Super cheap Boom

“Thinking creatively about the future, rather than unimaginatively extrapolating from the past is also the key to capturing the value of change.” Ed Lam, Somerset Capital, Portfolio Manager

Monday, November 27th 2017, 9:31AM

by Castle Point Funds Management

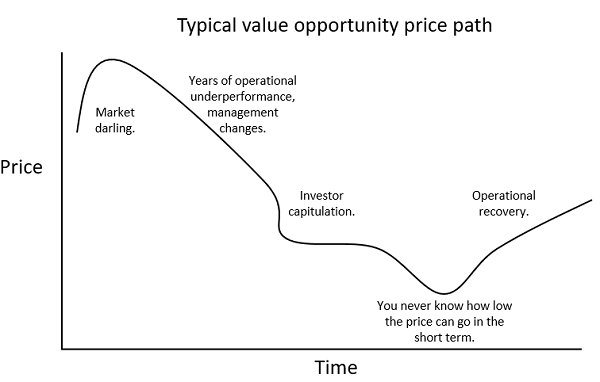

The above quote is an excellent encapsulation of why long-term investing works so well. In our, and Ed’s, opinion the market has a serious tendency to extrapolate the recent past into the future. This extrapolation creates some fantastic value opportunities when the market sees bad news as the new status quo. This can lead to companies becoming cheaper than even the most pessimistic value investor believes possible. The corollary of this is that value investors often buy too early - something our Ranger Fund suffered from in 2015.

However, as time progresses there is an interesting inflection point with value stocks where the market starts to question whether the bad news might be abating. This stage of the value opportunity can see a significant re-rating of the stock price from this shift in sentiment, but even with this re-rating the stock price can still be at very depressed levels as investors then wait for proof via positive trading statements and earnings results.

Recently, the Ranger Fund has benefited from some of our value positions appearing to reach this inflection point. This year two of our Mining Services companies, Macmahon Holdings and Boom Logistics, have appreciated significantly, up 145% and 81% respectively. At a fund level, they explain 11% of the 21% return that the Ranger Fund has delivered year to date. But, just as importantly, they are also a big part of why we remain confident in the ability of the fund to continue to deliver positive returns in the medium- and long-term. We still see significant upside in their share price. They have merely gone from extraordinarily cheap to super cheap.

Take Boom Logistics, for example, which we first purchased in the second half of 2014. We detailed the investment case in commentaries at the time. Basically, we purchased shares at a level which meant we got the assets of the business at less than 50% of their heavily written down value. The average entry cost at that time was around 16.5c a share. Our belief was that buying and holding those shares for the three to five years would generate returns well in excess of 100%. We were early. The shares continued to fall for the next two years and, in May last year, they were trading as low as 6c! The market had completely given up on any notion that the business could return to profitability. Boom had become extraordinarily cheap. We did take advantage of this extreme pessimism to purchase more shares, but we were clearly not making positive returns on the investment at that stage.

Slowly, though, the negative news flow began to abate. As 2016 progressed, investors started to once again contemplate the possibility that Resources and Mining Services businesses could make a half reasonable return on their capital. This was a slow thawing that started with the larger resources stocks and eked wider over time to the larger Mining Services names. And then finally last month it reached Boom. It began September trading at 10.5c and finished the month at 17.5c. A strong monthly return but one that merely elevated it back to the status of super cheap. Just about where we first purchased it three years ago with a target of over 100% return within the next five years. We still have that view and, having passed a news flow inflection point, we are increasingly optimistic about the continued contribution that Boom and our other Mining Services positions can make to the Ranger Fund.

Stephen Bennie is a founding partner and portfolio manager at Castle Point. He has worked in the investment industry for the past 24 years with a focus on Australasian equities for the past 20 years.

The commentaries represent only the opinions of the authors. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest. All material presented is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. Castle Point may or may not have investments in any of the securities mentioned.

| « A survival guide for financial adviser licensing | Policymakers and asset prices: an even bigger moral hazard? » |

Special Offers

Comments from our readers

No comments yet

Sign In to add your comment

| Printable version | Email to a friend |