by Andrew Hunt

With earnest intent on the part of their organisers, many conferences were held in the immediate aftermath of the GFC, in an attempt to marry the analysis offered by both academic and (albeit only a few) practical economists, in the hope of producing a new approach to economics that might be better able to explain the perceived new world order. In our view, the output from many of these events ultimately was quite limited – in practice, many of the conferences were hijacked by the mainstream financial media - but, nevertheless, over the course of these events, two surprisingly popular books came to achieve a high level of prominence and we believe that they came to gain an overriding influence on policymaking over the last decade.

Specifically, the two policy recommendations that emerged were that asset prices should be supported by either direct or indirect policy actions in order to prevent ‘balance sheet recessions’ (although we might argue that it would have been better to have avoided debt-fueled booms in the first place that then required high asset prices to offset the debt that had been/was amassed), and the second recommendation was that public sector debt must be reduced (even while encouraging an increase in private sector indebtedness) through the use of politically-divisive austerity policies, even at times during which government bond yields were occupying record lows.

We would argue – very strongly, in fact – that these policy recommendations merely represent attempts to alleviate the symptoms of what are, at their root cause, supply-side failures. Had Japan’s authorities liberalised their supply side via the abolition of some planning controls and reduction in MITI’s overbearing influence on the economy, then a credit boom would not have been ‘needed’ in order to (artificially and only temporarily) depress Japan’s trade surplus during the 1980s. Without the credit boom, there would have been no build-up of debt liabilities in the economy that allowed balance sheets to become stressed. Similarly, supply-side deregulation that lifted productivity growth and hence tax receipts would have ‘cured’ governments’ fiscal problems, in much the same way as had occurred in the first half of the nineteenth century in the UK, or in the Clinton-era USA.

However, in part as a result of the perceived new ‘orthodoxy’ that emerged in the early 2010s, governments such as the UK’s Cameron-Osborne administration have consistently eschewed supply-side measures and focused almost exclusively on austerity/reductions in government spending while at the same time utilising QEPs (Quantitative Easing Programs) and other related artificial policies that have been overtly designed to support asset prices, despite the inequalities in wealth that these policies have created (being an existing owner of assets has been ‘great’ over the last nine years, but if you were looking to buy, then the costs of houses, equities or bonds has seemed to be prohibitive in many cases).

From a very ‘top down’ level, we would suggest that this desire to support asset prices (particularly bond prices) and to suppress volatility within financial markets has acted in a manner that is equivalent to the ‘rationing’ of volatility. As we saw all too clearly in the 2000s (although policymakers still seem not to have recognized this fact…), investors and their advisers need and require risk and volatility, in order to manage their savings effectively, and an economic system needs functioning risk markets, so that capital can be allocated efficiently. However, the recent suppression of volatility in the bond (and other) markets has encouraged the boom in house price speculation and corporate zaitech (financial engineering rather than real ‘engineering’), while apparently doing little to foster investment in more productive pursuits.

Furthermore, we have always believed that risk cannot be destroyed, although it may be moved from one place to another. For example, when rationing occurs and the supply of an “item” is artificially depressed by decree, there will be a tendency for unofficial ‘black’ markets to spring up, in order to meet the unsatisfied demand. Unfortunately, when people start to utilise the often unregulated and opaque alternative markets, they often find themselves, ultimately, bearing much higher levels of risk than they might have done otherwise – certainly, artificial rationing encourages people to adopt modes of behaviour that they might otherwise not do….

For example, during the 2000s, the relative lack of volatility and yield in the bond markets that resulted from Greenspan’s desire to suppress volatility in the mainstream markets led the investment banks to hire clever mathematicians, who in turn built complex models based on what proved to be unrealistic assumptions that were then used to construct the whole alphabet soup of mortgage products and the expansion of the investment banks’ balance sheets. We would argue that by suppressing volatility in the conventional/mainstream markets, Greenspan merely succeeded in pushing the volatility underground, into the murkier unregulated parts of the system, with disastrous results.

When the end of the 2003-2008 credit boom first dawned, very few in the media or even PMs knew what a CDO was, just as a few years later, a similarly small number were aware of the shenanigans that had been occurring within the Euro Zone’s bond markets and banking sectors in 2009-10 with the direct collusion of the authorities before the ‘headlines hit’. Similarly, while the London Whale and the Tapering Tantrum stole the headlines and attracted much of the ‘blame’ for the short correction in the financial markets in 2013, even today we suspect that comparatively few are aware that much of the sell-off in EM bonds in that year may well have been driven by the coincidently simultaneous unwinding of an Investment Bank’s $500 billion fixed income portfolio in the wake of the Whale incident. Crucially, the bank in question was only running such a large ‘internal hedge fund’ because it needed to deploy the funds that were sticking on its balance sheet as a result of the operation of the Fed and others’ QEPs, and its need to generate a return for its shareholders in what had become a risk-rationed world.

Moreover, we would also suggest that the post-1987 increased use of risk-rationing has resulted in the ‘big systemic crashes’ becoming bigger each time: in the USA during 1987, the equity market crash notionally destroyed the equivalent of 10-15% of GDP. Losses in the US debt markets in 1994 were the equivalent of 20% of GDP. The LTCM event in 1998 appears to have resulted in a similar degree of losses, but the end of the NASDAQ bubble notionally cost 20-30% of GDP, while the GFC probably cost around twice that amount. Each time the authorities have sought to ration volatility and boost asset prices, the ‘stakes’ in the game may have become higher. This would seem to represent an ‘odd way’ to attempt to avoid a balance sheet recession; indeed, it seems that the authorities are creating even bigger problems in the long run.

In summary, if history tells us anything about rationing and state intervention in markets, it is that dangerous parallel alternative markets will spring up while the regime is in place and that, when the policy is halted, the sales and price of whatever has rationed adjust quite rapidly, while the alternative markets that sprang up while the regime was in place often simply ‘collapse’ as their raison d’etre is removed. We have long been of the view that when it comes to a ‘dangerous’ market correction, it is always the “unknown unknowns that get you”. Therefore, we are not overly concerned by the behaviour of the VIX per se, but instead we are much more concerned by the thought of where the volatility that was in the VIX has gone….

In terms of today’s probable areas of excess and overvaluation that could give rise to systemic crises or corrections, we would suggest that the high QE-inflated prices of corporate bonds; the boom in the crypto currencies (it will be interesting to see what happens if and when there is a significant default or ‘theft’ in these markets – or even power outages); the high level of Pacific Region property prices, and Euro Zone credit spreads are each obvious and well-known candidates, together with some of the new alternative credit channels. However, we are increasingly coming to the view that the biggest area of risk has (again) become the global household sector.

Households the world over have been told that one should not expect asset prices to be volatile and that, on the odd occasion in which they have declined in the last nine years, they have usually bounced back and ‘ended up higher’ than before any correction. Of course, if you encourage people to believe that asset prices are a one-way bet, they will alter their behaviour accordingly and, particularly those in society that were not trading in 2008, 2000, 1990 or 1982, will likely wish to leverage themselves either explicitly or even implicitly into such a seemingly attractive strategy.

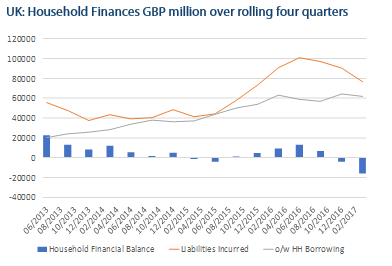

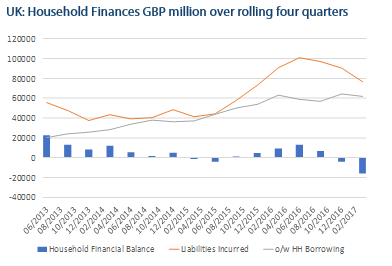

As a consequence, we have witnessed yet more debt being added to household balance sheets and households seem to have accepted it as normal to assume that they will be able to cash out of the asset markets frictionless at attractive prices - holding gains intact - and that current cash flow and incomes therefore don’t matter. Indeed, the notion of the ability to ‘cash out’ of the markets at will seems to have become institutionalised from London to Auckland and virtually all points in between…

It seems to us that, by rationing risk and by explicitly attempting to avoid balance sheet recessions, the world’s authorities have inadvertently sent a signal to real world investors and, in particular, ‘normal’ households to use more implied leverage, to take bigger risks within their own balance sheets, to run with minimal cash flows and to assume that rising asset prices will always bail them out over the longer term. However, if asset prices were to succumb to gravity for any prolonged period of time, then the assumptions that have underpinned so much of household behaviour over the last 20 – 30 years would be challenged at their most fundamental level. At the very least, households would be obliged to become significantly more cash-flow positive in the short term via an aggressive austerity drive of their own.

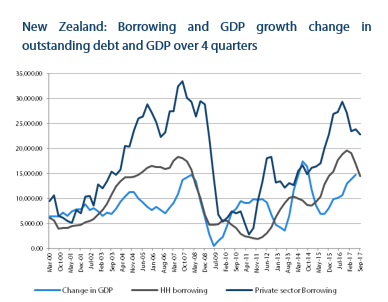

Some have suggested that this renewed dependency on high asset prices simply implies that central banks will never let asset prices decline. However, as the military strategist knows, any battle plan or strategy tends to be forgotten as soon as the first bullets start to fly. In central banking, the equivalent of incoming fire is either unexpected political events or, of course, inflation. When inflation began to ‘turn up’ in late 1993, Greenspan’s Post S and L market-friendly regime had to be modified all too publicly and, as a result, bond prices tumbled. In 2000, the recovery in Asia began to infect the global system with inflation and a rise in Chinese export prices in 2007 certainly contributed to the havoc that followed. Specifically, we have noted over the last 30 years that, if a central banker ever dares to admit that they are behind the curve on inflation and that they need to modify their stance, asset markets tend to re-price quite aggressively.

To further complicate matters for the central banks, we can argue that in today’s world, inflation is no longer a purely domestic phenomenon. In a globalised world, it can be changes within the global output gap or within pricing regimes inside the global supply chain that can generate inflation surprises independently of purely domestic conditions within any particular country and we would argue that the recent trend in world trade prices has been quite unequivocally concerning in this regard.

At present, we are sure that the World’s Central Bankers will endeavour to do everything that they can to avoid a Greenspan (1994) St Valentine’s Day Massacre scenario, under which they admit publicly that they are behind the curve with inflation but, as we witnessed in the 1970s, the longer they delay, the worse the fallout, and inflation outturn tends to be over the longer term.

At the very least, it seems to us that inflation is now the number one risk to financial markets and, by implication, to the state of the household sector’s balance sheets and households’ ability to spend. In our view, all those policymakers that are promising to achieve higher rates of inflation should be careful what they wish for – a rise in global inflation could easily re-introduce volatility back into not only markets, but the real economies.

Andrew Hunt International Economist London

| « Super cheap Boom | Nearing an end to the NZ Goldilocks? » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved