by Daniel Smith

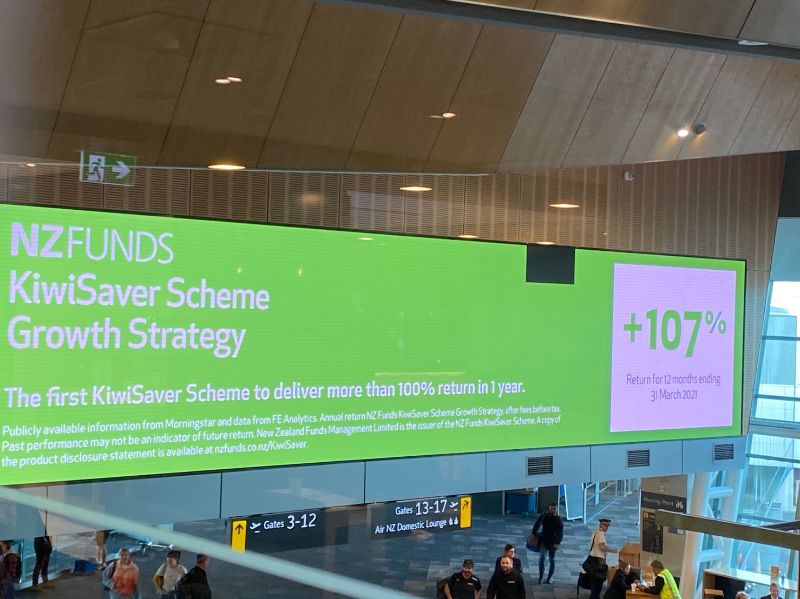

The FMA this week put out a warning to fund managers not to overstate their yearly returns due to large fluctuations in the market. Some in the industry took this to be a direct response to the NZ Funds’ billboard campaign.

Paul Gregory, director of investment management at the FMA has said, “For growth funds, we recommend investors pay most attention to performance over a period of three to five years and preferably longer.

“This is more a meaningful timeframe to judge performance compared to just one year and is in line with minimum suggested time frames for staying in a growth fund.”

NZ Funds has since changed its advertisement to reflect its three-yearly returns in line with the FMA position. But despite this, Grigor stands by the original advertisement.

“Ever since KiwiSaver started, managers have talked about their 12 month performance. We think this is a fairly normalised way of telling our clients and prospective clients how we have done.”

Grigor thinks that a lot of the chatter about NZ Funds’ advertisement has to do with issues other than the way the information was presented.

“I think that this has gotten a lot of headline-grabbing attention because this is the first time that a provider has achieved over 100%.

“There are providers out there that haven’t bounced back as fast as the rest of the market which is forcing them to voice their opinion in a more negative light.”

Grigor points to the way that NZ Funds operates as the key to its success over the year to March 31, 2020.

“The way that we look at it is our investment approach is not limited to asset class. What we are trying to do is assess the investment regime and seek out opportunities wherever they may be in the market.

“We still have the building blocks of the portfolios in shares and bonds, but these other asset classes enable us to amplify those returns.

“This is what has enabled us to generate the kinds of returns that we have seen over the past 12 months, or whatever time period you want to take it from.”

An element of NZ Funds’ KiwiSaver portfolio to achieve high returns is an allocation in cryptocurrency which contributed 17% of the 107% yearly return.

One figure who questioned the NZ Funds’ advertisement campaign was Sam Stubbs, managing director of Simplicity who said, “NZ Funds charge fees high enough to be able to afford an ethics and morals lesson, so perhaps that would be money well spent.”

Stubbs posted the picture above on LinkedIn and said: "Here’s an example of why the finance industry is so mis-trusted. The FMA have rightly asked managers not to advertise like this, because COVID related swings in the market can give a very wrong impression of future returns. Simplicity won’t advertise like this, and other responsible managers won’t either. But it takes one bad apple...."

Grigor responded to those comments by saying that “There are organisations that [claim to save] their clients hundreds and thousands of dollars’ worth of fees while at the same time those managers have lost their clients millions of dollars in returns by not being a bit more innovative and thinking outside the box.

“I think people should focus on what they are good at and generate strong returns for their clients. That is what we are trying to do.”

“At the end of the day our aim is to transform New Zealanders' wealth. We will continue to do that in a way which is compliant with what the FMA wants from an advertising perspective.”

| « Why PI insurance premiums are rising | Mann on a mission to diversify financial advice » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved