by Matthew Martin

The Financial Markets Authority (FMA) has released its annual Investor Confidence Report for 2021 with the results finding confidence in New Zealand’s financial markets has continued to rise in the last year, following a significant rebound in financial market performance, while more people are shifting from term deposits to shares.

Overall investor confidence is up on last year with 72% of investors saying they are confident in the country’s financial markets, up from 66% in 2020, and is the first time investor confidence has cracked the 70% mark since the FMA began its market confidence reports in 2013.

FMA chief executive Rob Everett says while it's nice to see investor confidence at those levels, "we are 10-12 years into a very bullish market for most asset prices and we've got a lot of people getting engaged in those markets who haven't been in before".

"There is a real note of caution to sound and we want to make sure that people who are getting involved for the first time, or are getting involved in size, appreciate the risk of a significant market crash and they focus on their long term goals and their ability to withstand loss."

He says when people start investing more they would be wise to get professional financial advice to manage all of their investments, which also usually include KiwiSaver investments.

The report also found that KiwiSaver continues to be the most common form of investment among New Zealanders at 63%, and for 3 in 10 KiwiSaver is the only investment they hold.

The overall proportion of people with investments has remained relatively consistent at 84% but in the last three years, term deposits have dwindled from 34% to 28%, while shares rose from 17% to 21%.

“Term deposits have tended to be the most prevalent investment product outside KiwiSaver, but in this low interest rate environment, with changing behaviours and preferences, individual shares are closing the gap," says Everett.

"This aligns closely with the rise of DIY, or fractional, digital share investing over the last few years, with 60% of share investors now buying shares through these platforms.”

But, he says the FMA is paying a lot more attention to digital investment platforms such as Sharesies, Hatch and Stake and how they can incentivise people to get involved in the share market.

"Our experience to date has been good...and if you look at their trading stats most people are staying in for some time and aren't doing crazy things, albeit of course when the markets turn then we may see a slightly different set of behaviours."

Everett says this also means the FMA has to up its game and make sure investors are fully aware of where they can look to get advice and do their due diligence.

"If you get to any degree of size and you're starting to take a slightly longer-term view...and you're looking at it as a portfolio, that's when you should be getting a professional - an objective professional who is regulated - to help you understand the pros and cons of different approaches."

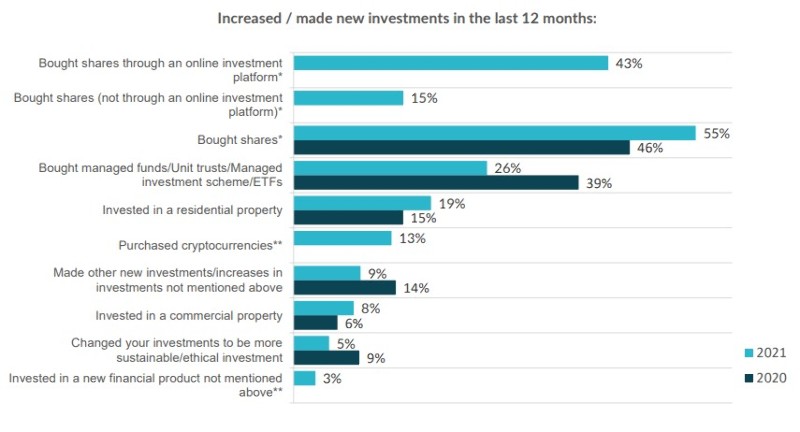

The report found more New Zealanders made new investments or increased existing investments in 2021 - 23% in 2021 compared to 17% in 2020 - however, there was also a slight increase in those who decreased investments - 9% compared to 6%, including extending a mortgage.

Of those who increased their investments, 43% bought shares through an online investing platform.

The online survey of 1020 New Zealanders aged 18 years and over was held between April 23 and May 17, 2021. The data is representative of the New Zealand population by age, gender, region, and ethnicity.

| « FMA passes 10-year milestone | Mann on a mission to diversify financial advice » |

Special Offers

No comments yet

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved