When is the right time for T?

AMP Financial Services' super expert Linda McCulloch considers what part of the savings process should be tax exempt.

Tuesday, May 22nd 2001, 2:59PM

In speaking to the International Fiscal Conference in Christchurch in March this year, Michael Cullen said "My view is that the tax system could do a lot more to encourage people to save for retirement, and this year I intend to foster an informed policy debate on the matter’.

Well I agree with Michael Cullen. The tax system is certainly capable of doing more to deliver a savings friendly environment. And to that end I’m certainly committed to being part of such a debate - as is AMP. We believe it’s an issue that New Zealanders ignore at their peril.

This forum is one that also has a clear responsibility to provide politicians and Michael Cullen in particular, with information that will stimulate and enhance this debate.

- Creating a savings friendly

tax environment

- When I sat back and started to think about the permutations of what might deliver a savings friendly tax environment, one that would encourage and foster retirement savings, there seem to be plenty of options. We can talk about taxing contributions at source, when converted to income, or not at all. We can also talk about taxing them at the full marginal rate or at another rate. There’s the option of tax incentives or tax deferment.

The same applies to investment earnings.

The 33% ‘one size fits all’ is clearly inequitable –but easy alternatives, apart from lowering the tax rate or no tax at all, don’t immediately spring to mind.

The obvious ones are either a minefield for the industry to administer or unacceptable to IRD and Government generally.

And a third option is to look at taxation at the point savings are converted into an income stream and ponder on what opportunity there is to tax, or not tax savings at this point. Which depends, of course, on what you’ve offered at source, and how you’ve taxed investment income.

The permutations aren’t endless (64 in fact!) - but they are diverse.

- Need to turn recognition

into action

- I think one of the biggest opportunities that face us today is to turn recognition into action. AMP has now been surveying New Zealanders for a year through our AMP SuperWatch research. What they’re telling us is what they’re thinking on super-related issues. 92% of New Zealanders recognise the need to save for retirement, and 74% of these consider it mostly their responsibility to save – not the Government’s. Interesting statistics. I think the industry and the Office of the Retirement Commissioner are getting their message through. I particularly like the television ad of the parents trying to convince their small children to provide for them in retirement. But there’s a division of opinion on just how effective such ‘shock’ tactics might be.

New Zealand’s State pension is a basic level of income - there’s no fat and there’s no frills!

OECD studies show NZ Superannuation is among the least generous old age pension as a percentage of average wages and, that the fiscal costs compared to other OECD countries, are low.

As we know, the tax take in any given year has to meet its obligation in this regard with no access to any Government or personal reserves to offset it. And as we all also know, the demographic bulge of baby boomers is going to consume an increasing share of the total tax take in the next 40 or so years.

The gap between the lifestyle people want and their current levels of retirement savings is widening. We have a choice here too. We can dampen expectations so that retirees and those expecting to become eligible for NZS in coming years accept a lower standard of living and few choices in retirement or we can create the savings friendly environment that will enhance their choices in later years. We need to continue to ensure that New Zealanders understand this. And at the same time we need to be sure that the impact of debate around current legislation for NZS does not divert us. As we all know NZS merely entrenches the status quo

I well remember the first time I became aware of the need for superannuation. It was the early 80’s and I was the mother of three young children in a self-employed one-income working class family. Money was tight, three children, a mortgage and one parent earning. I won’t say ‘working’ because I considered I worked just as hard as my husband - both at home and in the community - I just didn’t generate any income! Anyway, we had a financial adviser contact us and tell us that each year we could save up to $1200 in our own personal super scheme, or $1400 if my husband was a member of an employer sponsored scheme - he wasn’t - and not pay any tax on the savings. At this stage we had no retirement savings. Our serious savings went into upgrading our house, our car or having an annual holiday.

But the tax exemption on savings was too big a carrot for us to ignore. There was something magical about not having to pay tax. Maybe it was something to do with that biblical quotation:

"And it came to pass, that there went out a decree from Caesar Augustus, that all the world should be taxed.’

There was something inherently satisfying about not having to pay tax! So we signed up and saved the maximum exemption - with the promise of millions in our retirement - because of course, they were the heady days of high interest rates and projections were far from realistic. Thank goodness that’s changed! But, that savings scheme is still in place today.

Now I’m not necessarily advocating this approach - but what I’m saying, from personal experience is, the opportunity to save was limited, there were plenty of other competing priorities, but given the right encouragement, we found we could manage to save something for our future. And that I’m sure will be no different for thousands of families in NZ today.

How do we stack up against our peers?

To be able to help us get this into perspective, facilitate debate and create some realistic goals, it’s first necessary to review our own savings habits and compare them to others.

Statistics New Zealand’s household income and outlay account shows that collectively, for the last 7 years, households in New Zealand spent more than they earned. In the last 3 years we’ve done this to the tune of more than $2b per annum.

Granted, there is room for some variability in the figures, given the diversity of what is being measured, but it is still clearly a downward trend.

Here’s the national savings rate as a percentage of GDP:

| 1996 | 1997 | 1998 | 1999 | 2000 |

| 3.8 | 3.1 | 2.2 | 1.9 | 1.1 |

Of course, this is only one way to measure savings, however, a decline in savings is also indicated when we measure our gross national savings rate as a percentage of GDP against those for OECD countries overall.

|

|

|

||

| Lowest | Highest | Average | ||

| 1980 | 12.1 | 36.1 | 22.4 | 18.3 |

| 1985 | 14.4 | 48.5 | 21.3 | 17.1 |

| 1990 | 14.0 | 51.9 | 21.1 | 14.0 |

| 1997 | 14.9 | 48.1 | 21.2 | 14.9 |

As you can see, the lowest figures for OECD countries in 1990 and 1997 were New Zealand’s figures. 50% lower than ‘average’. Surely not where we should be, nor want to be !

What’s also interesting is that based on current indicators, countries like Slovenia will have a higher standard of living than New Zealand will have in 10 years time.

To make matters worse, the OECD is predicting New Zealand will have a negative savings rate for 2001. (refer Economist article, 20 January 2001)

Without saving – where is the generator for growth?

Does it matter that savings rates are low?

Yes, it does matter. It matters now and it’s going to matter more and more as time goes by.

- Savings and investment are important for economic growth.

- Superannuation savings help restore levels of household savings – softening our dependency, as a nation, on foreign debt and global economic cycles.

- In 1982 the net wealth of NZ households was 3.13 times income. In 1999 it was 3.64 times income. By comparison, in 1998 Australians had household net wealth of 5.25 times their disposable income.

- Debt’s increasing – from 61% of disposable income in 1990 to 110 % in 1999. Yes, 110%!

- Unlike Americans or Britons, New Zealanders have more of their wealth in housing than in more liquid financial assets like shares or bank deposits.

- Costs are significant if individuals delay saving.

- Savings made now, ensure monies will be available when the demographic bulge of baby boomers become eligible for New Zealand Superannuation

- The decreasing base of taxpayers will face the increasing costs of a substantially unfunded New Zealand Superannuation commitment.

- In other countries, baby boomers saving in their prime years of earning are driving the increase in financial assets.

- Expectations vs Reality

- As I’ve mentioned, the gap between the current reality and future expectations is growing exponentially. It doesn’t need a rocket scientist to tell us that we, and those who follow us into retirement over the next 40 years, will expect more in those years in the way of activity, opportunity and choice than those who live off NZS now. Not only will we expect more but we’ll expect it for longer because we’ll live longer. We’ve had busy and fulfilling lives and we’ll expect that to continue in some shape and form in our retirement. I know for certain that my expectations greatly exceed those of my mother who lives in retirement now.

In 30 years New Zealand men are expected to have a further 19 years ahead of them from age 65 (currently 14.8 years) and women will survive on average to age 87.1 years (currently 83.5 years).

Grey Power will become an increasingly powerful voting bloc. We’ve already seen what this group can do to the fortunes of a political party - they turned their back on National at the last election and helped bring about a change of Government. They will have the potential to hold the country to ransom if their expectations aren’t managed or met.

Recent independent research in Australia shows 80% of people estimate they will need a minimum retirement income of between A$20,000 - A$60,000 per annum.

Only 4% said they could live on A$20,000 or less.

In New Zealand, AMP’s research is telling the same story. Interestingly the single living alone benefit for New Zealand Superannuitants is currently $14,704.56 per annum ($12,195.56 after standard tax.).

I quote the single living alone rate because:

- more than 50% of New Zealand women will have a single status when they reach the eligible age for New Zealand Superannuation

- the current practise of quoting the 65% married rate is confusing. Very few people who hear it realise that 65% is shared between two – not 65% each.

New Zealand is unusual in that it relies on a universal state pension funded straight from taxation. The proposed NZS Fund is projected to reach something of the order of $50b, but it will not meet more than 15% of the total liability for NZS, which in itself provides a very modest retirement income.

