Market Review: August 2008 Commentary

How often recently have you heard the world 'extraordinary' used to describe our financial markets. These are, indeed, volatile times. Just compare commodity and oil prices now to a month ago.

Thursday, August 7th 2008, 2:57PM

In this Tyndall Comment, we point to economic troubles in the U.S. and the Euro zone. Unlike in the US, policymakers in Europe are speeding their economies into contraction.With many of the world economies recession-bound, there are implications for New Zealand - our currency, farm incomes, inflationary pressures and interest rate.

Substantial further interest rate cuts and a partial recovery in our asset markets are now distinct possibilities.

Greg Campbell, Managing Director, Tyndall

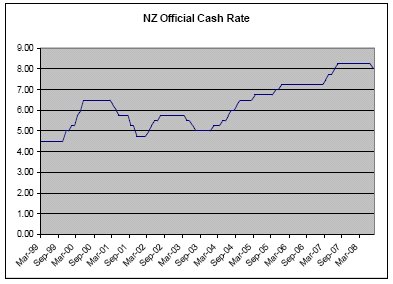

So the Reserve Bank of New Zealand (RBNZ) decided to go early and cut the official cash rate (OCR) now, rather than wait until September.

The reduction of the OCR from 8.25% to 8.00% is a positive move for the rapidly weakening New Zealand economy and represents the first OCR reduction since 24 July 2003 – exactly five years to the day from this latest cut. It also marks the start of an easing monetary cycle, of which it is anyone's guess how long it continues for and how large the reduction in the OCR becomes.

The July 24 OCR announcement was one of the most eagerly anticipated for quite some time. There was genuine uncertainty about whether the RBNZ would be bold enough to go ahead and cut (although most felt it was the right thing to do) or to wait until it had even more data (particularly early August's Household Labour Force Survey) and cut at the next announcement, on September 11.

The question now is will the RBNZ cut again this year? After September, there are two announcement dates in the final quarter of 2008 – October 23 and December 4. At this stage, there could well be a further cut (maybe another 0.25%, maybe even 0.50% if things are not looking particularly good) on at least one of those three dates.

Of course, the RBNZ does not have to wait until a scheduled announcement date to make a change. However, only once in its history has it altered the OCR outside of the eight scheduled announcement dates each year and that was after September 11, 2001. This year, though, we have already seen the US Federal Reserve's Open Market Committee make a surprise 0.75% cut to the Fed Funds rate in January, just over a week before making another 0.50% cut at its scheduled January announcement. So, with the current difficult (read: expensive) environment for credit, the RBNZ has at least a global precedent if it wanted to move on its own accord.

The main factors influencing the RBNZ's decisions on whether to cut are:

- the deteriorating economy

- the level of inflation

- the level of the NZD

If the data relating to employment, retail sales, growth and housing continue to exhibit deteriorating trends, the RBNZ's hand may well be forced in cutting further sooner rather than later. The likely extent of this deterioration may well determine the size of the cuts. There is a lag between the actual cut of the OCR and its effect on the economy, with estimates having this lag at around 12-18 months. Hence, the sooner the RBNZ acts, the sooner it can have a positive effect on the economy.

A month ago, inflation was causing massive headaches around the world. With food prices at extremely high levels and the oil price approaching USD150 a barrel, there were many predicting that a sustained period of very high inflation would persist. However, since 3 July, the Goldman Sachs Commodity Index has fallen a staggering 15% and the oil price is now down to just over USD120 a barrel.

There are many now questioning the sustainability of the commodity-induced part of inflation. However, there are other, more sustainable, inflationary areas, such as the inflation being exported by China for goods manufactured there. This is a result of the change in conditions from an ability to offer ever cheaper prices so that China could compete on the world stage to one where production costs are in an upward spiral with escalating wage prices. Even if food prices retrace from their high levels, the Chinese workers are not likely to accept decreases from the higher wage levels and hence production costs will likely be a lot remain a lot higher.

The RBNZ is forecasting NZ inflation to peak at around 5% p.a. in the current quarter. We broadly agree with that expectation. The ensuing reduction in inflation should allow the RBNZ to continue with an easing policy that will help foster a revitalisation in NZ economic growth, starting in 2009. If, however, inflation does remain high for longer than expected, then the RBNZ will be constrained in its ability to lower rates, as it will have to fight inflation instead, as required under the Policy Targets Agreement.

The NZD is expected to fall from its recent high levels as the RBNZ embarks on its easing programme. However, if the NZD falls too far too fast, it will create import inflation, which then causes the RBNZ to worry about the inflationary aspect again and possibly cease its easing. The speed at which the NZD falls is determined by foreign flows, so could be a bit of a wild card for the RBNZ.

If the conditions regarding the inflation and NZD value are not extreme and/or volatile, though, the RBNZ can probably embark on a steady programme of easing the Official Cash Rate, resulting in a turnaround in the New Zealand economy in the second half of 2009. Such a result should then be a positive for the New Zealand sharemarket, which in mid-July was down 30% from its peak in May 2007.

There are numerous expectations as to how low the RBNZ may have cut to engender such a turnaround. The last round of easings was a very short period from April to July 2003, where three consecutive 0.25% cuts took the OCR from 5.75% to 5.0%. Prior to that, there was an easing from March 2001 to November 2001 of 1.75%, taking the OCR from 6.5% to 4.75%.

Both of these easing "programmes" only lasted a matter of months and in both cases saw the OCR lifted again six months later. However, with the OCR level at 8%, we are in uncharted territory. Combine that with New Zealand possibly being in a technical recession (two consecutive quarters of negative GDP), massive falls in the New Zealand sharemarket and the housing market, yet counterbalanced by a very high NZD and the highest inflation level since a brief spike in 1995 and the picture becomes more complicated.

The RBNZ has traditionally been seen as being "hawkish" (quick to raise rates but not so keen to lower them). The current scenario of the RBNZ needing to reduce interest rates to 6.0–6.5% over the next year to 18 months has now become a distinct possibility.

Peter Lynn, CFA,Head of Strategy

| « A partial recovery ahead? | ASSET: FAB finale - Last moves for advisers » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |