by Ksenia Stepanova

The Reserve Bank has released its latest Financial Stability Report, and it shows that New Zealand's health insurers are under a lot of strain, while life and general insurers are slowly improving.

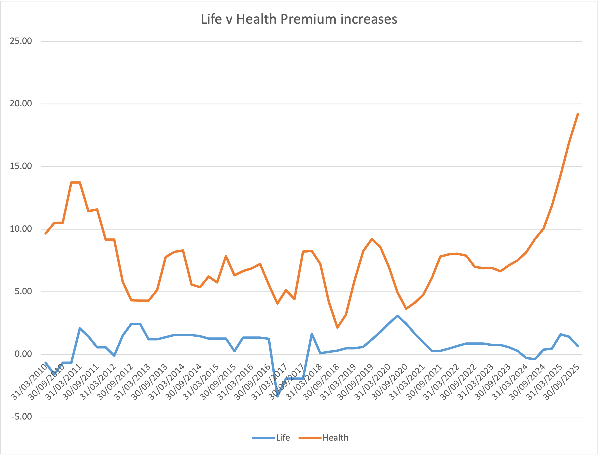

As a result, premiums in health insurance have skyrocketed while life premiums have remained relatively stable.

Here's what's happening in each sector.

A health insurance crisis

The report noted that health insurers have lost almost 40% of their financial reserves over two years. They're still meeting legal requirements, but they're losing money every quarter.

The main problem is rising medical costs. Until 2022, price increases were normal and manageable - but in 2023, insurers were reporting quarterly losses.

New Zealand's public hospitals became overwhelmed, pushing more people into private healthcare. Insurance companies hadn't planned for this surge in claims.

Additionally, new medical technologies now cost more, supply chains are under pressure, and healthcare workers are demanding higher wages. All these factors have pushed claims costs even higher.

By 2024, insurance companies responded with massive premium increases - about 19% in a single year. The biggest jumps came in late 2024 when insurers came out with "material repricing," which means significant changes to their entire pricing structure.

Despite these huge premium increases, health insurers are still losing money. There's a delay between announcing higher prices and collecting that money as policies renew throughout the year.

Source: RBNZ

Life insurance recovery

Life insurers are making money again after several difficult years, but profits remain low. Returns don't match what investors could earn elsewhere.

Solvency margins in the life insurance sector have remained “well above” regulatory requirements, but the Reserve Bank noted that they have trended lower in recent years.

Life insurers have responded by paying bigger dividends to shareholders and keeping smaller cash reserves.

Some technical accounting changes make life insurers look weaker than they actually are. The Reserve Bank says their financial positions are still adequate despite the subdued figures on paper.

Regulatory response

The Reserve Bank is intensifying its supervision of the insurance sector. Health insurers will now be included in its stress-testing programme, and will be put through scenarios where the pressures mentioned above continue to escalate.

The Reserve Bank will also be engaging with health insurers to ensure that responses support both the long-term sustainability of the sector and the resilience of households and the broader financial system.

Both the life and health sectors were mentioned as part of a broader look at the insurance industry.

The report noted that general insurers have largely maintained strong profits, supported by premium increases following the severe weather of 2023. Overall, health is the outlier in more serious stress, with health insurers still making losses.

| « Fidelity adds cancer support, digital tools for advisers | Mixed reviews from advisers on FMA regulation » |

Special Offers

Sign In to add your comment

© Copyright 1997-2026 Tarawera Publishing Ltd. All Rights Reserved

A few things make the situation very predictable, but most have either forgotten or disregarded them.

Back in the 00s, there were multiple studies and reports made that public health was headed to a crunch point; it wasn't just Covid, though it didn't help. The issues stated nearly 25 years ago were:

* Underfunding relative to the population growth.

* Lack of effective planning for the obsolescence of infrastructure. aka the replacement of hospitals we're seeing.

* Lack of training and utilisation of immigrant clinicians (with crazy re-training requirements)

* not to mention the bubble of baby boomersboth living longer as well as increasing the pressure on already straining resources.

* Pressure on social services and super with a declining tax base were already talked about.

* We knew unfunded medicines were coming, drug-eluting stents and Herceptin were already in to mix.

Then, with successive governments failing to address the predicted tax income shortfalls and failing to increase funding for the health system as recommended, the destination we see in 2025 with medicine should not be a surprise to anyone!

Not to mention that preventive healthcare accounts for less than 1% of the government's healthcare spending.

Completely ignoring that a dollar spent on health care results in a significant reduction in treatment costs!

Surprised? No. Frustrated, very much!