The pension provided by the State is designed to provide a safety net for poverty alleviation. If we fail to convince New Zealanders of the need to save for retirement or, fail to provide adequate incentives for self-reliance, most of us will not meet our higher or even modest aspirations.

- So what’s the current

tax cocktail?

- The current taxation system lacks consistency. It is skewed against New Zealand registered unit trusts, and superannuation funds. In comparison, direct personal investment, investment through certain offshore vehicles and investment in residential property all receive favourable tax treatment.

An individual who makes a direct long-term investment in shares generally does not pay tax on capital gains. But an individual who makes an investment for a similar term through a collective investment vehicle such as a unit trust or superannuation fund pays tax on capital gains indirectly, when the fund itself is taxed and, if not then, often on the distribution of gains. By comparison, the same amount of money invested in residential housing would rarely incur any tax on capital gains on the sale of that asset.

Similarly, passive managed funds, or, as they’re often called, index funds, pay no tax on share gains, whereas even mildly active share funds do. While from an investor’s point of view investments in these two types of funds are economically similar, they are taxed very differently.

Significant inequity exists for those who want to save for retirement and earn less than $38,000 – and this is the majority of New Zealand’s taxpayers. While the marginal tax rate for these people is 21% (for income over $9500) their superannuation savings have investment income and employer contributions taxed at 33%.

All this tells us is that we don’t have a savings friendly tax environment. But we do have an opportunity to change that - by adjusting tax arrangements to improve the ‘adequacy’ of future retirement incomes. I’m particularly encouraged by comments made by Michael Cullen in a recent address to ASFONZ members. He does appear to be listening to those who have embraced the debate on creating a favourable environment for retirement savings.

What about taxing gains on housing?

Taxation of capital gains in owner occupied housing appears to be an option. Justified where all the costs of home ownership (depreciation, maintenance, insurance, interest, rates etc.) are deductible. But this has the potential to result in high compliance costs for homeowners and the IRD. Never mind the feast of legislative opportunities and variables that could ensue. Given this, it’s debatable as to whether a broader tax base would result.

There is some debate on whether owner occupied housing is bought purely for investment as opposed to lifestyle reasons, and whether any major changes in this area would change the balance of household wealth represented by owner occupied housing. The fact that mortgage interest on owner occupied housing is not deductible means that it makes more sense for individuals to pay off their mortgage than invest in other assets that produce taxable income. There is an argument that making mortgage interest deductible will encourage saving in other investment classes. It is possible, however, that making mortgage interest deductible will reduce the apparent cost of borrowing and make a more expensive house seem just that more attainable.

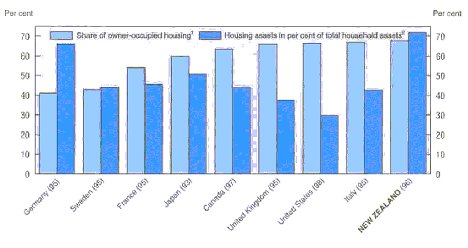

The December 2000 Economic Survey by the OECD indicates that New Zealanders generally have a much higher proportion of household wealth invested in their houses – but, we don’t have a standout level of home ownership.

Germany, for example, has similar levels of investment and taxing for housing as New Zealand, but much lower home ownership. The same tax basis applies in the USA, where Americans also invest significantly less in their houses.

Italy and the United Kingdom have more favourable housing tax treatment with deductibility of mortgage interest but with lower proportionate investment in housing.

Housing investment in selected OECD countries

- Data in brackets is the census year

- 1998 figures for all countries. These data are particularly fragile due to difficulties of measurement of household portfolios and may hence not be fully comparable across countries.

To a degree low household saving behaviour, other than the family home, is attitudinal. In other words it reflects a belief that the State will provide. Is that the prevailing attitude of New Zealanders - one that expects the State to provide? Will the current Bill before Parliament on New Zealand Superannuation only serve to exacerbate this?

I have to say I’d be surprised if it didn’t.

So, what’s going to change our attitudes to home ownership and saving?

I’d suggest that before any decision to implement taxation of owner-occupied housing is made, there needs to be established good evidence that such a change would deliver a change in attitude and behaviour so that over time a reallocation of resources towards savings would result.

There are a number of inconsistencies that need to be cleared up if savings are to increase. We need consistency!

An individual who is not an active trader will generally not pay tax on capital gains on direct share investments and property. Apart from passive investments, professional managers do.

This lack of consistency sends the wrong messages.

- It is both inefficient and impractical for most individuals to manage a diversified investment portfolio.

- With the increasing complexity of investments, use by individuals of professional investment managers is not only desirable, but necessary.

- Individuals who seek to create and maintain a diversified portfolio may well lack the experience necessary and are, therefore, likely to be exposed to unnecessary risk.

- Individuals may find it impossible to get access to particular asset classes – like private capital type investment, international equities and/or bonds.

There needs to be some consistency between taxation treatment of individuals and managed investments.

- Saving for Retirement is

Income Deferral

- I’d like to suggest it’s time we treated saving for retirement as income deferral. It clearly differs from other forms of saving because, in effect we put aside income we earn now to provide a nest egg for retirement. That nest egg is then converted at retirement into income - whether by way of lumpsum or as an income stream.

There is almost no recognition of the income deferral nature of superannuation and the consequent implications this has for the taxation of retirement savings.

The average full time equivalent (FTE) income in New Zealand is around $35,000 per annum. Incomes up to $38,000 are subject to a marginal tax rate of 21%. It’s not hard to work out the lack of equity this delivers for contributors in this tax bracket to registered superannuation schemes – and we’re talking about the majority of income earners. They are effectively penalised for using this form of saving.

The Government can convert the value of savings made now into gains for the future. Whether they’re prepared to manage the consequent budget constraints this would impose is another matter. But by treating retirement savings as income deferral, a reduction occurs in the current tax take. Taxation is delayed until the very time in which pressure will be placed on the Government to meet NZS through its budget of the day.

So where are we now?

There’s no doubt the bells are ringing loudly in the minds of those who see retirement approaching.

The numbers are challenging when you remember

92% of New Zealanders believe they need to save for retirement and

74% see it as primarily their responsibility.

It’s hard to know at what age the bells start to ring - but for the purpose of this exercise, let’s say it’s at age 45. Twenty years away from most peoples expected age of retirement – although there are no economic or biological reasons for retiring at this or any other age.

Realisation dawns that’s there’s going to be little if any gain from selling the family home to supplement retirement funds. The market for family homes will be significantly diminished in 20 years time. Not only that - the cost of a retirement home, on the flat, close to services, with minimal maintenance required long term may even cost more than the proceeds the family home will bring.

This brings me back to where we started - ‘when is the right time for ‘T’?"

Well, let’s shift a few ‘T’s’ around.

- Some options

- A decision is made to up the anti and start putting away some serious money for retirement. The back of the mortgage is broken, the kids are becoming a little bit more independent. Perhaps two fulltime incomes are helping the family budget look more healthy.

With a combined household income of $75,000 you decide to each start saving 10% of your salaries - a total of $7500 per year. By my calculations that’s $150,000 by age 65 - all going well. Not a bad sum to have from which to derive income to supplement NZS in retirement.

- Option 1:

- If that sum attracts an annual tax paid investment income of 5% compounded over 20 years then it gets boosted to $257,000. Even better! And that’s where things are today - with TTE.

- Option 2:

- Of course, if contributions aren’t taxed until the point of withdrawal - whether that withdrawal’s a lumpsum or pension – we have ETT or ETt.

- If that sum attracts an annual tax paid investment income of 5% compounded over 20 years then it gets boosted to $257,000. Even better! And that’s where things are today - with TTE.

If a lumpsum was withdrawn, then it would be taxed at the appropriate tax rate on receipt, and I’d suggest that the pension be treated similarly, with tax applied appropriately to each pension payment – not when the income stream is purchased. So here we have an example of a reverse situation to what we have now – tax exempt at the point of going in but taxed on receipt. And the math on this is similar to TTE too. Broadly speaking the individual ends up with the same value – but with a greatly enhanced incentive to save.

- Option 3:

- Another option is to look at extending the current 6% advantage offered to savers in the 39% marginal tax bracket across all tax groups and leaving investment income taxed as it is now. A sort of tTE - with a small ‘t’ in front.

Savings made to retirement schemes at present total $2.776b net (according to the latest report of the GA). This is the total of employer and personal savings. Let’s say a 6% reduction is offered to all retirement savings that are locked in until retirement and there is a positive public response to this. Retirement savings double!

By my estimates if we double today’s saving it’ll end up costing the Government $497m per annum. The payback being a doubling (or more) of retirement saving – and maybe a change in savings culture by an increased number of New Zealanders. We’d need to be sure that such reduction in the tax take would deliver the desired change in savings culture. And when I say ‘we’ I mean the industry – who would need to invest substantially in carrying this ‘good news’ to the market and converting it into action.

These are tough decisions for any Government. They would result in less money for services in a 3-year term, for gains they probably won’t see while in power. Indications are that this budget is shaping up to be tight. Future budgets would be the same.

- Option 4:

- I’d now like to look at Michael Cullen’s current proposal of TET or TEt.

If, the Government chose to defer tax on superannuation investment earnings then based on a collective income of $75,000 ($50,000 and $25,000) savings of $257,000 under TTE could be boosted to the majestic sum of $300,000. (And we have TET or TEt or TeT.)

So what’s the difference between a pension based on $300,000 compared to one of $257,000?

A joint pension purchased today for $300,000 converts into a monthly income for two of $1,570. However, with tax on investment income having been deferred, some form of tax would apply to this amount. In comparison $257,000 converts into a monthly pension of $1,342 – tax paid. Not a million miles away from where the exemption on investment income ends up – but still marginally better off.

My immediate thought is that this option falls at the first hurdle. Why would I save more just because tax is deferred on my investment earnings - those semi invisible - can’t be relied upon - often volatile extras that my savings attract? What happens when I get negative returns - like I have for the last two quarters? No investment returns - no tax break. If I struggle now to understand even the most basic concepts of compound interest - it’s unlikely this scenario will appeal. In fact it’s likely it will only appeal to those who are already committed to retirement saving - existing penalties and all.

I find the Treasury estimates for this option of around $500m deferred revenue per annum based on current savings patterns a bit optimistic – or pessimistic – depending on your position. But given this figure, let’s remember it’s likely to be a worst case scenario. Not only that, but tax is deferred only until those funds are redeemed and tax is payable. By my estimate, in due course, drawdown of these monies will result in a net rolling deferral of nearly half that forecast – in the order of $280m.

I’m sorry, this carrot looks more like a turnip to me.

Even if the recently floated idea of reducing the big ‘T’ at the end to a little ‘t’, is offered as an inducement - it’s not the circuit breaker we need to change prevailing attitudes to saving.

Sorry Michael - it’s just not enough to move me from recognising the need to save, to action.

- Option 5:

- And so to my last scenario. (EeT or EET or EtT.)

I don’t pay tax on any income that I save and put aside to create income for my retirement. I accept that this might be capped but, even so, I’m sitting up and listening! And you may also defer collecting tax on my investment earnings - well that is a bonus! Where do I sign?

I’d even treat it as a bonus if you reduced tax on investment income to 21% across the board instead of 33% - especially if I’m one of the majority of income earners who have that as my marginal tax rate anyway.

And I understand that my savings will attract tax – most probably at the rate of 21% - when eventually I convert it into retirement income.

So let’s take our original assumptions of two people with incomes of $50,000 and $25,000. They’ll continue to pay tax into their mid 80’s of around $6,400 per annum - in addition to the tax they pay on their NZ Super. This is almost identical to the tax they would have paid if savings put aside for retirement had been taxed at source, rather than on receipt.

And that’s just a few of the range of possible options.

- Consequences for Government

- Now I realise that a number of these options include a serious contribution from Government in deferring collection of tax. And I don’t underestimate the pain this may cause – either by reduction of services or increases in taxation. But by deferring the collection of tax on savings until they are converted to retirement income, the Government ensures a flow of tax into their coffers concurrent with the retirement span of the superannuitant.

Remembering at the same time there’ll be fewer taxpayers, and baby boomers will be creating a greater tax burden. This scenario is in contrast to the present time, when tax deducted from our salaries is used to pay our parents and grandparents their NZ Super entitlement – or anything else the Government chooses to spend it on.

- Conclusion

- So there you have it - a range of scenarios and none ideal or perfect. They all cost money now - there’s no getting away from that and they all require guts from Government. But the better they sound the more likely they are to deliver the circuit breaker we need to change prevailing savings behaviour in New Zealander.

I suspect it’s no pain, no gain.

And there are big transition issues. But it’s important to remember that saving for retirement is about planning over 20, 30 or 40 years – not 3 or 4.

Let’s get serious about this. All of us here have something to offer towards a solution.

If we always do what we’ve always done, we’ll always get what we’ve always got.

Linda McCulloch is the head of superannuation strategy at AMP Financial Service. This is a speech she made to the Super Summit conference in Wellington.| « Cullen refines ethical investments | AMP & Good Returns launch superannuation website » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |