Investors keener on SRI than planners

Research shows that investors are keen on putting a greater proportion of their money into ethical investments than financial planners generally recommend.

Monday, September 10th 2001, 10:11AM

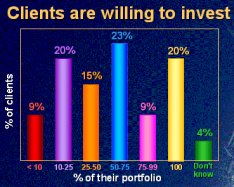

The research, carried out by Rothschild Asset Management in Australia, revealed that two thirds of planners would allocate between 1 and 10% of a client's portfolio into ethical funds. However, investors showed the opposite approach.

The largest portion (23%) of investors said they were prepared to allocate between 50-75% of their portfolio to ethical funds.

Rothschild suggests that financial planners see ethical investments as a tool for diversifying a portfolio, while enabling their clients to make an emotional statement with a small part of their investments.

"This is understandable as it is the planners' duty to diversify their clients' portfolios according to goals and appetite for risk of each client."

To get planners to put more money into ethical funds there needs to be a greater number of funds available across the asset classes.

Rothschild says that once this happens planners will place a larger percentage of their clients' portfolios into this area.

Rothschild says interest in ethical investment is growing: "The latest survey shows that the number of planners currently using or considering using ethical funds has increased by over 10% within a year, Rothschild manager product development Mark Watmore says.

This claim is backed up by research from Melbourne-based Deni Greene Consulting Services, which calculate the in total A$10.5 billion is invested in socially responsible funds. This figure includes money invested by the country's major church groups, but excludes property.

Deni Green says the amount invested in ethical managed funds has grown by more than 80% in the past 12 months to exceed A$1.55 billion.

Rothschild says it is important to survey intentions to ethical investments as attitudes are constantly changing.

One example of this is the ranking of 'bad' industries.

As part of the survey Rothschild asks what are the most important industries to screen out of a portfolio.

Here the differences between financial planners and investors were very similar. Both groups had the environment and human rights at the top of the list, while alcohol was at the bottom.

Watmore says that alcohol is seen as not an important area to screen and has fallen from fifth on the list to 10th.

There may be a number of reasons for this including the fact that alcohol includes the wine industry that is seen to be somewhat glamorous.

The biggest changes in the ranking of bad industries was the placing of weapons and logging at third and fourth respectively.

The bad news from the survey was that the term ethical investing was not that well-known among respondents, although it has been getting a lot of press.

The survey asked 1250 investors if they had heard of the term ethical/socially responsible investing.

Only 16% of respondents said yes. But a third of that group were currently using or had considered using ethical funds or investments.

The strongest demand was in the over 55 age group.

This situation could well change as the Australian government has added a clause to its Financial Services Reform Bill that requires fund managers to outline the extent, if any, to which labour standards, and environmental, social or ethical considerations are taken into account in the selection, retention or realisation of their investments.

"The survey's results clearly highlights the need for investor education, which is the key to ethical or socially responsible investment," Rothschild says.

"Investors feel it is the right thing to do - they just need to understand and be given financial advice on how to integrate their personal values with their investment decisions."

| « Fund Manager League Table | King builds an empire » |

Special Offers

Commenting is closed

| Printable version | Email to a friend |