

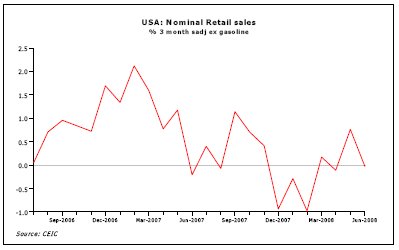

For more than a decade, American consumers have over-spent and although the myriad of measures mentioned above have succeeded in postponing the necessary fall in consumer spending relative to incomes, it now seems that this moment is finally upon us. Despite the reported strength in the economy during the second quarter, the more recent US economic data have been notably weaker and we find it particularly significant that the latest retail data was weak despite the supposed benefits of the tax rebate cheques. It seems that, finally, the US may be succumbing to a recession.

However, if the US is only now falling into a recession, we doubt that it will have been the first of the major economies to be so afflicted in this cycle. A quick research visit to Japan last month revealed an economy that may already be in a recession. Certainly, Japanese incomes and consumer spending in general are coming under acute pressure at present from not only rising fuel and food prices, but also a weakening labour market.

Interestingly, this potential recessionary situation is already being acknowledged by the new authorities, who are showing some well-timed willingness to both ease fiscal policy and adjust their monetary policy settings. Therefore, aside from being the first 'in' to the recession, Japan stands some chance of being the first 'out'.

The UK economy, like its US counterpart, also managed to avoid a recession in the early stages of the credit crisis but over recent weeks the level of 'bad news' emanating from the economy has increased seemingly exponentially. Housing market volumes have almost completely evaporated, consumers are facing difficulty in obtaining new credit, the labour market is softening and real incomes are being eroded by taxes and higher subsistence costs. Consequently, we would not be surprised to find that the UK economy may have succumbed to a recession as early as May this year.

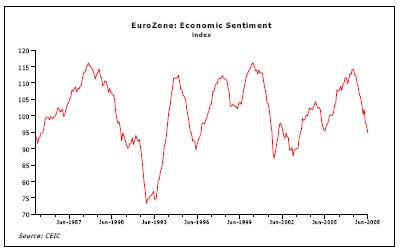

However, it is in Continental Europe that the recession process has perhaps unfolded at the fastest pace. Partly as a result of the global economic situation but primarily as a result of the structural flaws that lay at the very heart of the Euro currency system, the European economies appear to be deteriorating extremely sharply at present. In fact, on a country specific basis, we find that Spain, Italy and Ireland are clearly recession bound while France is also slowing and the German domestic economy remains stagnant.

Moreover, unlike the situation within the USA, the Euro Zone authorities have tightened their monetary regime even as the economies have weakened and it also seems that regional fiscal policies have also maintained a slightly restrictive bias of late. Rather than attempting to prevent or postpone a recession, Europe's policymakers appear to be speeding their economy's descent into a contraction in what we believe is the mistaken belief that the Region faces a threat from sustained inflation.

Unsurprisingly, this strategy has not proven popular with Europe's electorates, Belgium and Austria (which were actually two of the better economies in the Region) have recently witnessed falls in their governments and we can only assume that these represent precedents for possible changes elsewhere within the Euro Zone. With unemployment rising, house prices falling and bankruptcies rising sharply, we suspect that Europe's population will soon question the wisdom of the Euro Project and, while these debates may not wreck the project, they may at least undermine it, particularly on the FOREX markets. In comparison to events in Europe, US policy making may soon start to look rather better conceived, to the possible benefit of the US dollar's external value.

For Australasia, the news that the bulk of the G7 is now recession-bound, that India's industrial economy is slowing and that much of Southeast Asia's growth is cooling under the weight of higher fuel prices and tighter fiscal regimes, is clearly significant. With global growth apparently cooling rapidly (along with domestic growth in New Zealand), the case for higher commodity prices is clearly becoming ever more tenuous.

Indeed, we are beginning to see some 'wobbles' in the commodity markets and if these are continued, then New Zealand could suffer not just an implied reduction in farm incomes as prices fall but also some pressure on the NZD as sentiment to the commodity currencies changes. Clearly, the local export sector would welcome a weaker dollar but the RBNZ may be less enamoured with the event since higher import prices will both raise the CPI inflation rate, and constrain its ability to cut interest rates, in order to combat the domestic economic slowdown.

Therefore, it seems that the current global economic slowdown could pose a challenge in the near term not just for foreign asset markets but for the domestic markets and the NZ dollar as well. However, the global slowdown, and potentially lower commodity prices that it will imply, will ultimately pave the way for further 'global' interest rate cuts as the year draws to a close, an event that could presage at least a partial recovery in the asset markets over the final months of the year.

Andrew Hunt, London

| « Select Committee second report | Market Review: August 2008 Commentary » |

Special Offers

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved