KiwiSaver provider Generate commissioned Deloitte Consulting Australia to compare fees KiwiSaver fees to similar funds in Australia and the United Kingdom.

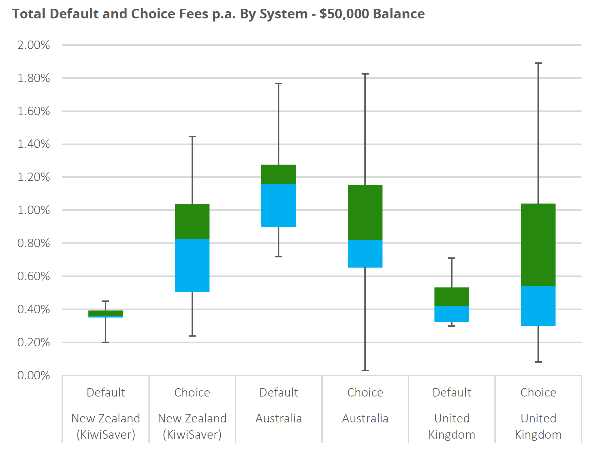

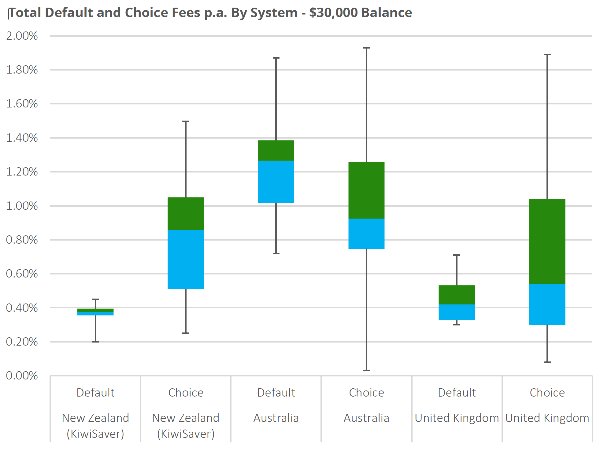

It found that KiwiSaver fees are on average lower than fees charged on similar funds in Australia and KiwiSaver default fees are on average lower than the fees for default products in both Australia and the UK.

“It’s good news for KiwiSaver members that the fees they pay have been found to be globally competitive,” Generate chief executive Henry Tongue said.

He says KiwiSaver members can have confidence that the fees charged by managers are reasonable by international standards.

“The fact our fees are lower than Australia is quite phenomenal.”

The report compared fees on default funds in each country and also fees on non-default funds which Deloitte called “choice”.

More advice is the key outcome to customers, now.

As could be expected there was a wider range of fees on Choice funds due to varying asset allocations, management style and relative scale.

Deloitte concluded; “fees charged to members of KiwiSaver default products are on average lower than fees charged to members in similar default funds in Australia and in the UK.”

Source: Deloitte

This graph compares fees for default schemes in NZ, Australia and the UK for balances of $50,000. The coloured bars are the second and third quartiles. A graph for $30,000 balances is further down the page.

There are some common myths that KiwiSaver fees are higher than fees in Australia and this report demonstrates that is not true, he says.

Tongue says a single-minded focus on lowering fees will not do KiwiSaver members any good.

“The pursuit of ever-lower fees also leads to more low-cost, vanilla KiwiSaver products, which ultimately reduces consumer choice of active KiwiSaver funds and has implications for the long-term health of the New Zealand economy and capital markets,” he says.

The research is also remarkable given the relatively small scale of the KiwiSaver market which sits at $90 billion versus the Australian superannuation system which is more than $3,100 billion and the UK system at more than $5,000 billion.

"This shows KiwiSaver fees to be highly competitive in relation to their much larger scale Australian and UK peers."

Tongue says it is time to focus the KiwiSaver discussion onto issues which will make a bigger impact on KiwiSaver members including fund selection and contribution rates.

“A single-minded focus on fees, especially when these are already highly competitive when compared to other markets, crowds-out the critical need to also focus members attention on fund selection and contribution levels. We should be encouraging members to seek advice, think about fund choice and contribution rates, and encouraging more financial advisers to provide advice on KiwiSaver.

“More advice is the key outcome to customers, now.”

Other research by the Financial Services Council shows the majority of respondents contribute only 3%-4% into their KiwiSaver, while 74% of respondents think that Kiwis should be contributing a bigger percentage of their earnings.

In addition, 80% of respondents considered that they were getting value for the fees they paid.

The methodology used for this research was to focus on the total fees charged to members with account balances of $30,000 (the current average KiwiSaver account balance) and $50,000 (a potential future state average account balance) across a representative peer group of funds from each system.

| « Financial Advice NZ membership numbers revealed | Tough times ahead for NZ economy: Nikko economist » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved