by Pathfinder Asset Management

His thoughts apply to each of insurance, investment, mortgage and comprehensive planning advice businesses.

There is little information available on licensing of financial advisory businesses. This commentary is based on what is available from MBIE/FMA, plus lessons from the licensing of fund managers and DIMs providers. Fund manager and DIMs licensing is relevant as Section 396 of the Financial Markets Conduct Act sets out the structure for the FMA to grant market licenses. Section 396 has three key components for licensing:

As a boutique fund manager, we faced licensing with the same apprehension many adviser businesses now have. Yes, it took time and energy to get through the process, but we managed to run virtually all of the licensing process ourselves with relatively little money spent on external advisers/consultants. The purpose of this commentary is to get advisers prepping for licensing. This means thinking about the business, its processes and its systems – and, more importantly, how to coherently articulate what the business does.

The world changed for advisers when the Financial Advisers Act 2008 was enacted. Further significant changes are proposed under the current Financial Services Legislation Amendment Bill. From an advice delivery perspective, the changes are intended to provide flexibility and clarity, such as:

The last point is important – it will no longer be a regime of licensing/registering individual advisers. Everyone giving financial advice (including robo advice) will need to be operating under a licensed business.

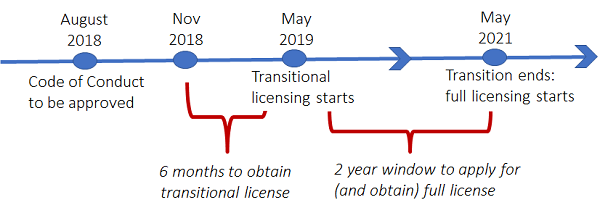

The expectation is that, from May 2019, anyone providing financial advice will need to work for a firm with a transitional license (transitional licenses can be applied for from November 2018 which is three months after when the Code of Conduct is expected to be approved). Existing adviser businesses will have two years to meet the standards and obtain a license.

The transitional licensing gives existing participants two years to meet the required standards. The good news is that MBIE expect transitional licensing to be a simple process – no more than simply notifying the FMA of the firm’s name, list of financial advisers at the firm and description of services provided. Yes, MBIE are indicating a transitional license should be that easy – but a full license will be a higher hurdle.

The implementation timeline does come with one caveat – the new Bill is not on the new Labour government’s 100-day plan. There is market speculation that this could mean a few months' delay, but nothing has been confirmed.

MBIE have indicated high level factors that the FMA is likely to take into account with licensing requirements. Essentially, they will be asking “is the adviser business fit for purpose?” There is no single right way to prove this. What is appropriate for one business in terms of infrastructure and process, may be quite different to another – the firm’s structure, resources and risk management must be “right sized” for its operations.

There are two critical points to note from the FMA’s “Quick guide to license applications for small businesses providing DIMs”. It will be very helpful for small adviser businesses if the FMA were to apply these to financial advisory licensing:

The license application will likely begin at a high level with the FMA looking at:

The introductory part of the license application should be seen by advisers as an opportunity to clearly articulate what the business does. This will effectively frame the direction of the application and how the FMA views your business. For example, you could include:

By the end of the introductory part of the application, the FMA should understand your business. This will make the rest of the application easier for the FMA to follow.

Here the FMA assesses if the people running the business are fit and proper to do so – it essentially covers only those with significant influence on how the business is run. This will likely involve providing a bio of relevant experience and qualifications.

The FMA may also ask how the business ensures that directors and senior managers do not cause detriment to clients or gain an improper advantage. This is easily answered by confirming advisers will comply with the Code of Conduct and act with integrity. There is nothing particularly onerous here.

The capability section will likely take the bulk of time preparing an application. We can break it into three parts: (1) team capability (2) operational infrastructure and (3) governance structure.

First, for the team’s skill and capability you will need to address:

Secondly, what operational infrastructure does the business have:

Thirdly, governance of the business:

Short answer – no, it will not be impossible. It has been clear in market services licensing by the FMA (for fund managers and DIMs providers) that the requirements are “right sized” for each business and there is flexibility on how standards are met. There are four things adviser businesses should be thinking about now:

Next month, we will focus on some key parts of licensing (such as compliance testing) and also practical tips to make the licensing process less stressful. Licensing is coming – there is no need to fear it. As long as you can tell a story mapping out your business, and your systems are fit for purpose, you will get a financial advisory license.

John Berry is co-founder and CEO of Pathfinder Asset Management Limited, an independent director of Punakaiki Fund Limited and a member of the Code Working Group. This commentary contains views of John Berry writing as CEO of Pathfinder. His views are formed and given independently of the Code Working Group.

Pathfinder is an independent boutique fund manager based in Auckland. We value transparency, social responsibility and aligning interests with our investors. We are also advocates of reducing the complexity of investment products for NZ investors. www.pfam.co.nz

| « When price and value diverge | Super cheap Boom » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved