by Harbour Asset Management

While markets performed strongly in November, there were increasing signs, particularly in New Zealand, that 2018 may involve a transition away from this goldilocks environment.

Globally, equity markets continued to inch higher (up 1.3% in US dollar terms), led by the US and Japan. The US reporting season continued to better expectations, and there was a growing positive expectation of tax reform. The ASX200 was up about 1.6% (in AUD) with the best stocks in the property and energy sectors. The oil price was up 5% and iron ore recovered strongly, although base metal prices were weak.

The NZX50 (gross) returned around 0.5% in November, led by companies in the aged care and property sectors. A key feature of the month was the inclusion of F&P Healthcare in the global MSCI index, and other changes which saw massive volumes of stock trade on the last day of the month. November continued to see a large dispersion in announcements from companies at annual general meetings. By and large, globally-facing companies were more optimistic in their view of prospects while there was a more cautious tone to company news in domestically-oriented companies.

Throughout 2017, the Reserve Bank of New Zealand (RBNZ) has brought stability to the fixed interest market by making it very clear that they are happy with existing policy settings, i.e. the Official Cash Rate at 1.75%. While this message remained in place at the November Monetary Policy Statement, there were the first hints that this outlook may come under review in 2018, as more broad-based inflation pressures begin to emerge.

Since the outcome for the New Zealand general election, we have identified a number of key risks to monitor, including the danger of a fall in business confidence, a slowdown in the housing market, and a lift in inflation pressures.

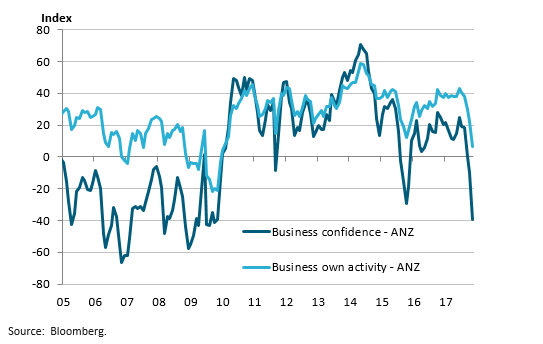

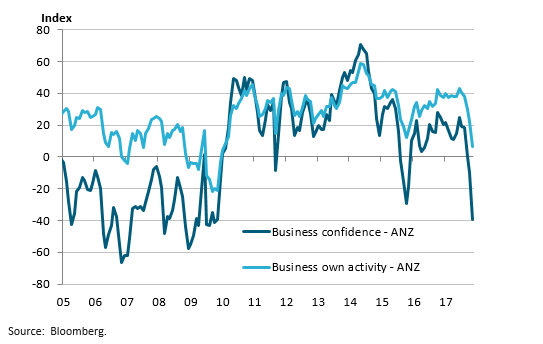

ANZ business confidence fell sharply in November, capturing the first period since the coalition was formed. Not only did the headline Business Confidence number fall from -10.01 to -39.3, but the more important Activity Outlook measure fell from 22.2 to 6.5, and the reduction was broad-based across sectors. ANZ’s composite business and consumer confidence number is now pointing to GDP growth closer to 2% than the 4%.

Chart 1. NZ business confidence

It’s important to note that we need to see more evidence that this confidence effect is playing out in real economic activity and decisions. We know that confidence surveys sometimes diverge from reality for a period, and there may be an element of a protest vote from the business community in these survey responses. There is also some evidence that business confidence is systematically lower than the more important Activity Outlook measures during Labour-led governments. However, we are undoubtedly in a more fragile economic environment for the business sector, which needs to be monitored.

At the same time, the slowdown in the residential housing market, particularly around the Auckland region, is also receiving greater focus. Certainly, housing is being challenged on several fronts. Reduced migration, policy change for offshore buyers, tighter credit availability from the banks and extremely lofty prices have prompted the property investor group to pull back, leaving just owner-occupiers to participate. House prices are already falling in Auckland, and there is a risk this spills into other regions and adversely affects consumer confidence. Reflecting this cooling in the housing market, the RBNZ made a modest easing in loan-to-value (LTV) restrictions in November.

While the market has one eye firmly on risks to economic growth, the other is scanning the horizon for increased Consumer Price Index (CPI) inflation pressures. Here, multiple factors are at play and appear likely to cause headline inflation to rise over the next 12 months. The chief catalysts are the minimum wage policy, the weaker NZ Dollar, rising oil prices, rising rents and rates, increased government spending and ongoing tightness in the labour market. While some of these are transitory, there is certainly a plausible scenario where higher headline inflation feeds into higher inflation expectations. This scenario would put pressure on the RBNZ to shift away from its current stance.

The outlook for the global economy seems moderately robust for 2018. Against that background, it seems likely that monetary stimulus will continue to be reduced bringing the prospect of gradually higher interest rates in some countries, in particular the US. The increased likelihood of tax stimulus in the US may continue, however, to promote growth. In Australia, business confidence remains solid, at close to cyclical highs; however, coincident indicators of growth remain more subdued, with the consumer and housing activity still muted. We see disruption in a number of industries as a continuing key theme for 2018.

In New Zealand, we are cautious about the equity market. A significant amount of attention needs to be placed on cyclical conditions. Although there is a strong prospect of a large fiscal stimulus and higher income growth from wage inflation, the sharp drop in business confidence is telling another story, and many domestically-orientated businesses seem downbeat in their assessment of future profit growth. In part, capacity constraints and disruption appear similar themes. We continue to focus on quality growth companies. Many of these companies have been strong performers in 2017, but they still form a core in our Australasian equity portfolios.

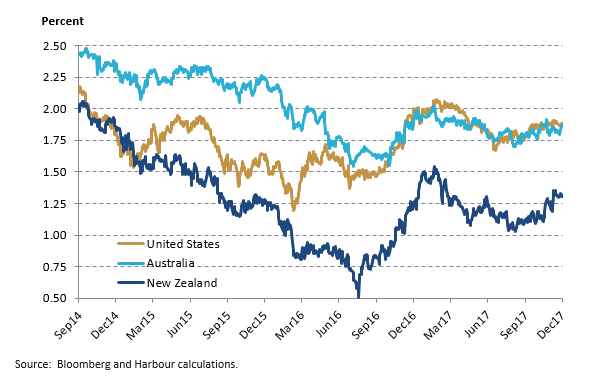

In fixed interest markets, we think the most likely scenario is where we do see rising inflation, despite softness in confidence and activity. We also expect the RBNZ to be relatively patient about responding to higher inflation, with any hike in the OCR unlikely before Q4 2018. After several years of inflation below target, and given the flexibility of the implementation of policy, we could see the RBNZ getting a little ‘behind the curve’ in the eyes of some analysts. This scenario, reinforced by similar developments offshore, has caused inflation-indexed bonds to outperform regular fixed-rate government bonds in recent months, and we expect this to continue.

Chart 2. Breakeven Inflation Rates (BEIs) from inflation-Iinked bonds

In the corporate bond sector, we continue to see the pressure of investor funds chasing securities, while companies are taking advantage of the lower yields to lock in term funding. Issuance is concentrated in the seven-year maturity band, as this is the maturity needed to issue attractive coupons, especially with term deposit rates at attractive levels. This dynamic looks likely to continue. However, if we are moving into a higher inflation environment, we would expect some risk aversion to develop, pushing credit spreads wider. Accordingly, we are reasonably cautious about longer-dated credit at present, especially in cyclically-exposed sectors.

Important disclaimer information

| « Policymakers and asset prices: an even bigger moral hazard? | 2017 and 2018: recap and outlook » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved